SunTrust 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT46

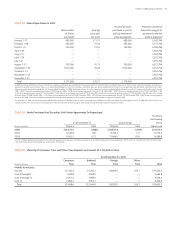

. million, or .%, from the fourth quarter of . The increase was

primarily related to merit increases and increased incentive costs. Outside

processing and software increased . million, or .%, due to higher

processing costs associated with higher transactional volumes. Consulting

fees increased . million, or .%, mainly due to the Mortgage line of

business’ initiative to enhance the efficiency of origination, processing and

distribution efforts, resulting in faster delivery of product into the second-

ary market. Also contributing to the increase in consulting fees were initia-

tives to enhance the Company’s risk management processes. Marketing and

customer development increased . million, or .%, due to market-

ing campaigns focused on retail loan and deposit products, Visa® gift cards,

and online banking services.

Provision for income taxes was . million for the fourth quarter

of compared to . million in the same period of . The pro-

vision represents an effective tax rate of .% for the fourth quarter of

, compared to .% for the fourth quarter of . The decrease in

the fourth quarter effective tax rate was due to AHG tax credits, an

annual true-up of the tax expense to the tax return as filed, and

a review of federal and state tax reserves.

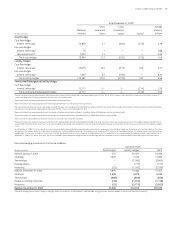

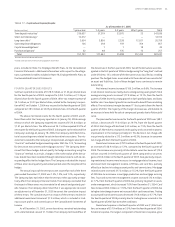

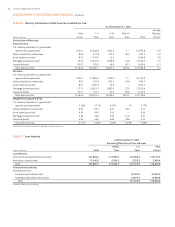

EARNINGS AND BALANCE SHEET ANALYSIS VS.

CONSOLIDATED OVERVIEW

Net income was ,. million in , up .% from ,. million

earned in . Diluted earnings per share were . in and .

in . In , the Company incurred . million, or . per diluted

share, in after-tax merger expense associated with the acquisition of NCF.

Net interest income increased . million, or .%, to ,.

million in , compared to ,. million in . The increase was

due to the acquisition of NCF, healthy loan growth, and net interest margin

improvement. Rising interest rates throughout most of resulted in a

slow down of mortgage prepayments. NCF also contributed to the increase

due to the higher yield on NCF’s earning assets. The net interest margin

improved seven basis points to .% in from .% in . The

NCF acquisition accounted for three basis points of the net interest margin

increase. The improvement in the margin was attributed to multiple factors

including the Company’s balance sheet management, which was positioned

to benefit from higher interest rates and a steeper yield curve, significant

growth in lower cost deposits, a higher yield in the investment portfolio,

and a decrease in the cost of long-term debt.

Net charge-offs were . million, or .%, of average loans for

, compared to . million, or .%, of average loans for .

The Company benefited from a . million reduction in commercial

net charge-offs. The provision for loan losses decreased . million, or

.%, from to due to credit quality improvement in .

Noninterest income was ,. million in , compared

to ,. million in , an increase of . million, or .%.

Approximately million of the increase was attributable to NCF. Trust

and investment management income increased . million, or .%,

compared to due to increased assets under management, estate

settlement fees, and distribution fees. Retail investment services income

increased . million, or .%, due to higher brokerage and insurance

sales. NCF contributed approximately million of the increase in trust

and investment management income and approximately million of the

increase in retail investment services income.

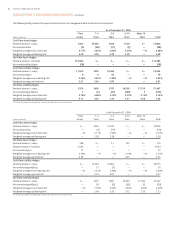

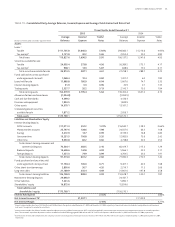

Combined trading account profits and commissions and investment

banking income, the Company’s capital market revenue sources, increased

. million, or .%, compared to the prior year. The NCF acquisition

contributed approximately million of the increase and the remaining

increase was due to growth in the equity capital markets business. Service

charges on deposits increased . million, or .%, due to increased NSF/

stop payment volumes, increased pricing and other revenue enhancement

initiatives. Approximately million of the increase was attributable to

NCF. Other charges and fees increased . million, or .%, from

to as a result of increased letter of credit fees and insurance revenues.

Approximately million of the increase was attributable to NCF. Other

noninterest income increased . million, or .%, primarily due to

combined mortgage production and servicing related income, and the con-

solidation of certain affordable housing partnerships, which occurred in the

third quarter of .

Noninterest expense was ,. million in , compared

to ,. million in , an increase of . million, or .%.

Approximately million of the increase was attributable to the NCF

acquisition including . million of merger expense. Personnel expenses

increased . million, or .%, primarily due to the NCF acquisition,

increased headcount, merit increases, and incentive costs. Commissions

and performance based incentive payments increased as a result of busi-

ness growth, higher production volumes, and higher revenue in the Wealth

and Investment Management, Retail, Commercial, and CIB lines of business.

Net occupancy expense increased . million, or .%, due to increases

in rent, utility, and maintenance costs, primarily related to investments in

the retail distribution network. Outside processing and software expenses

increased . million, or .%, due to higher software amortization and

maintenance expense. Also impacting the increase in other noninterest

expense was the consolidation of certain affordable housing partnerships,

which contributed . million of the increase.

Average earning assets increased . billion, or .%, from to

, of which approximately billion was related to the NCF acquisition.

Average loans increased . billion, or .%, from to . The

acquisition of NCF contributed approximately billion of the increase in

loans. Securities available for sale increased . billion, or .%. Average

earning asset growth was offset by a decrease in average loans held for sale

of . billion, or .%, from to due to a decline in mortgage

production.

Average interest-bearing liabilities increased . billion, or .%,

from to , of which approximately billion was related to the

NCF acquisition. Average consumer and commercial deposits increased

. billion, or .%, compared to , primarily due to increases in DDA,

NOW accounts, and savings. Average demand deposits increased . bil-

lion, or .%, average NOW accounts increased . billion, or .%,

and average savings increased . billion, or .%, as the Company ben-

efited from campaigns to grow client deposits and the overall volatility in

the financial markets.

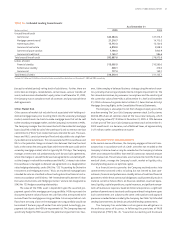

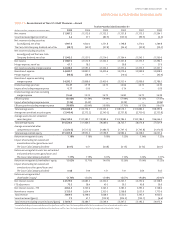

BUSINESS SEGMENTS

The following analysis details the operating results for each line of business

for the years ended December , and . These periods have been

restated to conform to the presentation.

MANAGEMENT’S DISCUSSION AND ANALYSIS continued