SunTrust 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT34

price was funded with cash generated by a combination of million of

wholesale CDs issued in May of and billion of senior debt issued in

August of .

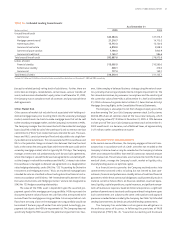

SunTrust manages capital through dividends and share repurchases

authorized by the Company’s Board of Directors. Management assesses

capital needs based on expected growth and the current economic climate.

In , the Company repurchased ,, shares for . million

compared to , shares for . million repurchased in . As of

December , , the Company was authorized to purchase up to an

additional . million shares under current Board authorization.

The Company declared common dividends totaling . million

during , or . per share, on net income of ,. million. The

dividend payout ratio was .% in versus .% in .

One measure of capital adequacy is the tangible equity ratio, which is

calculated using total shareholders’ equity less purchase accounting intan-

gibles, including goodwill, divided by total assets less purchase accounting

intangibles. This ratio was .% as of December , versus .% as

of December , . Management analyzes the Company’s capital posi-

tion with and without the impact of the stock of The Coca-Cola Company.

As of December , , the amount in total shareholders’ equity related

to this security holding was . billion compared to . billion as of

December , . This decline accounted for two basis points of the

basis points decline in the tangible equity ratio. The remainder of the decline

was attributed to strong earning asset growth.

ENTERPRISE RISK MANAGEMENT

In the normal course of business, SunTrust is exposed to various risks. To

manage the major risks that are inherent to the Company and to provide

reasonable assurance that key business objectives will be achieved, the

Company has established an enterprise risk governance process and formed

the SunTrust Enterprise Risk Program (“SERP”). Moreover, the Company

has policies and various risk management processes designed to effectively

identify, monitor, and manage risk.

Management continually refines and enhances its risk management

policies, processes, and procedures to maintain effective risk manage-

ment and governance, including identification, measurement, monitor-

ing, control, mitigation, and reporting of all material risks. Over the last

few years, the Company has enhanced risk measurement applications and

systems capabilities that provide management information on whether

the Company is being appropriately compensated for the risk profile it has

adopted. The Company balances its strategic goals, including revenue and

profitability objectives, with the risks associated with achieving its goals.

Effective risk management is an important element supporting business

decision making at SunTrust.

Enterprise Risk Management’s focus is on synthesizing, assessing,

reporting and mitigating the full set of risks at the enterprise level, providing

senior management with a holistic picture of the organization’s risk profile.

The Company implemented an enterprise risk management framework

that will improve the Company’s ability to manage its aggregate risk profile.

At the core of the framework are SunTrust’s risk vision and mission.

Risk Vision: To deliver sophisticated risk management capabilities con-

sistent with those of top-tier financial institutions that support the needs of

the business, enable risk-enlightened management and the optimal alloca-

tion of capital.

Risk Mission: To promote a strong risk management culture which facili-

tates accountability, risk-informed decisions consistent with the Company’s

strategic objectives and the creation of shareholder value.

The Company’s Chief Risk Officer (“CRO”) reports to the Chief

Executive Officer and is responsible for the oversight of the risk manage-

ment organization as well as risk governance processes. The CRO provides

overall leadership, vision, and direction for the Company’s enterprise risk

management framework.

Organizationally, the Company measures and manages risk accord-

ing to three main risk categories: credit risk, market risk (including liquid-

ity risk), and operational risk (including compliance risk). The Chief Credit

Officer manages the Company’s credit risk program. The Chief Financial

Officer and Treasurer manage the Company’s market risk program. The

Chief Operational Risk Officer manages the Company’s operational risk

program. These three areas of risk are managed on a consolidated basis

under the Company’s enterprise risk management framework, which also

takes into consideration legal and reputational risk factors.

In , SunTrust made significant enhancements to its enter-

prise risk management function. The Model Validation and Enterprise

Risk Measurement groups were formed to provide reasonable assurance

that risks inherent in model development and usage are properly identi-

fied and managed and to oversee the calculation of economic capital.

SERP was created to ensure that the approach and plans for risk manage-

ment are aligned to the vision and mission of Enterprise Risk Management

as well as to manage regulatory compliance. In addition, SERP’s goal is to

ensure the Company’s future compliance with the Basel II Capital Accord.

Key objectives of SERP include incorporating risk management principles

that encompass Company values and standards and are designed to guide

risk-taking activity and maximize performance through the balance of risk

and reward and leveraging initiatives driven by regulatory requirements to

deliver capabilities to better measure and manage risk.

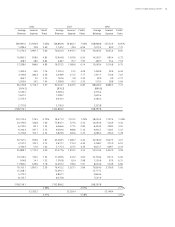

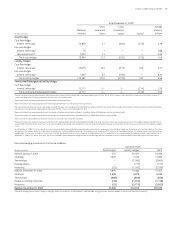

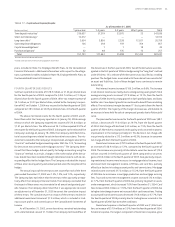

TABLE • Capital Ratios

As of December

(Dollars in millions)

Tier capital ,. ,. ,. ,. ,. ,.

Total capital ,. ,. ,. ,. ,. ,.

Risk-weighted assets ,. ,. ,. ,. ,. ,.

Risk-based ratios:

Tier capital .% .% .% .% .% .%

Total capital . . . . . .

Tier leverage ratio . . . . . .

Total shareholders’ equity to assets . . . . . .

Tier capital includes trust preferred obligations of . billion at the end of and , . billion at the end of , and , and . billion at the end of .

MANAGEMENT’S DISCUSSION AND ANALYSIS continued