Rogers 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

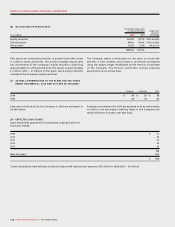

2008 2007

Reclassification from other comprehensive income of change in fair value of derivatives

not accounted for as hedges under United States GAAP $ (93) $ 226

Decrease in fair value of prepayment option not accounted for under United States GAAP 9 6

Deferral of transaction costs 16 –

Amortization of deferred transaction costs under United States GAAP (8) (22)

United States GAAP difference in net income (pre-tax) $ (76) $ 210

As a result of the application of the new Canadian GAAP standards,

the Company separated the early repayment option on one of

the Company’s debt instruments and recorded the fair value of

$19 million related to this embedded derivative at January 1, 2007,

with a corresponding decrease in opening deficit of $13 million, net

of income taxes of $6 million. During 2008, the decrease in fair value

of this early repayment option, amounting to $9 million (2007 –

$6 million), was recorded in the consolidated statements of income

under Canadian GAAP. Under United States GAAP, the Company is

not permitted to separate the early repayment option.

Effective January 1, 2007, under Canadian GAAP, the Company

records all transaction costs for financial assets and financial

liabilities in income as incurred. As a result, under Canadian GAAP,

the carrying value of transaction costs of $39 million, net of income

taxes of $20 million, was charged to opening deficit on transition at

January 1, 2007. Under United States GAAP, the Company continues

to defer these costs and amortize them over the term of the related

asset or liability. During 2008, the Company capitalized $16 million

in debt issuance costs for United States GAAP purposes.

The impact of these changes on net income on a pre-tax basis are

summarized as follows for the year ended December 31:

The impact of these changes on shareholders’ equity is summarized

as follows:

2008 2007

Transaction costs $ 47 $ 39

Early repayment option (4) (13)

United States GAAP difference in ending shareholders’ equity (pre-tax) $ 43 $ 26

The Financial Accounting Standards Board (“FASB”) Statement

No. 157 (“FASB No. 157”), Fair Value Measurements, defines fair

value, establishes a framework for measuring fair value under

generally accepted accounting principles and establishes a hierarchy

that categorizes and prioritizes the sources to be used to estimate

fair value. FASB No. 157 also expands disclosures about fair value

measurements in the financial statements. On February 12, 2008,

the FASB issued FASB Staff Position 157-2 (“FSP 157-2”), Effective

Date of FASB Statement No. 157, which delays the effective date

of FASB No. 157 for one year, for all non-financial assets and non-

financial liabilities, except those that are recognized or disclosed at

fair value in the financial statements on a recurring basis (at least

annually). The Company elected a partial deferral of FASB No. 157

under the provisions of FSP 157-2 related to the measurement of fair

value used when initially measuring non-financial assets and non-

financial liabilities in a business combination, evaluating goodwill,

other intangible assets, wireless licences and other long-lived

assets for impairment and valuing asset retirement obligations and

liabilities for exit or disposal activities. The impact of implementing

FSP 157-2, effective January 1, 2009, is not expected to be material

to the Company’s financial statements. The impact of partially

adopting FASB No. 157 effective January 1, 2008 was not material to

the Company’s financial statements.

On October 10, 2008, the FASB issued FSP 157-3, Determining the

Fair Value of a Financial Asset When the Market for That Asset

is Not Active, which clarifies the application of FASB No.157 in a

Market that is not active. FSP 157-3 was effective upon issuance,

including prior periods for which financial statements have not

been issued. The adoption of this FSP did not have any impact on

the Company.

FASB Statement No. 159:

Effective January 1, 2008, FASB Statement No. 159, The Fair Value

Option for Financial Assets and Financial Liabilities - Including an

Amendment of SFAS No. 115 (“FASB No. 159”), was adopted by the

Company. This statement permits but does not require the Company

to measure financial instruments and certain other items at fair

value. As the Company did not elect to fair value any of its financial

instruments under the provisions of FASB No. 159, the adoption of

this statement did not have an impact on the Company’s financial

statements.