SunTrust 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10 SUNTRUST 2005 ANNUAL REPORT

SunTrust at a glance

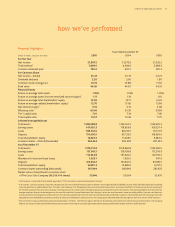

SunTrust Banks, Inc., with year-end 2005 assets of $179.7

billion, is one of the nation’s largest and strongest financial

holding companies.

Through its flagship subsidiary, SunTrust Bank, the

Company provides deposit, credit, and trust and investment

services. Additional subsidiaries provide mortgage banking,

insurance, asset management, equipment leasing, brokerage

and capital market services. SunTrust’s client base encompasses

a broad range of individuals and families, high-net-worth

clients, businesses, and institutions.

SunTrust enjoys strong market positions in some of the

highest-growth markets in the United States and also serves

clients in selected markets nationally. The Company’s priorities

include consistency in financial performance, quality in customer

service, and a strong commitment to all segments of the

communities it serves.

SunTrust’s 1,694 retail and specialized service branches and

2,782 ATMs are located primarily in Florida, Georgia, Maryland,

North Carolina, South Carolina, Tennessee, Virginia, and the

District of Columbia. In addition, SunTrust provides clients with

a selection of technology-based banking channels including

Internet, PC and Telephone Banking. Our internet address is

www.suntrust.com.

As of December 31, 2005, SunTrust had total assets under

advisement of $242.5 billion. This includes $209.1 billion in

trust assets as well as $33.4 billion in retail brokerage assets.

SunTrust’s mortgage servicing portfolio grew to $105.6 billion

at year end.

SunTrust’s five key lines of business are:

•Retail Banking, which provides loan, deposit and other services

to consumers and business clients with up to $10 million

in sales.

•Commercial Banking, which offers enterprises a full array of

financial products and services including commercial lend-

ing, treasury management, financial risk management, and

corporate bankcard.

•Corporate and Investment Banking, which focuses on

companies with sales in excess of $250 million, is com-

prised of the following businesses: corporate banking,

investment banking, capital markets, commercial leasing,

and merchant banking.

•Mortgage Banking, which offers residential mortgage products

nationally through its retail, broker, and correspondent

channels.

•Wealth and Investment Management, which provides a full

array of wealth management products and professional

services to both individual and institutional clients.

Our mission is to help people and institutions prosper by

providing financial services that meet the needs, exceed the

expectations, and enhance the lives of our colleagues, clients,

communities, and ultimately our shareholders.

Our Businesses

Our Company

Our Mission