SunTrust 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT98

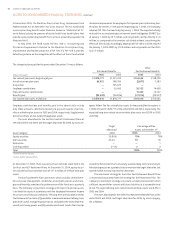

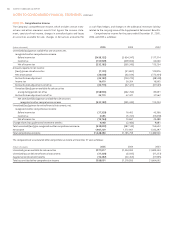

The following methods and assumptions were used by the Company in esti-

mating the fair value of financial instruments:

• Short-term financial instruments are valued at their carrying amounts

reported in the consolidated balance sheets, which are reasonable esti-

mates of fair value due to the relatively short period to maturity of the

instruments. This approach applies to cash and cash equivalents, short-

term investments, and certain other assets and liabilities.

• Trading assets and liabilities are predominantly valued at quoted market

prices. If quoted market prices are not available, fair values are based on

quoted market prices of comparable instruments. Fair values for deriva-

tives are based on quoted market prices, current settlement values, pric-

ing models or other formulas.

• Securities available for sale are predominantly valued at quoted market

prices.

• Loans held for sale are valued based on observable current market prices.

• Loans are valued on the basis of estimated future receipts of principal and

interest, discounted at rates currently being offered for loans with similar

terms and credit quality. Loan prepayments are used to adjust future cash

flows based on historical patterns. The carrying amount of accrued inter-

est approximates its fair value.

• Mortgage servicing rights are valued using assumptions that are sup-

ported by market and economic data collected from various sources.

• Deposit liabilities with no defined maturity such as demand deposits,

NOW/money market accounts, and savings accounts have a fair value

equal to the amount payable on demand at the reporting date, i.e., their

carrying amounts. Fair values for certificates of deposit are estimated

using a discounted cash flow calculation that applies current interest

rates to a schedule of aggregated expected maturities. The intangible

value of long-term relationships with depositors is not taken into account

in estimating fair values.

• Fair values for foreign deposits, short-term borrowings and long-term

debt are based on quoted market prices for similar instruments or esti-

mated using discounted cash flow analysis and the Company’s current

incremental borrowing rates for similar types of instruments.

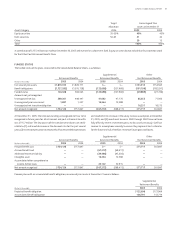

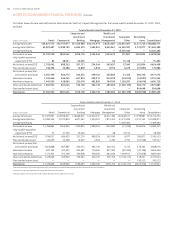

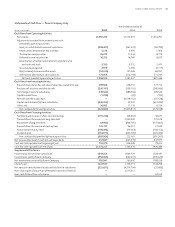

NOTE • Fair Values of Financial Instruments

The following table presents the carrying amounts and fair values of the Company’s financial instruments at December , and :

Carrying Fair Carrying Fair

(Dollars in thousands) Amount Value Amount Value

Financial assets:

Cash and short-term investments ,, ,, ,, ,,

Trading assets ,, ,, ,, ,,

Securities available for sale ,, ,, ,, ,,

Loans held for sale ,, ,, ,, ,,

Loans ,, ,, ,, ,,

Mortgage servicing rights , , , ,

Financial liabilities:

Consumer and commercial deposits ,, ,, ,, ,,

Brokered deposits ,, ,, ,, ,,

Foreign deposits ,, ,, ,, ,,

Short-term borrowings ,, ,, ,, ,,

Long-term debt ,, ,, ,, ,,

Trading liabilities ,, ,, ,, ,,

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued