Rogers 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

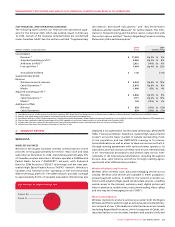

Loss on Repayment of Long-Term Debt

During 2007, we redeemed Wireless’ US$155 million 9.75% Senior

Debentures due 2016 and Wireless’ US$550 million Floating Rate

Senior Notes due 2010. These redemptions resulted in a loss on

repayment of long-term debt of $47 million, including aggregate

redemption premiums of $59 million offset by a write-off of the fair

value increment arising from purchase accounting of $12 million.

Foreign Exchange Gain (Loss)

During 2008, the Canadian dollar weakened by 24 cents versus

the U.S. dollar resulting in a foreign exchange loss of $99 million,

primarily related to US$750 million of U.S. dollar-denominated

long-term debt that is not hedged for accounting purposes. During

2007, the foreign exchange gain of $54 million arose primarily from

the strengthening of the Canadian dollar by 18 cents versus the

U.S. dollar, favourably affecting the translation of our U.S. dollar-

denominated long-term debt that was not hedged for accounting

purposes.

Debt Issuance Costs

We recorded debt issuance costs of $16 million during 2008 due

to the fees and expenses incurred in connection with the

US$1.75 billion investment grade debt offerings that were closed on

August 6, 2008.

Interest on Long-Term Debt

Despite the $0.9 billion net increase in long-term debt, including the

impact of Cross-Currency Swaps, at December 31, 2008 compared

to December 31, 2007, interest expense declined marginally in 2008

reflecting the 0.24% decrease in the weighted average interest

rate on our long-term debt, which was 7.29% at December 31, 2008

compared to 7.53% at December 31, 2007. This decrease was largely

due to the following: the full year impact of the 2007 repayments

of three higher coupon debt issues; the 2008 recouponing of three

Cross-Currency Swaps aggregating US$575 million notional principal

amount at Canadian dollar interest rates lowered by approximately

1.0%; and, lower floating interest rates on our bank debt in 2008.

Operating Income

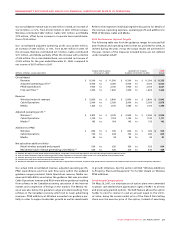

The increase in our operating income, compared to the prior year,

is primarily due to the growth in revenue of $1,212 million exceed-

ing the growth in operating expenses, including integration and

restructuring expenses, of $684 million. See the section entitled

“Segment Review” for a detailed discussion on respective segment

results.

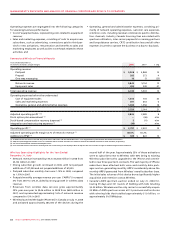

Impairment Losses on Goodwill, Intangible Assets and Other

Long-Term Assets

In the fourth quarter of 2008, we determined that the fair value

of the conventional television business of Media was lower than

its carrying value. This primarily resulted from weakening of indus-

try expectations and declines in advertising revenues amidst the

slowing economy. As a result, we recorded an aggregate non-cash

impairment charge of $294 million with the following components:

$154 million related to goodwill, $75 million related to broadcast

licences and $65 million related to intangible assets and other long-

term assets.

Depreciation and Amortization Expense

The increase in depreciation and amortization expense for the year

ended December 31, 2008, over 2007, primarily reflects an increase

in depreciation on PP&E expenditures.

Integration and Restructuring Expenses

During the year ended December 31, 2008, we incurred $38 mil-

lion of restructuring expenses related to severances resulting from

targeted restructuring of our employee base to improve our cost

structure in light of the declining economic conditions. In addition,

we incurred integration expenses of $9 million related to the inte-

gration of previously acquired businesses and certain restructuring

and $4 million for the closure of 18 underperforming Rogers Retail

locations.

Adjusted Operating Profit

Wireless and Cable both contributed to the increase in adjusted

operating profit for the year ended December 31, 2008. This increase

was partially offset by a decrease in Media’s adjusted operating

profit for 2008 compared to 2007. Wireless’ adjusted operating

profit reflects significant costs associated with the heavy sales

volumes of smartphone devices. Refer to the individual segment

discussions for details of the respective increases and decreases in

adjusted operating profit.

Consolidated adjusted operating profit increased to $4,060 million

in 2008, compared to $3,703 million in 2007. Adjusted operating

profit excludes: (i) the impact of a $452 million one-time non-cash

charge related to the introduction of a cash settlement feature for

stock options during 2007; (ii) stock-based compensation (recov-

ery) expense of $(100) million in 2008 and $62 million in 2007;

(iii) integration and restructuring expenses of $51 million in 2008 and

$38 million in 2007; (iv) the impact of a one-time charge of

$52 million resulting from the renegotiation of an Internet-related

services agreement in 2007; and (v) an adjustment for CRTC Part II

fees related to prior periods of $31 million in 2008. See the section

entitled “Government Regulation and Regulatory Developments”

for further details.

For details on the determination of adjusted operating profit, which

is a non-GAAP measure, see the sections entitled “Supplementary

Information: Non-GAAP Calculations” and “Key Performance

Indicators and Non-GAAP Measures”.

Employees

Employee remuneration represents a material portion of our

expenses. At December 31, 2008, we had approximately 25,800

full-time equivalent employees (“FTEs”) across all of our operating

groups, including our shared services organization and corporate

office, representing an increase of approximately 1,400 from the

level at December 31, 2007. The increase is primarily due to an

increase in our shared services staffing, partially offset by reduc-

tions associated with operational efficiencies. Total remuneration

paid to employees (both full and part-time) in 2008 was approxi-

mately $1,566 million, a decrease of approximately $13 million from

$1,579 million in 2007. The decrease in remuneration paid to employ-

ees is primarily attributed to the change in stock prices resulting

in a $100 million recovery to stock-based compensation which is

partially offset by an increase in the FTEs compared to 2007.