SunTrust 2005 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 19

This narrative will assist readers in their analysis of the accompanying

Consolidated Financial Statements and supplemental financial infor-

mation. It should be read in conjunction with the Consolidated Financial

Statements and Notes on pages through .

Effective October , , National Commerce Financial Corporation

(“NCF”) merged with SunTrust Banks, Inc. (“SunTrust” or “Company”). The

results of operations for NCF were included with SunTrust’s results begin-

ning October , . Prior periods do not reflect the impact of the merger.

Subsequent to the release of the Company’s earnings on January ,

, the Company identified immaterial accounting errors related to cer-

tain derivative transactions accounted for under hedge accounting. The

cumulative impact of correcting these errors was recorded as of December

, . Please see Fourth Quarter Results for additional discussion.

In Management’s Discussion and Analysis, net interest income, net

interest margin and the efficiency ratio are presented on a FTE basis and

the ratios are presented on an annualized basis. The FTE basis adjusts for

the tax-favored status of income from certain loans and investments. The

Company believes this measure to be the preferred industry measurement

of net interest income and provides relevant comparison between taxable

and non-taxable amounts. The Company also presents diluted earnings per

share excluding merger expense and an efficiency ratio excluding merger

expense that exclude merger expense in and related to the NCF

acquisition. The Company believes the exclusion of the merger expense,

which represents incremental costs to integrate NCF’s operations, is more

reflective of normalized operations. Additionally, the Company presents a

return on average realized shareholders’ equity, as well as a return on aver-

age total shareholders’ equity (“ROE”). The Company also presents a return

on average assets less net unrealized securities gains and a return on aver-

age total assets (“ROA”). Due to its ownership of approximately million

shares of common stock of The Coca-Cola Company, resulting in an unreal-

ized net gain of . billion as of December , , the Company believes

ROA and ROE excluding these impacts from the Company’s securities port-

folio is the more comparative performance measure when being evaluated

against other companies. The Company provides reconcilements on pages

and for all non generally accepted accounting principles in the United

States (“US GAAP”) measures. Certain reclassifications have been made to

prior period financial statements and related information to conform them

to the presentation.

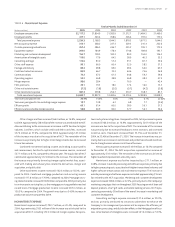

INTRODUCTION

SunTrust, headquartered in Atlanta, Georgia, operates primarily within

Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee,

Virginia, and the District of Columbia. Within the geographic footprint,

SunTrust strategically operates under five functional business segments.

These business segments are: Retail, Commercial, Corporate and Investment

Banking (“CIB”), Wealth and Investment Management, and Mortgage.

One of the top Company priorities for was the continued success-

ful integration of NCF, which was acquired on October , . The integra-

tion process focused on revenue generation, client and employee retention,

and the achievement of the financial goals established for the acquisition.

One of the main hurdles of the integration process was completed in April

when all major NCF systems were converted to SunTrust systems. The

results of the conversion were exceptional and fulfilled the Company’s focus

of continuing to make the integration seamless to clients. At the time of the

acquisition, the Company anticipated approximately million of pretax

expense savings to be recognized by the end of with approximately

million expected to be realized in . These estimates were exceeded

as total pretax expense savings for were approximately million,

exceeding the original estimate of million by over %. These savings

were achieved through the consolidation and elimination of duplicate func-

tions, procurement savings and branch closings. The Company has also real-

ized considerable revenue benefits through synchronized pricing strategies

and the introduction of the full array of SunTrust products to NCF clients.

For the second year in a row, the Company achieved record earnings.

Net income totaled . billion, or . per diluted share for , up

.% and .%, respectively, from . The following are some of the

key drivers of the Company’s financial performance:

• Total revenue increased . billion, or .%, compared to . The

acquisition of NCF, successful implementation of sales initiatives and

intense sales focus drove increases in both net interest income and non-

interest income.

• Net interest income increased . million, or .%, and the net

interest margin improved one basis point to .% for . This was

driven by strong loan and deposit growth as well as the acquisition of

NCF. Loan growth was driven by higher home equity line, residential real

estate, construction and commercial volumes, and deposits were driven

by solid growth among most categories.

• The average earning asset yield increased basis points compared to

while the average interest bearing liability cost increased basis points.

This reduction in interest rate spread was primarily due to increases in short

term funding rates and the flattening yield curve throughout .

• Noninterest income improved . million, or .%, compared

to . The increase was driven by the acquisition of NCF, higher

transaction volumes, record mortgage production, growth in trust and

investment management income, and a . million net gain on the sale

of Receivables Capital Management (“RCM”).

• Noninterest expense increased . million, or .%, compared to

. The increase was driven by the acquisition of NCF including a .

million increase in merger expense to integrate the operations of NCF,

which consisted primarily of consulting fees for systems and other inte-

gration initiatives, employee-related charges, and marketing expendi-

tures. Additionally impacting noninterest expense were higher personnel

costs due to increased headcount, merit increases, and increased incen-

tive costs associated with higher business volumes.

• Credit quality continued to improve throughout . Nonperforming

assets declined . million, or .%, compared to December ,

and net charge-offs as a percentage of average loans declined five basis

points compared to , to .%.

The following analysis will provide further detail and insight on

SunTrust’s performance.

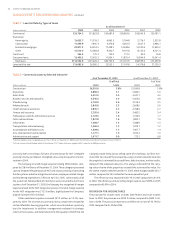

BUSINESS SEGMENTS

The Company has five primary functional lines of business (“LOBs”): Retail,

Commercial, Corporate and Investment Banking, Wealth and Investment

Management, and Mortgage. In this section, the Company discusses the

performance and financial results of its business segments. For more finan-

cial details on business segment disclosures, please see Note , Business

Segment Reporting, to the Consolidated Financial Statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS