SunTrust 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 SUNTRUST 2005 ANNUAL REPORT

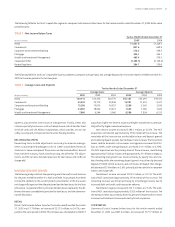

•Revenue Growth – As noted earlier, strong loan and deposit

growth contributed to a healthy gain in net interest income, up

seven percent over 2004. The net interest margin for 2005 was

relatively stable —no small achievement in a challenging

rate environment.

Our sales efforts also produced good noninterest income

growth - up six percent over 2004. Once again, mortgage pro-

duction was a key factor, along with ATM/debit cards and trust

and investment product-related fee income. It all added up to

total core revenue of $7.8 billion, up six percent.

•Expense Discipline – Our strong revenue growth, balanced with

success in holding core expense growth to a reasonable four

percent over 2004, resulted in positive operating leverage in

2005, which in turn led to an improvement in our efficiency ratio

of 146 basis points, or 2.4 percent, over last year. As pleased as

we are with that achievement — and we want to be more

efficient in the future — we would note that there is a limit to how

low this ratio can go at SunTrust. That’s because our business mix

is different from that of our peers in that it emphasizes some

higher-efficiency ratio businesses like Wealth and Investment

Management and Mortgage. We believe operating leverage is a

true barometer of how we are performing in terms of expense dis-

cipline, and our progress in that regard bodes well for the future.

Finally, any discussion of earnings drivers would be incomplete

without reference to credit quality, traditionally an area in which

SunTrust is recognized as an industry leader. Although bank credit

quality tends to mirror the economy, SunTrust is typically “best in

class” in virtually all key measures of credit quality regardless of the

point in the economic cycle. That was surely the case in 2005 as our

loan mix shifted toward lower risk categories such as residential real

estate and home equity loans. Net charge-offs declined for the third

consecutive year and, although there can always be surprises in this

area, credit quality measures for both consumer and commercial

loans looked good as 2006 began.

Seeing Beyond Money

In our view what it all boils down to, at the mid-way point of a

turbulent decade for our industry, is this: SunTrust enjoys a particularly

enviable position among large U.S. banking organizations.

We are concentrated in the most attractive banking markets

in the United States. We are in the right businesses, with proven

growth strategies. We have the financial resources, product scope

and technology platform we need to compete effectively. And, not

incidentally, we have some of the most talented, most motivated

people in the business.

We also, as demonstrated again in 2005, can point to a track

record of performance that shows how it all comes together.

We are committed to building on our success and delivering

results that further validate the merits of “Seeing beyond money” as

we serve the interests of our clients, our communities, our employees

and, of course, our shareholders.

Thank you for your interest in SunTrust.

L. Phillip Humann

Chairman and Chief Executive Officer

James M. Wells III

President and Chief Operating Officer

6%

Core Revenue

Growth1

4%

Core Expense

Growth2

IMPROVING EFFICIENCY

A concerted effort to improve operating leverage shows results as

2005 revenues grew at a faster rate than expenses.

1SunTrust presents total revenue excluding realized securities gains/losses

and the net gain on sale of factoring assets for 2005.

2Core expense growth excludes merger related expenses, amortization of

intangibles and impairment charge on Affordable Housing Properties.

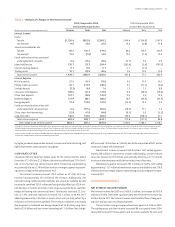

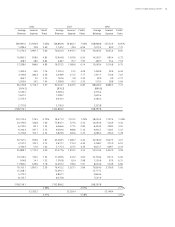

4Q03

0.00%

0.30%

0.60%

1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05

SunTrust Peer Average1

1Peers include AmSouth, Bank of America, BB&T, Comerica, Fifth Third,

First Horizon, Keycorp, M&T Bank, Mellon, National City, Northern Trust,

PNC, Regions, US Bancorp, Wachovia and Wells Fargo. Source: SNL

Financial

STRONG CREDIT QUALITY

Net charge-offs as a percentage of loans at SunTrust continue to

compare favorably to peers