SunTrust 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT92

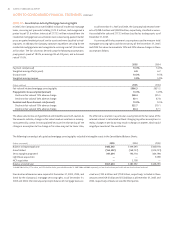

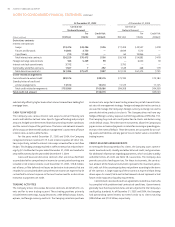

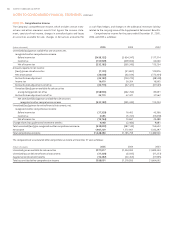

NET PERIODIC COST

Components of net periodic benefit cost were as follows:

Supplemental Other

Retirement Benefits Retirement Benefits Post Retirement Benefits

(Dollars in thousands)

Service cost , , , , , , , , ,

Interest cost , , , , , , , , ,

Expected return on plan assets (,) (,) (,) — — — (,) (,) (,)

Amortization of prior service cost () () () , , , — — —

Recognized net actuarial loss , , , , , , , , ,

Amortization of initial transition

obligation — — — — — , , ,

Other (,) — — , — — , — —

Net periodic benefit cost , , , , , , , , ,

Weighted-average assumptions

used to determine net cost

Discount Rate .% .% .% .% .% .% .% .% .%

Expected return on plan assets . . . N/A N/A N/A . . .

Rate of compensation increase . . . . . . N/A N/A N/A

The weighted average shown for is the weighted average discount rate of all nonqualified plans as of the beginning of the fiscal year. Interim remeasurements were required during due to settlements

(i.e., large lump sum payments occurring). The discount rate as of each remeasurement date was selected based on the economic environment as of that date.

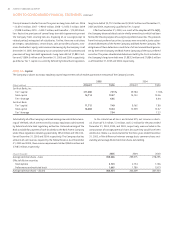

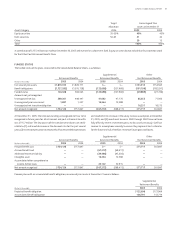

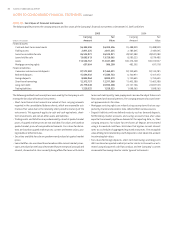

EXPECTED CASH FLOWS

Information about the expected cash flows for the pension and other Post Retirement benefit plans follows:

Supplemental Other Post Retirement Value to Company

Retirement Retirement Benefits (excluding of Expected

(Dollars in thousands) Benefits Benefits Medicare Subsidy) Medicare Subsidy

Employer Contributions

(expected) to plan trusts , — , ()

(expected) to plan participants — , — —

Expected Benefit Payments

, , , ()

, , , ()

, , , (,)

, , , (,)

, , , (,)

– , , , (,)

At this time, SunTrust anticipates contributions to the Retirement Plan may be permitted (but not required) during based on the funded status of the Plan and contribution limitations under the Employee

Retirement Income Security Act of (ERISA). SunTrust expects to make a contribution up to million not to exceed IRS Section limits.

The expected benefit payments for the Supplemental Retirement Plan will be paid directly from SunTrust corporate assets.

The expected contribution for the Other Post Retirement Benefits Plans represent the expected benefit payments under the medical plans only. Note that expected benefits under Other Post Retirement Benefits

Plans are shown net of participant contributions.

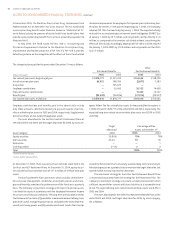

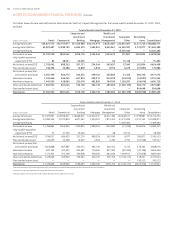

Based on a ten-year capital market projection of the target asset alloca-

tion set forth in the investment policy for the SunTrust and NCF Retirement

Plans, the pre-tax expected rate of return on plan assets was .% in

and . SunTrust will leave the return on asset assumption at .%

for for the Retirement Plans. SunTrust will lower the return on asset

assumption to .% for for the Other Post Retirement Benefit

Plans.

In addition, SunTrust sets pension asset values equal to their market

value, in contrast to the use of a smoothed asset value that incorporates

gains and losses over a period of years. Utilization of market value of assets

provides a more realistic economic measure of the plan’s funded status and

cost.

Assumed discount rates and expected returns on plan assets affect the

amounts of net periodic pension cost reported. A basis point decrease

in the discount rate or expected long-term return on plan assets would

increase the Retirement Benefits net periodic benefit cost approximately

million and million, respectively.

Assumed health care cost trend rates have a significant effect on the

amounts reported for the health care plan. A one-percentage-point change

in the assumed health care cost trend rates would have had the following

effect in fiscal :

(Dollars in thousands) % Increase % Decrease

Effect on total of service and

interest cost ()

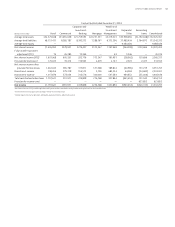

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued