SunTrust 2005 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT78

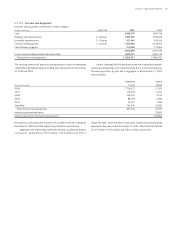

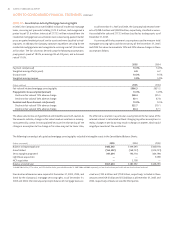

Total nonaccrual loans at December , and were . mil-

lion and . million, respectively. The gross amounts of interest income

that would have been recorded in , , and on nonaccrual

loans at December of each year, if all such loans had been accruing inter-

est at their contractual rates, were . million, . million, and .

million, while interest income actually recognized totaled . million,

. million, and . million, respectively.

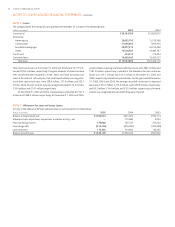

At December , and , impaired loans amounted to .

million and . million, respectively. At December , and ,

impaired loans requiring an allowance for loan losses were . million and

. million, respectively. Included in the allowance for loan and lease

losses was . million and . million at December , and

, respectively, related to impaired loans. For the years ended December

, , , and , the average recorded investment in impaired

loans was . million, . million, and . million, respectively;

and . million, . million, and . million, respectively, of interest

income was recognized on loans while they were impaired.

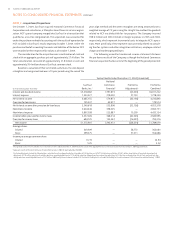

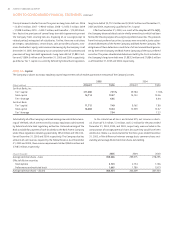

NOTE • Loans

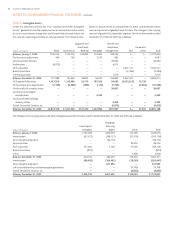

The composition of the Company’s loan portfolio at December is shown in the following table:

(Dollars in thousands)

Commercial ,, ,,

Real estate:

Home equity ,, ,,

Construction ,, ,,

Residential mortgages ,, ,,

Other ,, ,,

Credit card , ,

Consumer loans ,, ,,

Total loans ,, ,,

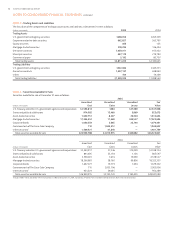

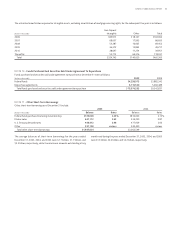

NOTE • Allowance for Loan and Lease Losses

Activity in the allowance for loan and lease losses is summarized in the table below:

(Dollars in thousands)

Balance at beginning of year ,, , ,

Allowance from acquisitions, dispositions and other activity – net — , ,

Provision for loan losses , , ,

Loan charge-offs (,) (,) (,)

Loan recoveries , , ,

Balance at end of year ,, ,, ,

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued