Rogers 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 37

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Total retention spending, including subsidies on handset upgrades,

was $536 million in 2008, compared to $403 million in 2007. As a

direct result of the smartphone marketing campaign, Wireless had

a higher than normal rate of upgrade activity by existing subscrib-

ers during the year. Approximately 57% of the smartphone device

activations in 2008 were hardware and service plan upgrades by

existing subscribers which drove the largest portion of the increase

in retention, along with growth in the subscriber base, in general,

increasing retention spending compared to prior periods.

Wireless estimates that the incremental hardware subsidy and data

plan commission costs associated with the significant smartphone

volumes during the year drove approximately $200 million of incre-

mental expenses versus what the same volume of devices would

have been with the device sales mix which existed at the end of

20 07.

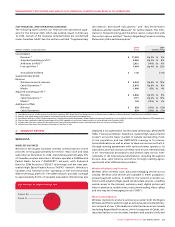

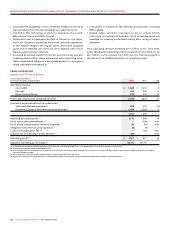

Wireless Adjusted Operating Profit

The moderate increase in year-over-year adjusted operating profit

reflects the significant growth in network revenues, partially offset

by the increase in cost of equipment sales from the smartphone

handset subsidies discussed above. Primarily as a result of the

investment in a significant number of high ARPU, but high subsidy

smartphone activations, Wireless’ adjusted operating profit mar-

gin on network revenue (which excludes equipment sales revenue)

decreased to 48.0% for 2008,

compared to 50.2% in 2007.

Spectrum Auction Conclusion

Wireless participated in the AWS

spectrum auction in Canada

which commenced on May 27,

2008 and concluded on July 21,

2008. Wireless acquired 20 MHz

of AWS spectrum, which operates

in the 1700/2100 MHz frequency

range, across all 13 provinces

and territories with winning bids

that totalled approximately $1.0

billion, or approximately $1.67/

MHz/pop. Final payment was

submitted to Industry Canada on

September 3, 2008 and Rogers

was granted its licences on

December 22, 2008.

Wireless Additions to Property, Plant and Equipment

Wireless additions to PP&E, which excludes the acquisition of AWS

spectrum discussed above, are classified into the following categories:

20082007

$2,806$2,589$1,987

WIRELESS ADJUSTED

OPERATING PROFIT

(In millions of dollars)

2007

2008

2006

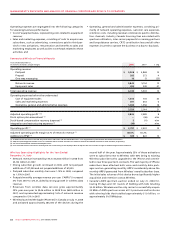

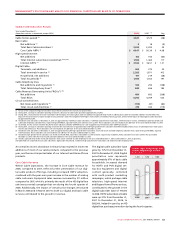

2008 WIRELESS ADDITIONS TO PP&E

(%)

HSPA 34%

Other 16%

Inukshuk 1%

Network 49%

Years ended December 31,

(In millions of dollars) 2008 2007 % Chg

Additions to PP&E

HSPA $ 315 $ 316 (0)

Network – capacity 200 169 18

Network – other 259 175 48

Information and technology and other 152 147 3

Inukshuk 3 15 (80)

Total additions to PP&E $ 929 $ 822 13

Additions to Wireless PP&E for 2008 reflect spending on network

capacity, such as radio channel additions and network enhancing

features. Additions to PP&E associated with the deployment of

HSPA were mainly for the continued roll-out to various markets

across Canada and the upgrade to faster network throughput

speeds. Other network-related PP&E additions included national

site build activities, additional spending on test and monitoring

equipment, network sectorization work, operating support system

activities, investments in network reliability and renewal initia-

tives, and new product platforms. Information and technology and

other initiatives included billing and back office system upgrades,

and other facilities and equipment spending.

CABLE

CABLE’S BUSINESS

Cable is one of Canada’s largest providers of cable television, cable

telephony and high-speed Internet access, and is also a facilities-

based telecommunications alternative to the traditional telephone

companies. Its business consists of the following three segments:

The Cable Operations segment has 2.3 million basic cable subscrib-

ers at December 31, 2008, representing approximately 30% of basic

cable subscribers in Canada. At December 31, 2008, it provided

digital cable services to approximately 1.6 million households and

high-speed Internet service to approximately 1.6 million residential

subscribers. Through Rogers Home Phone, it offers local telephone

and long-distance services to residential customers with both

voice-over-cable and circuit-switched technologies with 1.1 million

subscriber lines at December 31, 2008.

The RBS segment offers local and long-distance telephone,

enhanced voice and data services, and IP access to Canadian busi-

nesses and governments, as well as making some of these offerings