SunTrust 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT 77

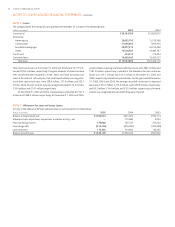

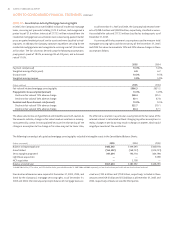

Proceeds from the sale of investments in debt securities were . billion,

. billion and . billion in , and . Gross realized gains

were . million, . million, and . million and gross realized

losses on such sales were . million, . million, and . million in

, , and .

Securities available for sale that were pledged to secure public depos-

its, trust and other funds had fair values of . billion, . billion, and

. billion at December , , , and .

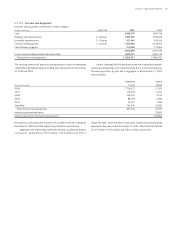

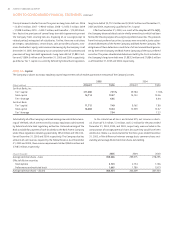

Securities with unrealized losses at December were as follows:

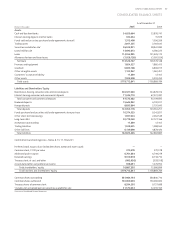

Less than twelve months Twelve months or longer Total

Fair Unrealized Fair Unrealized Fair Unrealized

(Dollars in thousands) Value Losses Value Losses Value Losses

U.S. Treasury and other U.S. government agencies and corporations , , ,, , ,, ,

States and political subdivisions , , , , , ,

Asset-backed securities , , , , ,, ,

Mortgage-backed securities ,, , ,, , ,, ,

Corporate bonds , , , , , ,

Total securities with unrealized losses ,, , ,, , ,, ,

Less than twelve months Twelve months or longer Total

Fair Unrealized Fair Unrealized Fair Unrealized

(Dollars in thousands) Value Losses Value Losses Value Losses

U.S. Treasury and other U.S. government agencies and corporations ,, (,) , () ,, (,)

States and political subdivisions , (,) , () , (,)

Asset-backed securities ,, (,) — — ,, (,)

Mortgage-backed securities ,, (,) , (,) ,, (,)

Corporate bonds , (,) , (,) , (,)

Total securities with unrealized losses ,, (,) , (,) ,, (,)

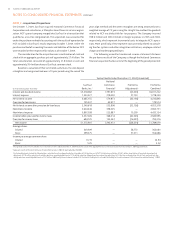

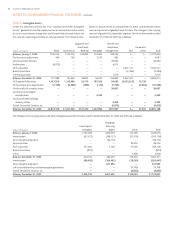

The amortized cost and fair value of investments in debt securities at December , by estimated average life are shown below. Actual cash flows will

differ from estimated average lives and contractual maturities because borrowers may have the right to call or prepay obligations with or without call or

prepayment penalties.

Amortized Fair

(Dollars in thousands) Cost Value

Due in one year or less ,, ,,

Due in one year through five years ,, ,,

Due after five years through ten years ,, ,,

After ten years , ,

Total ,, ,,

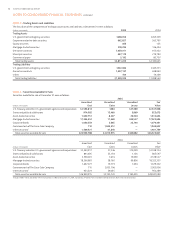

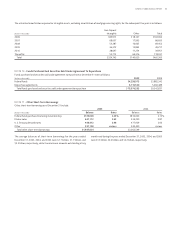

Market changes in interest rates and market changes in credit spreads will

result in temporary unrealized losses as a normal fluctuation in the mar-

ket price of securities. Securities with unrealized losses totaling .

million have been in an unrealized loss position for less than months.

These securities were purchased mostly in and the temporary losses

are due primarily to a rise in market interest rates during . The .

million in unrealized losses which have been in a loss position for more

than months are primarily mortgage-backed securities issued by U.S.

Government Agencies which were purchased in and . The rea-

son for the temporary loss is that market interest rates are higher than

when these securities were originally purchased. The total unrealized loss

of . million represents .% of the fair value. The Company reviews

all of its securities with unrealized losses for impairment at least quarterly.

As part of these reviews, the Company determined that a particular asset-

backed security was impaired for other-than-temporary reasons and recog-

nized a security loss of . million in . The Company has determined

that there were no additional other-than-temporary impairments associ-

ated with the above securities at December , .