SunTrust 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

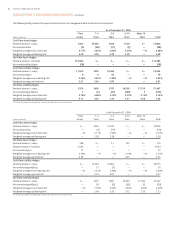

SUNTRUST ANNUAL REPORT 39

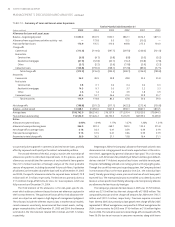

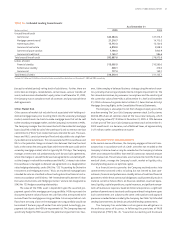

As of December ,

Gross Gross Average

Notional Unrealized Unrealized Maturity

(Dollars in millions) Amount Gains Losses Equity in Years

Asset Hedges

Cash flow hedges

Interest rate swaps , () () .

Fair value hedges

Interest rate swaps — — .

Forward contracts , — — .

Total asset hedges , () () .

Liability Hedges

Cash flow hedges

Interest rate swaps , () .

Fair value hedges

Interest rate swaps , () — .

Total liability hedges , () .

Terminated/Dedesignated Liability Hedges

Cash flow hedges

Interest rate swaps , — — () .

Total terminated/dedesignated hedges , — — () .

Includes only derivative financial instruments which are currently, or were previously designated as, qualifying hedges under SFAS No. . All of the Company’s other derivative instruments are classified as trading. All

interest rate swaps have variable pay or receive rates with resets of six months or less.

Represents interest rate swaps designated as cash flow hedges of commercial loans.

Represents interest rate swaps designated as fair value hedges of fixed-rate loans and reverse purchase agreements.

Forward contracts are designated as fair value hedges of closed mortgage loans, including both fixed and floating, which are held for sale. Certain other forward contracts which are effective for risk management purposes,

but which are not in designated hedging relationships under SFAS No. , are not incorporated in this table.

Represents interest rate swaps designated as cash flow hedges of floating rate certificates of deposit, Global Bank Notes, FHLB Advances and other variable rate debt.

Represents interest rate swaps designated as fair value hedges of trust preferred securities, subordinated notes, FHLB Advances and other fixed rate debt.

Represents the fair value of derivative financial instruments less accrued interest receivable or payable.

Represents interest rate swaps that have been terminated and/or dedesignated as derivatives that qualified for hedge accounting. The interest rate swaps were designated as cash flow hedges of floating rate debt and tax

exempt bonds. The . million of net losses, net of taxes recorded in accumulated other comprehensive income will be reclassified into earnings as a component of interest expense over the life of the respective hedged

items.

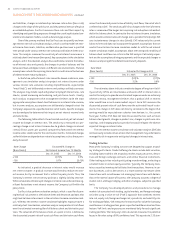

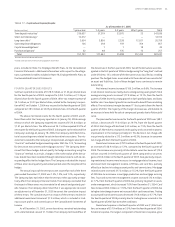

As of December , , the net unrealized loss on derivatives included in accumulated other comprehensive income, which is a component of stockholders’ equity, was . million, net of tax, that represents the effec-

tive portion of the net gains and losses on derivatives that qualified as cash flow hedging relationships. This includes an unrealized gain of . million on active hedges offset by a . million loss on terminated or desig-

nated hedges. Gains or losses on hedges of interest rate risk will be classified into interest income or expense as a yield adjustment of the hedged item in the same period that the hedged cash flows impact earnings. As of

December , , . million of net gains, net of taxes recorded in accumulated other comprehensive income are expected to be reclassified as interest income or interest expense during the next twelve months.

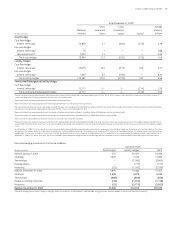

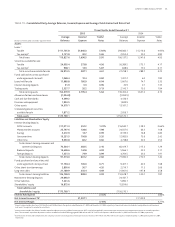

Derivative hedging instrument activities are as follows:

Notional Values

(Dollars in millions) Asset Hedges Liability Hedges Total

Balance, January , , ,

Additions , , ,

Terminations — (,) (,)

Dedesignations — () ()

Maturities () (,) (,)

Balance, December , , , ,

Additions , , ,

Terminations () () ()

Hedge accounting correction () (,) (,)

Maturities () (,) (,)

Balance, December , , , ,

Excludes the hedging activity for the Company’s mortgage loans in the warehouse. As of December , and , mortgage notional amounts totaled . billion and . billion, respectively.