SunTrust 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT 43

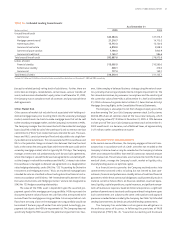

plans, included in Note , Employee Benefit Plans, to the Consolidated

Financial Statements. Additional information with respect to the obliga-

tions is presented in tables included in Note , Employee Benefit Plans, to

the Consolidated Financial Statements.

FOURTH QUARTER RESULTS

SunTrust reported net income of . million, or . per diluted share

for the fourth quarter of compared to . million, or . per

diluted share for the fourth quarter of . After-tax merger expense of

. million, or . per diluted share, related to the Company’s acquisi-

tion of NCF on October , was incurred in the fourth quarter of

compared to . million, or . per diluted share, in the fourth quarter

of .

The above mentioned results for the fourth quarter of are dif-

ferent from what the Company reported in its January , earnings

release in which the Company reported net income of . million, or

. per diluted share. The difference of . million equaled .% of

net income for the fourth quarter of . Subsequent to the release of the

Company’s earnings on January , , the Company identified imma-

terial accounting errors related to certain derivative transactions. The mis-

statements related to the Company’s interpretation and application of the

“shortcut” method of hedge accounting under SFAS No. , “Accounting

for Derivative Instruments and Hedging Activities.” The Company deter-

mined that these hedges did not qualify for hedge accounting using the

“shortcut” method. As a result, changes in the market value of the deriva-

tives should have been recorded through noninterest income with no cor-

responding offset to the hedged item. The Company evaluated the impact

of these errors to all quarterly and annual periods since the inception of the

hedges.

The annual impact of these errors to net income for each of the three

years ended December , was .%, .%, and .%, respectively.

The Company does not believe that these errors either positively or nega-

tively affect the Company’s financial trends. The Company concluded that

the impact of these errors was immaterial to all annual and quarterly peri-

ods; however, the Company determined that it was appropriate to record

an adjustment as of December , to correct the cumulative impact

of these errors. The cumulative pre-tax impact of these errors resulted in

additional noninterest income of . million, which is included in trad-

ing account profits and commissions in the Consolidated Statement of

Income.

As of December , , seven derivatives remained outstanding

with a total notional value of . billion. The Company terminated four of

the derivatives in the first quarter of . Two of the derivatives were des-

ignated in the first quarter of as hedges using the “long haul” method

under SFAS No. , and one of the derivatives was classified as a trading

position. The hedged items associated with these derivatives consisted of

an asset and liabilities. Each of these hedged items continues to remain

outstanding.

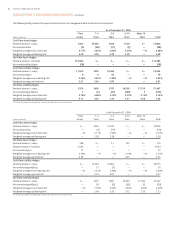

Net interest income increased . million, or .%. The increase

in net interest income was mainly due to strong earning asset growth. Total

average earning assets increased . billion, or .%, from the fourth

quarter of driven by strong growth in both portfolio loans and loans

held for sale. Core deposit growth has continued to benefit from marketing

efforts. The net interest margin decreased basis points from the fourth

quarter of . The majority of the margin decrease was attributable to

an increase in loans held for sale at compressed spreads due to flatter yield

curve.

The provision for loan losses for the fourth quarter of was .

million, a decrease of . million, or .%, from the fourth quarter

of . Net charge-offs declined . million, or .%, from the fourth

quarter of due to improved credit quality and sustained economic

improvement in the Company’s footprint. The decline in net charge-offs

was primarily related to a . million, or .%, decrease in consumer

net charge-offs from the fourth quarter of .

Noninterest income was . million in the fourth quarter of ,

an increase of . million, or .%, compared to the fourth quarter of

. The increase was primarily attributable to securities losses of .

million incurred in the fourth quarter of compared to securities

gains of . million in the fourth quarter of . Also positively impact-

ing noninterest income were increases in mortgage related income, trust

and investment management income, ATM fees, and card fees; partially

offset by a decline in trading account profits and commissions. Mortgage

related income increased . million, or .%, from the fourth quarter

of due to an increase in mortgage production and mortgage servicing

fees. Trust and investment management income increased . million,

or .%, from the fourth quarter of due primarily to growth in assets

under management, which increased .% from December , . Card

fees increased . million, or .%, from the fourth quarter of due

to higher interchange income on increased debit card transactions. Trading

account profits and commissions decreased . million, or .%, from

the fourth quarter of primarily due to trading losses incurred in the

fourth quarter of due to market conditions.

Noninterest expense in the fourth quarter of was ,. mil-

lion, an increase of . million, or .%, from the fourth quarter of .

Personnel expense, the largest component of noninterest expense, grew

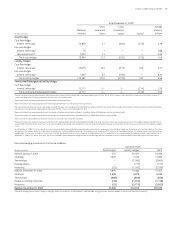

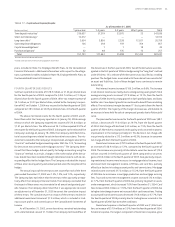

TABLE • Contractual Commitments

As of December ,

(Dollars in millions) year or less – years – years After years Total

Time deposit maturities , , , ,

Short-term borrowings , — — — ,

Long-term debt , , , , ,

Operating lease obligations

Capital lease obligations —

Purchase obligations

Total , , , , ,

Amounts do not include accrued interest.

Includes contracts with a minimum annual payment of million.