SunTrust 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT 75

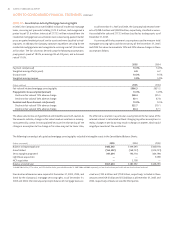

On December , , SunTrust entered into a stock purchase agreement

whereby the Company sold its % interest in Carswell of Carolina, Inc., a

full service insurance agency offering comprehensive insurance services to

its clients, for cash totaling . million.

On September , , SunTrust entered into a definitive agreement

to sell its % interest in First Market Bank, FSB. Although it is currently

anticipated that the sale will take place in the first quarter of , the

Company cannot give any assurance as to when, or if, the sale will occur.

During the second quarter of , AMA Holdings, Inc. (“Holdings”), a

% subsidiary of SunTrust, exercised a right to call minority member

owned interests in AMA, LLC (“LLC”). The transaction resulted in . mil-

lion of goodwill that was deductible for tax purposes. As of December ,

, Holdings owned member interests and member interests

of LLC were owned by employees. The employee-owned interests may be

called by Holdings at its discretion, or put to Holdings by the holders of the

member interest.

On March , , SunTrust sold substantially all of the factoring

assets of its division, Receivables Capital Management (“RCM”), to CIT

Group, Inc. The sale of approximately million in net assets resulted

in a gain of . million. This gain was partially offset by . million

of expenses primarily related to the severance of RCM employees and the

write-off of obsolete RCM financial systems and equipment. The net gain of

. million was recorded in the Consolidated Statements of Income as

a component of noninterest income. In the third quarter of , an addi-

tional gain of . million was recorded due to the actual expense incurred

for severance and the write-off of obsolete systems and equipment being

less than what was estimated in the first quarter of . As a result, the

gain related to the RCM factoring asset sale totaled . million for the

year ended December , .

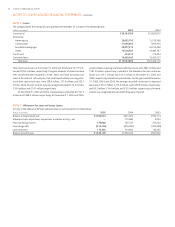

On January , , SunTrust purchased the remaining % minor-

ity interest of Lighthouse Partners, LLC (“LHP”), a non-registered limited

liability company established to provide alternative investment strategies

for clients. The transaction resulted in . million of goodwill and .

million of other intangibles which were both deductible for tax purposes.

On May , , SunTrust acquired substantially all of the assets of

Seix Investment Advisors, Inc (“Seix”). The Company acquired approximately

billion in assets under management. The Company paid million

in cash, resulting in . million of goodwill and . million of other

intangible assets, all of which are deductible for tax purposes. Additional

payments may be made in and , contingent on performance. The

additional payments are currently estimated to total approximately .

million.

On June , , SunTrust completed the acquisition of Lighthouse

Financial Services, Inc. (Lighthouse) based in Hilton Head Island, South

Carolina. The Company acquired approximately . million in assets,

. million in loans, and . million in deposits. In addition,

SunTrust paid . million in a combination of cash and SunTrust stock.

The transaction resulted in . million of goodwill and . million of

other intangible assets, which were not deductible for tax purposes.

SunTrust completed the acquisition of SunAmerica Mortgage

(SunAmerica), one of the top mortgage lenders in Metro Atlanta, on July ,

.The transaction resulted in . million of goodwill and . million

of other intangibles, all of which were deductible for tax purposes. In ,

additional payments of . million were made to SunAmerica employees

that were contingent on performance.

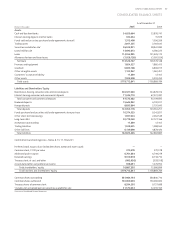

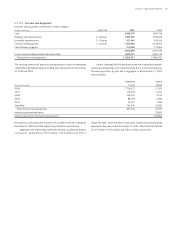

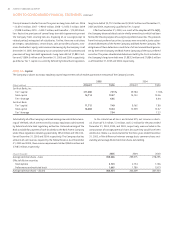

NOTE • Funds Sold And Securities Purchased Under Agreements to Resell

Funds sold and securities purchased under agreements to resell at December were as follows:

(Dollars in thousands)

Federal funds , ,

Resell agreements , ,,

Total funds sold and securities purchased under agreements to resell ,, ,,

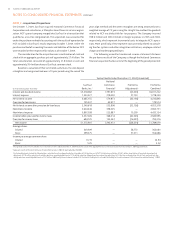

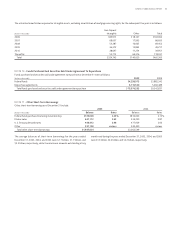

Securities purchased under agreements to resell are collateralized by U.S.

government or agency securities and are carried at the amounts at which

securities will be subsequently resold. The Company takes possession of all

securities under agreements to resell and performs the appropriate margin

evaluation on the acquisition date based on market volatility, as necessary.

The Company requires collateral between % and % of the underly-

ing securities. The total market value of the collateral held was . mil-

lion and ,. million at December , and , of which .

million and . million was repledged, respectively.