Rogers 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 107

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

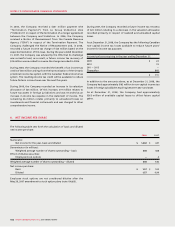

(I) FOREIGN EXCHANGE:

Foreign exchange losses related to the translation of long-term

debt recorded in the consolidated statements of income totalled

$65 million (2007 – gain of $46 million).

(J) TERMS AND CONDITIONS:

The provisions of the Company’s $2.4 billion bank credit facility

described above impose certain restrictions on the operations and

activities of the Company, the most significant of which are debt

maintenance tests.

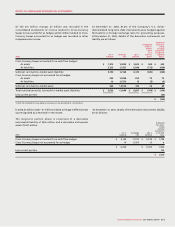

In addition, certain of the Company’s Senior Notes and Debentures

described above (including the Company’s 9.625% Senior Notes due

2011, 7.875% Senior Notes due 2012, 6.25% Senior Notes due 2013

and 8.75% Senior Debentures due 2032) contain debt incurrence

tests as well as restrictions upon additional investments, sales of

assets and payment of dividends, all of which are suspended in

the event the public debt securities are assigned investment grade

ratings by at least two of three specified credit rating agencies.

As at December 31, 2008, all of these public debt securities were

assigned an investment grade rating by each of the three specified

credit rating agencies and, accordingly, these restrictions have

been suspended for so long as such investment grade ratings are

maintained. The Company’s other Senior Notes and its Senior

Subordinated Notes do not contain any such restrictions, regardless

of the credit ratings for such securities.

In addition to the foregoing, the repayment dates of certain debt

agreements may be accelerated if there is a change in control of

the Company.

At December 31, 2008 and 2007, the Company was in compliance with

all of the terms and conditions of its long-term debt agreements.

(F) DEBT REPAYMENTS:

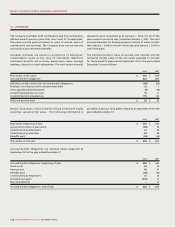

On February 6, 2007, the Company repaid at maturity, the aggregate

principal amount outstanding of Cable’s $450 million 7.60% Senior

Notes.

On May 3, 2007, the Company redeemed the aggregate principal

amount outstanding of Wireless’ U.S. $550 million ($609 million)

Floating Rate Senior Notes due 2010 at a redemption premium of

2%, or $12 million.

On June 21, 2007, the Company redeemed the aggregate principal

amount outstanding of Wireless’ U.S. $155 million ($166 million)

9.75% Senior Debentures due 2016 at a redemption premium of

28.416%. The Company incurred a net loss on repayment of the

Senior Debentures aggregating $47 million, including aggregate

redemption premiums of $59 million offset by a write-down of a

previously recorded fair value increment of $12 million.

In conjunction with the May 3, 2007, redemption of Wireless’ U.S.

$550 million Floating Rate Senior Notes due 2010 and the June

21, 2007, redemption of Wireless’ U.S. $155 million 9.75% Senior

Debentures due 2016, the Company incurred a net cash outlay of

$35 million on settlement of Cross-Currency Swaps and forward

contracts (note 15(d)).

(G) WEIGHTED AVERAGE INTEREST RATE:

The Company’s effective weighted average interest rate on all

long-term debt, as at December 31, 2008, including the effect of all

of the derivative instruments, was 7.29% (2007 – 7.53%).

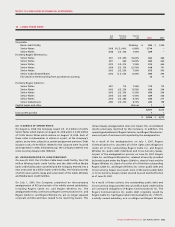

(H) PRINCIPAL REPAYMENTS:

As at December 31, 2008, principal repayments due within each

of the next five years and thereafter on all long-term debt are as

follows:

2009 $ 1

2010 –

2011 1,235

2012 1,494

2013 1,014

Thereafter 4,751

$ 8,495