SunTrust 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT26

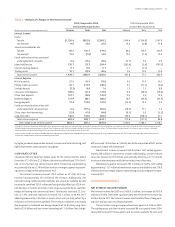

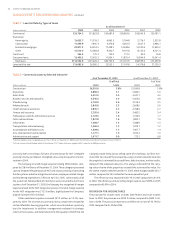

increased basis points from the prior year. The increase in loan yield was

due in part to the increase in yield on floating-rate loans which benefited

from the increase in short-term market interest rates. In addition, the yield

on new fixed rate loan production increased as long term interest rates were

also higher in . The increase in securities available for sale yield was due

to reinvestment of lower-yielding investment cash flows into higher-yield-

ing investments during . In , the total interest-bearing liability

cost increased basis points from . Growth in noninterest-bearing

DDA of . billion, or .%, mitigated the impact of these higher funding

costs on the margin.

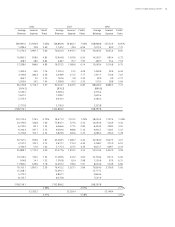

The relatively flat margin was due more specifically to a number of

factors. The Company’s balance sheet was positioned to benefit from

higher rates and a steeper yield curve. During , while both short- and

long-term interest rates increased, the yield curve flattened considerably.

While one-month LIBOR increased basis points on average in ,

the five-year swap rate only increased basis points. The Company’s

prime rate averaged .% for , an increase of approximately

basis points from . The Federal Reserve Bank Fed Funds rate averaged

.% for , approximately basis points over the average.

The improvement in margin compared to was mitigated by an increase

in the size of the loans held for sale portfolio, whose spread decreased

commensurate with the flattening of the yield curve. A factor supporting the

net interest margin was the significant growth in lower cost deposits, mainly

DDA and NOW accounts. Average DDA and NOW accounts increased .

billion, or .%, compared to . The NCF merger accounted for slightly

more than one-half of the increase. The growth in DDA and NOW accounts

replaced more expensive wholesale funding, helping maintain the margin in

. The margin also benefited from the improvement in investment port-

folio yield. The reasons for the improvement are covered in the Securities

Available for Sale discussion beginning on page .

Average earning assets increased . billion, or .%, and aver-

age interest-bearing liabilities increased . billion, or .%, versus

. Average loans rose . billion, average securities available for sale

increased . billion, and average loans held for sale increased . billion

in . Loans held for sale increased due largely to an increase in mortgage

production.

The Company continued to take steps to obtain alternative lower

cost funding sources, such as developing initiatives to grow client deposits.

Campaigns to attract client deposits were implemented in and .

Interest income that the Company was unable to recognize on non-

accrual loans had a negative impact of one basis point on the net interest

margin in and no impact in .

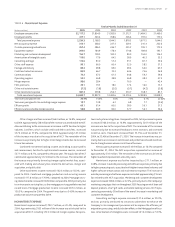

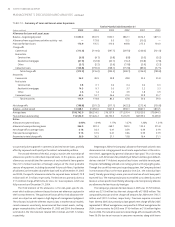

NONINTEREST INCOME

Noninterest income for was ,. million, an increase of .

million, or .%, compared to . Approximately million of the

increase was attributable to NCF. Positively impacting noninterest income

were increases in service charges on deposits, wealth management income

(the combination of trust and investment management income and retail

investment services), other charges and fees, card fees, and mortgage

related income (classified in other noninterest income). Additionally, net

securities losses decreased . million, or .%, compared to , and

the Company realized a net gain of . million on the sale of RCM assets

in . On March , , SunTrust sold substantially all of the factoring

assets of RCM to CIT Group, Inc. The sale of approximately million in

net assets resulted in a gain that was partially offset by expenses primarily

related to the severance of RCM employees and the write-off of obsolete

financial systems.

Service charges on deposit accounts increased . million, or

.%, compared to . NCF accounted for approximately million

of the increase. The impact of NCF was offset by a decrease in account anal-

ysis service charges on commercial accounts, due to higher client compen-

sating balances and increased client earnings credit rates, driven by rising

short-term interest rates in .

Trust and investment management income increased . million,

or .%, compared to . NCF contributed approximately million

of the increase. An overall increase in assets under management resulted

in higher income, as well as the acquisition of Seix in May of . Retail

investment services income increased . million, or .%, compared

to the prior year. Approximately million of the increase was attributable

to NCF, and the remaining increase was due to continued sales momentum

in the Wealth and Investment Management segment.

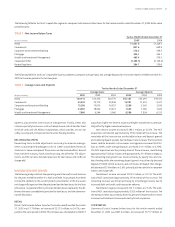

TABLE • Noninterest Income

Twelve Months Ended December

(Dollars in millions)

Service charges on deposit accounts . . . . . .

Trust and investment management income . . . . . .

Retail investment services . . . . . .

Other charges and fees . . . . . .

Investment banking income . . . . . .

Trading account profits and commissions . . . . . .

Card fees . . . . . .

Net gain on sale of RCM assets . — — — — —

Other noninterest income . . . . . .

Total noninterest income before securities

(losses)/gains ,. ,. ,. ,. ,. ,.

Securities (losses)/gains (.) (.) . . . .

Total noninterest income ,. ,. ,. ,. ,. ,.

Year-over-year growth rate in noninterest

income before securities (losses)/gains .% .% .% .% .%

MANAGEMENT’S DISCUSSION AND ANALYSIS continued