SunTrust 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT 41

(except to related parties) voting stock of subsidiaries. Further, there are

restrictions on mergers, consolidations, certain leases, sales or transfers of

assets, and minimum shareholders’ equity ratios. As of December , ,

the Company was in compliance with all covenants and provisions of these

debt agreements.

Other Market Risk

Other sources of market risk include the risk associated with holding resi-

dential mortgage loans prior to selling them into the secondary mortgage

market, commitments to clients to make mortgage loans that will be sold

to the secondary mortgage market, and the Company’s investment in MSRs.

The Company manages the risks associated with the residential mortgage

loans classified as held for sale (“the warehouse”) and its interest rate lock

commitments (“IRLCs”) on residential loans intended for sale. The ware-

house and IRLCs consist primarily of fixed and adjustable-rate single fam-

ily residential real estate loans. The risk associated with the warehouse and

IRLCs is the potential change in interest rates between the time the client

locks in the rate on the anticipated loan and the time the loan is sold on the

secondary mortgage market, which is typically - days. The Company

manages interest rate risk predominately with forward sale agreements,

where the changes in value of the forward sale agreements substantially off-

set the changes in value of the warehouse and the IRLCs. Interest rate risk on

the warehouse is managed via forward sale agreements in a designated fair

value hedging relationship, under SFAS No. “Accounting for Derivative

Instruments and Hedging Activities.” IRLCs on residential mortgage loans

intended for sale are classified as free standing derivative financial instru-

ments in accordance with SFAS No. “Amendment of Statement on

Derivative Instruments and Hedging Activities” and are not designated as

SFAS No. hedge accounting relationships.

The value of the MSRs asset is dependent upon the assumed pre-

payment speed of the mortgage servicing portfolio. MSRs represent the

discounted present value of future net cash flows that are expected to be

received from the mortgage servicing portfolio. Future expected net cash

flows from servicing a loan in the mortgage servicing portfolio would not

be realized if the loan pays off earlier than anticipated. Accordingly, pre-

payment risk subjects the MSRs to impairment risk. The Company does not

specifically hedge the MSRs asset for the potential impairment risk; how-

ever, it does employ a balanced business strategy using the natural coun-

ter-cyclicality of servicing and production to mitigate impairment risk. The

fair value determination, key economic assumptions and the sensitivity of

the current fair value of the MSRs as of December , and December

, is discussed in greater detail in Note , Securitization Activity/

Mortgage Servicing Rights, to the Consolidated Financial Statements.

The Company is also subject to risk from changes in equity prices that

arise from owning The Coca-Cola Company common stock. SunTrust owns

,, shares of common stock of The Coca-Cola Company, which

had a carrying value of . billion at December , . A % decrease

in share price of The Coca-Cola Company common stock at December ,

would result in a decrease, net of deferred taxes, of approximately

million in other comprehensive income.

OFFBALANCE SHEET ARRANGEMENTS

In the normal course of business, the Company engages in financial trans-

actions that, in accordance with US GAAP, are either not recorded on the

Company’s balance sheet or may be recorded on the Company’s balance

sheet at an amount that differs from the full contract or notional amount

of the transaction. These transactions are structured to meet the financial

needs of clients, manage the Company’s credit, market or liquidity risks,

diversify funding sources, or optimize capital.

As a financial services provider, the Company routinely enters into

commitments to extend credit, including, but not limited to, loan com-

mitments, financial and performance standby letters of credit and financial

guarantees. While these contractual obligations could potentially result in

material current or future effects on financial condition, results of opera-

tions, liquidity, capital expenditures, capital resources, or significant compo-

nents of revenues or expenses, based on historical experience, a significant

portion of commitments to extend credit expire without being drawn upon.

Such commitments are subject to the same credit policies and approval

processes accorded to loans made by the Company. See Table , Unfunded

Lending Commitments, for details on unfunded lending commitments.

The Company has undertaken certain guarantee obligations in

the ordinary course of business. In following the provisions of FASB

Interpretation (“FIN”) No. , “Guarantors Accounting and Disclosure

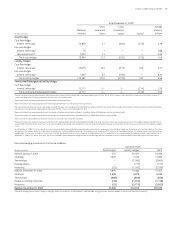

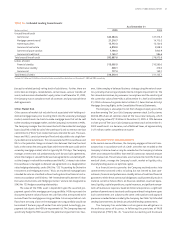

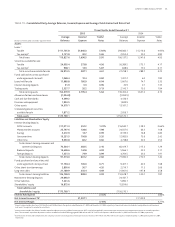

TABLE • Unfunded Lending Commitments

As of December

(Dollars in millions)

Unused lines of credit

Commercial ,. ,.

Mortgage commitments ,. ,.

Home equity lines ,. ,.

Commercial real estate ,. ,.

Commercial paper conduit ,. ,.

Commercial credit card ,. .

Total unused lines of credit ,. ,.

Letters of credit

Financial standby ,. ,.

Performance standby . .

Commercial . .

Total letters of credit ,. ,.

Includes . billion and . billion in interest rate locks accounted for as derivatives as of December , and , respectively.