SunTrust 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT48

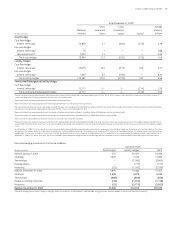

investment services income which was partially offset by higher personnel

and structural expense.

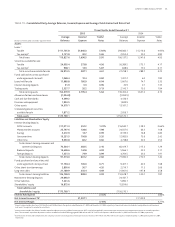

Net interest income increased . million, or .%. NCF con-

tributed approximately million to the increase. The remainder of the

growth was primarily due to increases in average loans of . billion,

or .%, including approximately million attributable to NCF.

Additionally, average deposits increased . billion, or .%, including

approximately million attributable to NCF. Net charge-offs increased

. million, or .%.

Noninterest income increased . million, or .%. NCF

accounted for approximately million while Seix and ZCI accounted

for approximately million of the increase. Retail investment services

income increased due to continued sales momentum. An increase in trust

income contributed to the total increase due to growth in assets under

management. Assets under management were . billion and .

billion as of December , and , respectively, which represented

an increase of . billion, or .%. The acquisitions of Seix and NCF

contributed approximately billion and billion, respectively, to the

increase. The remainder of the increase was driven by new business and an

increase in equity markets. SunTrust’s total assets under advisement were

approximately . billion, which include the aforementioned assets

under management, . billion in non-managed trust assets, . bil-

lion in retail brokerage assets, and . billion in non-managed corporate

trust assets.

Noninterest expense increased . million, or .%. NCF con-

tributed approximately million while Seix and ZCI contributed approxi-

mately million of the increase. The remainder of the increase was

primarily driven by additional sales personnel and costs associated with

installing the new trust accounting system.

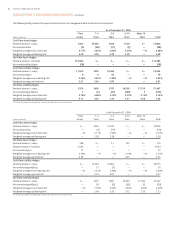

CORPORATE/OTHER

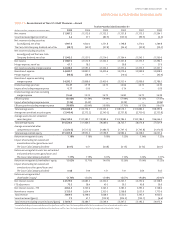

Corporate/Other’s total loss before taxes for the twelve months ended

December , was . billion, a decline in profitability of .

million, or .%, compared to the same period in .

Net interest income increased . million due to a . million

spread increase on the investment portfolio. This was partially offset by the

impact of NCF which represented an approximate million decline in net

interest income.

Total assets decreased . billion, or .%. The decline was due to

a . billion decline in intercompany loans offset by approximately

billion of NCF assets and a . billion increase in the securities portfolio.

Total liabilities increased . billion, or .%. The increase was due to a

. billion increase in long-term debt and approximately billion of NCF

liabilities, partially offset by declines in short term funding sources includ-

ing brokered and foreign deposits. Net charge-offs increased . million,

or .%.

Noninterest income decreased . million, or .%. The acqui-

sition of NCF added approximately million in noninterest income. The

decrease in noninterest income was mainly due to securities losses in

versus securities gains in , which reduced noninterest income .

million.

Noninterest expense increased . million, or .%. The main driv-

ers of the increase were the acquisition of NCF, which added approximately

million of noninterest expense and approximately million of

merger expense. Additionally, an increase in direct expenses of . mil-

lion was more than offset by higher cost allocations to the lines of business

of . million.

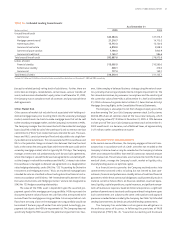

CRITICAL ACCOUNTING POLICIES

The Company’s significant accounting policies are described in detail in

Note , Accounting Policies, to the Consolidated Financial Statements and

are integral to understanding Management’s Discussion and Analysis of

results of operations and financial condition. Management has identified

certain accounting policies as being critical because they require manage-

ment’s judgment to ascertain the valuation of assets, liabilities, commit-

ments and contingencies and they have a significant impact on the financial

statements. A variety of factors could affect the ultimate value that is

obtained either when earning income, recognizing an expense, recover-

ing an asset, or reducing a liability. The Company’s accounting and report-

ing policies are in accordance with US GAAP, and they conform to general

practices within the applicable industries. The Company has established

detailed policies and control procedures that are intended to ensure these

critical accounting estimates are well controlled and applied consistently

from period to period. In addition, the policies and procedures are intended

to ensure that the process for changing methodologies occurs in an appro-

priate manner. The following is a description of the Company’s current

accounting policies that are considered to involve significant management

valuation judgments.

ALLOWANCE FOR LOAN AND LEASE LOSSES

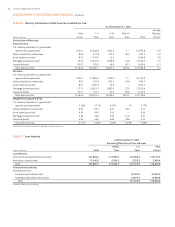

The ALLL represents the ALLL Committee’s estimate of probable losses

inherent in the existing loan portfolio. The ALLL is increased by the provision

for loan losses charged to expense and reduced by loans charged off, net

of recoveries. The ALLL is determined based on management’s assessment

of reviews and evaluations of larger loans that meet the Company’s defi-

nition of impairment and the size and current risk characteristics of pools

of homogeneous loans (i.e., loans having similar characteristics) within the

portfolio.

Impaired loans, except for smaller balance homogeneous loans,

include loans classified as nonaccrual where it is probable that SunTrust

will be unable to collect the scheduled payments of principal and interest

according to the contractual terms of the loan agreement. When a loan is

deemed impaired, the amount of specific allowance required is measured

by a careful analysis of the most probable source of repayment, including

the present value of the loan’s expected future cash flows, the fair value of

the underlying collateral less costs of disposition, or the loan’s estimated

market value. In these measurements, management uses assumptions and

methodologies that are relevant to estimating the level of impaired and

unrealized losses in the portfolio. To the extent that the data supporting

such assumptions has limitations, management’s judgment and experience

play a key role in enhancing the ALLL estimates.

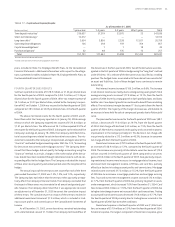

General allowances are established for loans and leases grouped into

pools that have similar characteristics, including smaller balance homoge-

neous loans. The ALLL Committee estimates probable losses by evaluating

several factors: historical loss experience, current internal risk ratings based

on the Company’s internal risk rating system, internal portfolio trends such

as increasing or decreasing levels of delinquencies, concentrations, and

external influences such as changes in economic or industry conditions.

The Company’s financial results are influenced by the Company’s pro-

cess for determining an appropriate level for its ALLL. This process involves

MANAGEMENT’S DISCUSSION AND ANALYSIS continued