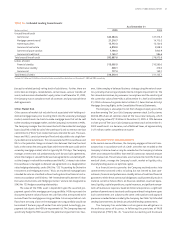

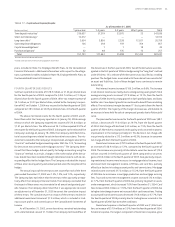

SunTrust 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 47

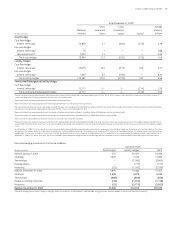

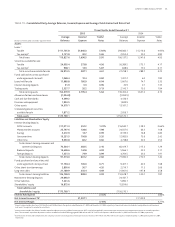

RETAIL

Retail’s total income before taxes for the twelve months ended December

, was . billion, an increase of . million, or .%, com-

pared to the same period in . This increase was attributable to the NCF

acquisition, higher net interest income, improved credit quality and higher

noninterest income partially offset by higher noninterest expense.

Net interest income increased . million, or .%. The NCF

acquisition contributed approximately million of the increase. The

remainder of the increase was attributable to loan and deposit growth and

widening deposit spreads. Average loans increased . billion, or .%,

while average deposits increased . billion, or .%. The NCF acquisi-

tion contributed approximately billion to the loan increase and approxi-

mately billion to the deposit increase. The remaining loan growth was

driven primarily by equity lines while the remaining deposit growth was

driven by demand deposits. Net charge-offs decreased . million, or

.%, primarily due to a decline in consumer indirect net charge-offs.

Noninterest income increased . million, or .%. The addition

of NCF contributed approximately million of the increase. The remain-

ing increase was driven primarily by higher service charges on deposit

accounts.

Noninterest expense increased . million, or .%. The addition

of NCF contributed approximately million of the increase. The remain-

ing increase was driven primarily by investments in the retail distribution

network and technology.

COMMERCIAL

Commercial’s total income before taxes for the twelve months ended

December , was . million, an increase of . million, or

.%, compared to the same period in . Income before taxes was

positively impacted by the inclusion of NCF results in the fourth quarter of

, and was partially offset by a decrease in AHG profitability.

Net interest income increased . million, or .%. Average loans

increased . billion, or .%. Average deposits increased . billion, or

.%. Loan growth was driven by the inclusion of NCF results in the fourth

quarter of , and higher demand for commercial and commercial real

estate loans. The growth in deposits was attributable to increased client

liquidity. Net charge-offs increased . million, or .%.

Noninterest income increased . million, or .%. The increase

was largely attributable to AHG related tax credits from new properties and

investments, as well as higher partnership revenue. Also contributing to the

increase was internal cross line of business sales credits. Partially offsetting

these increases were decreases in service charges on deposit accounts and

deposit sweep income. The decrease in the income from deposit accounts

was anticipated in a rising rate environment as clients earned a higher credit

on their deposits.

Noninterest expense increased . million, or .%. The increase

was largely attributable to AHG related partnership operating expenses and

impairment and other charges related to affordable housing properties.

The remaining increase was driven by indirect support costs and personnel

expense.

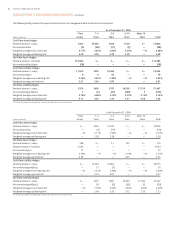

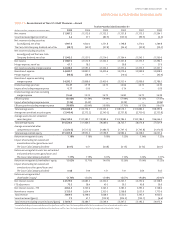

CORPORATE AND INVESTMENT BANKING

CIB’s total income before taxes for the twelve months ended December ,

was . million, an increase of . million, or .%, com-

pared to the same period in . A significant improvement in net charge-

offs and noninterest income contributed to the increase.

Net interest income decreased . million, or .%. Average loans

decreased . billion, or .%. Average deposits increased . billion, or

.%. The decrease in average loan balances was due to the deconsolida-

tion of the Company’s commercial paper conduit in March , weaker

corporate loan demand, and lower usage of revolving credit lines. Net

charge-offs decreased . million, or .%, as net charge-offs returned

to levels experienced prior to the most recent economic downturn.

Noninterest income increased . million, or .%, which was

driven by an increase in revenues from merchant banking coupled with an

increase in equity capital markets revenue.

Noninterest expense increased . million, or .%, primarily due

to an increase in personnel expense of . million, or .%. The increase

in personnel expense was driven by increased variable compensation asso-

ciated with increased fee income.

MORTGAGE

Mortgage’s total income before taxes for the twelve months ended

December , was . million, a decrease of . million, or

.%, compared to the same period in . Declines in production income

were only partially offset by higher earnings due to lower servicing amorti-

zation and higher servicing fees, as well as higher income from growth in the

residential mortgage portfolio.

Net interest income decreased . million, or .%. The primary

driver of this decrease was lower income from mortgage loans held for sale

that was only partially offset by higher residential portfolio loan income.

Average mortgage loans held for sale decreased . billion, or .%. The

decline in average balances combined with compressed margins resulted in

a . million, or .%, decrease in net interest income. Total average

portfolio loans, principally residential mortgages, increased . billion, or

.%, contributing . million to net interest income, an increase of

. million, or .%. Average deposit balances were lower by .

million due to reduced loan prepayments and resulted in a decline in net

interest income of . million. Net charge-offs remained at a low level but

increased . million, or .%.

Noninterest income increased . million. The increase in non-

interest income was driven by lower amortization of mortgage servicing

rights and higher servicing fee income. MSRs amortization declined .

million, or .%, due to slower loan prepayments. Servicing fees increased

. million, or .%, principally due to higher servicing balances. The

servicing portfolio was . billion at December , compared with

. billion at December , . The increase in servicing income was

partially offset by lower loan production income, which declined . mil-

lion, or .%. Lower production volumes and compressed margins drove

the production income decline.

Noninterest expense increased . million, or .%. Higher per-

sonnel expense and expenditures related to sales promotions and growth

initiatives were the primary drivers. The higher personnel expense was prin-

cipally a result of sales force growth and higher benefit costs.

WEALTH AND INVESTMENT MANAGEMENT

Wealth and Investment Management’s total income before taxes for the

twelve months ended December , was . million, an increase

of . million, or .%, compared to the same period in . NCF

represented approximately million while Seix and ZCI represented

approximately million of the increase. The remainder of the growth was

primarily driven by increased net interest income, trust income, and retail