Rogers 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 95

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

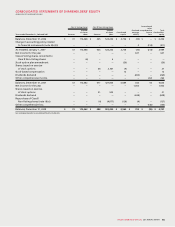

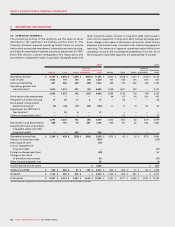

In addition, Cable consists of the following reportable segments:

2008 2007

Rogers Corporate Rogers Corporate

Cable Business Rogers items and Total Cable Business Rogers items and Total

Operations Solutions Retail eliminations Cable Operations Solutions Retail eliminations Cable

Operating revenue $ 2,878 $ 526 $ 417 $ (12) $ 3,809 $ 2,603 $ 571 $ 393 $ (9) $ 3,558

Cost of sales – – 197 – 197 – – 186 – 186

Sales and marketing 248 26 192 – 466 257 75 187 – 519

Operating, general

and administrative* 1,459 441 25 (12) 1,913 1,338 484 24 (9) 1,837

1,171 59 3 – 1,233 1,008 12 (4) – 1,016

Stock option plan amendment* – – – – – 106 2 5 – 113

Integration and restructuring 9 6 5 – 20 9 29 – – 38

Stock-based expense (recovery) * (30) (1) (1) – (32) 10 – 1 – 11

Adjustment for CRTC Part II

fees decision* 25 – – – 25 – – – – –

Contract renegotiation fee* – – – – – 52 – – – 52

1,167 54 (1) – 1,220 831 (19) (10) – 802

Depreciation and amortization 791 737

Operating income (loss) $ 429 $ 65

Additions to PP&E $ 829 $ 36 $ 21 $ – $ 886 $ 710 $ 83 $ 21 $ – $ 814

Goodwill $ 982 $ – $ – $ – $ 982 $ 926 $ – $ – $ – $ 926

Total assets $ 4,003 $ 1,210 $ 265 $ (325) $ 5,153 $ 3,330 $ 1,723 $ 257 $ (99) $ 5,211

*Included with operating, general and administrative operating expenses in consolidated statements of income.

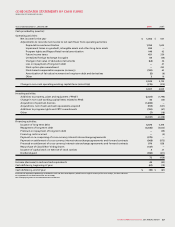

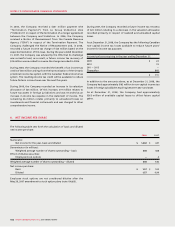

(B) PRODUCT REVENUE:

Revenue is comprised of the following:

2008 2007

Wireless:

Postpaid $ 5,548 $ 4,868

Prepaid 285 273

One-way messaging 10 13

Network revenue 5,843 5,154

Equipment sales 492 349

6,335 5,503

Cable:

Cable Operations 2,878 2,603

Rogers Business Solutions (“RBS”) 526 571

Rogers Retail 417 393

Intercompany eliminations (12) (9)

3,809 3,558

Media:

Advertising 758 629

Circulation and subscription 184 164

Retail 276 282

Blue Jays/Sports Entertainment 198 172

Other 80 70

1,496 1,317

Corporate items and intercompany eliminations (305) (255)

$ 11,335 $ 10,123