Rogers 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 67

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

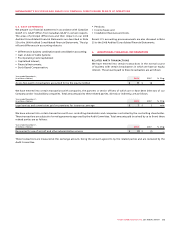

• Sales and marketing expenses, which represent the costs to

acquire new subscribers (other than those related to equipment),

such as advertising, commissions paid to third parties for new

activations, remuneration and benefits to sales and marketing

employees, as well as direct overheads related to these activities

and the costs of operating the Rogers Retail store locations; and

• Operating,generalandadministrativeexpenses,whichinclude

all other expenses incurred to operate the business on a day-to-

day basis and service existing subscriber relationships, including

retention costs, inter-carrier payments to roaming partners and

long-distance carriers, network maintenance costs, program-

ming related costs, the CRTC contribution levy, Internet and

e-mail services and printing and production cost.

In the wireless and cable industries in Canada, the demand for ser-

vices continues to grow and the variable costs, such as commissions

paid for subscriber activations, as well as the fixed costs of acquir-

ing new subscribers, are significant. Fluctuations in the number of

activations of new subscribers from period-to-period and the sea-

sonal nature of both wireless and cable subscriber additions result

in fluctuations in sales and marketing expenses and accordingly, in

the overall level of operating expenses. In our Media business, sales

and marketing expenses may be significant to promote publishing,

radio and television properties, which in turn attract advertisers,

viewers, listeners and readers.

Sales and Marketing Costs (or Cost of Acquisition)

Per Subscriber

Sales and marketing costs per subscriber, which is also often referred

to in the Wireless industry as cost of acquisition per subscriber

(“COA”), “subscriber acquisition cost”, or “cost per gross addition”,

is calculated by dividing total sales and marketing expenditures,

plus costs related to equipment provided to new subscribers for

the period, by the total number of gross subscriber activations dur-

ing the period. Subscriber activations include postpaid and prepaid

voice and data activations and one-way messaging activations.

COA, as it relates to a particular activation, can vary depending

on the level of ARPU and term of a subscriber’s contract. Refer

to the section entitled “Supplementary Information: Non-GAAP

Calculations” for further details on the calculation.

The wireless communications industry in Canada continues to grow

and the costs of acquiring new subscribers are significant. Because

a substantial portion of subscriber activation costs are variable in

nature, such as commissions paid for each new activation, and due to

fluctuations in the number of activations of new subscribers from peri-

od-to-period and the seasonal nature of these subscriber additions,

we experience material fluctuations in sales and marketing expenses

and, accordingly, in the overall level of operating expenses.

Operating Expense per Subscriber

Operating expense per subscriber, expressed as a monthly average,

is calculated by dividing total operating, general and administrative

expenses, plus costs related to equipment provided to existing sub-

scribers, by the average number of subscribers during the period.

Operating expense per subscriber is tracked by Wireless as a mea-

sure of our ability to leverage our operating cost structure across

a growing subscriber base, and we believe that it is an impor-

tant measure of our ability to achieve the benefits of scale as we

increase the size of our business. Refer to the section entitled

“Supplementary Information: Non-GAAP Calculations” for further

details on this Wireless calculation.

Operating Profit and Operating Profit Margin

We define operating profit as net income before depreciation and

amortization, interest expense, income taxes and non-operating

items, which include impairment losses on goodwill, intangible

assets and other long-term assets, foreign exchange gains (losses),

loss on repayment of long-term debt, change in fair value of deriv-

ative instruments, and other income. Operating profit is a standard

measure used in the communications industry to assist in under-

standing and comparing operating results and is often referred to

by our peers and competitors as EBITDA (earnings before interest,

taxes, depreciation and amortization) or OIBDA (operating income

before depreciation and amortization). We believe this is an impor-

tant measure as it allows us to assess our ongoing businesses

without the impact of depreciation or amortization expenses as

well as non-operating factors. It is intended to indicate our ability

to incur or service debt, invest in PP&E and allows us to compare

us to our peers and competitors who may have different capital or

organizational structures. This measure is not a defined term under

Canadian GAAP or U.S. GAAP.

We calculate operating profit margin by dividing operating profit

by total revenue, except in the case of Wireless. For Wireless,

operating profit margin is calculated by dividing operating profit

by network revenue. Network revenue is used in the calculation,

instead of total revenue, because network revenue better reflects

Wireless’ core business activity of providing wireless services. Refer

to the section entitled “Supplementary Information: Non-GAAP

Calculations” for further details on this Wireless, Cable and Media

calculation.

Adjusted Operating Profit, Adjusted Operating Profit Margin,

Adjusted Net Income, and Adjusted Basic and Diluted Net

Income Per Share

Beginning in 2007, we have included certain non-GAAP measures

that we believe provide useful information to management and

readers of this MD&A in measuring our financial performance.

These measures, which include adjusted operating profit, adjusted

operating profit margin, adjusted net income and adjusted basic

and diluted net income per share, do not have a standardized mean-

ing under GAAP and, therefore, may not be comparable to similarly

titled measures presented by other publicly traded companies, nor

should they be construed as an alternative to other financial mea-

sures determined in accordance with GAAP. We define adjusted

operating profit as operating profit less: (i) the impact of the one-

time non-cash charge resulting from the introduction of a cash

settlement feature related to employee stock options; (ii) stock-

based compensation expense; (iii) integration and restructuring

expenses; (iv) the impact of a one-time charge resulting from the

renegotiation of an Internet-related services agreement; and (v) an

adjustment for Canadian Radio-television and Telecommunications

Commission (“CRTC”) Part II fees related to prior periods. In addi-

tion, adjusted net income and net income per share excludes debt

issuance costs, losses on repayment of long-term debt, impairment

losses on goodwill, intangible assets and other long-term assets,

and the related income tax impacts of the above items.