Rogers 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

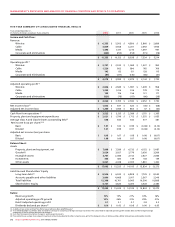

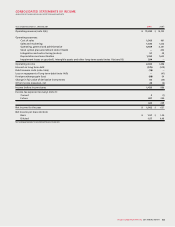

FIVE-YEAR SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

Years ended December 31,

(In millions of dollars, except per share amounts) 2008 2007 2006 2005 2004

Income and Cash Flow:

Revenue

Wireless $ 6,335 $ 5,503 $ 4,580 $ 3,860 $ 2,689

Cable 3,809 3,558 3,201 2,492 1,946

Media 1,496 1,317 1,210 1,097 957

Corporate and eliminations (305) (255) (153) (115) (78)

$ 11,335 $ 10,123 $ 8,838 $ 7,334 $ 5,514

Operating profit(1)

Wireless $ 2,797 $ 2,532 $ 1,969 $ 1,337 $ 950

Cable 1,220 802 890 765 709

Media 142 82 151 128 115

Corporate and eliminations (81) (317) (135) (86) (41)

$ 4,078 $ 3,099 $ 2,875 $ 2,144 $ 1,733

Adjusted operating profit(1)

Wireless $ 2,806 $ 2,589 $ 1,987 $ 1,409 $ 958

Cable 1,233 1,016 916 778 715

Media 142 176 156 131 117

Corporate and eliminations (121) (78) (117) (66) (38)

$ 4,060 $ 3,703 $ 2,942 $ 2,252 $ 1,752

Net Income (loss)(2) 1,002 $ 637 $ 622 $ (45) $ (68)

Adjusted net income (loss) $ 1,260 $ 1,066 $ 684 $ 47 $ (32)

Cash flow from operations (3) $ 3,522 $ 3,135 $ 2,386 $ 1,551 $ 1,305

Property, plant and equipment expenditures $ 2,021 $ 1,796 $ 1,712 $ 1,355 $ 1,055

Average Class A and Class B shares outstanding (Ms)(4) 638 642 642 577 481

Net income (loss) per share:(2)(4)

Basic $ 1.57 $ 1.00 $ 0.99 $ (0.08) $ (0.14)

Diluted 1.57 0.99 0.97 (0.08) (0.14)

Adjusted net income (loss) per share:

Basic $ 1.98 $ 1.67 $ 1.08 $ 0.08 $ (0.07)

Diluted 1.98 1.66 1.07 0.08 (0.07)

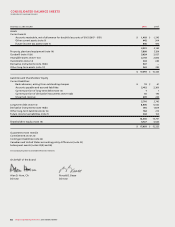

Balance Sheet:

Assets

Property, plant and equipment, net $ 7,898 $ 7,289 $ 6,732 $ 6,152 $ 5,487

Goodwill 3,024 3,027 2,779 3,036 3,389

Intangible assets 2,761 2,086 2,152 2,627 2,856

Investments 343 485 139 138 139

Other assets 3,067 2,438 2,303 1,881 1,402

$ 17,093 $ 15,325 $ 14,105 $ 13,834 $ 13,273

Liabilities and Shareholders’ Equity

Long-term debt (2) $ 8,506 $ 6,033 $ 6,988 $ 7,739 $ 8,542

Accounts payable and other liabilities 3,860 4,668 2,917 2,567 2,346

Total liabilities 12,366 10,701 9,905 10,306 10,888

Shareholders’ equity 4,727 4,624 4,200 3,528 2,385

$ 17,093 $ 15,325 $ 14,105 $ 13,834 $ 13,273

Ratios:

Revenue growth 12% 15% 21% 33% 16%

Adjusted operating profit growth 10% 26% 31% 29% 21%

Debt

(2)/adjusted operating profit 2.1 2.1 2.7 3.8 5.3

Dividends declared per share(4) $ 1.00 $ 0.42 $ 0.08 $ 0.06 $ 0.05

(1) As defined. See section entitled “Key Performance Indicators Non-GAAP Measures”.

(2) Year ended December 31, 2004 has been restated for a change in accounting of foreign exchange translation. The ratio of debt to adjusted operating profit includes debt and the foreign exchange

component of the fair value of derivative instruments.

(3) Cash flow from operations before changes in working capital amounts.

(4) Prior period shares and per share amounts have been retroactively adjusted to reflect a two-for-one-split of the Company’s Class A Voting and Class B Non-Voting shares on December 29, 2006.