Rogers 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

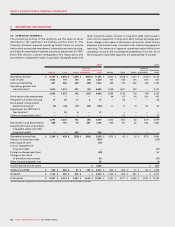

5. INVESTMENT IN JOINT VENTURES

2008 2007

Current assets $ 7 $ 7

Long-term assets 68 73

Current liabilities 4 6

Revenue – –

Expenses 29 25

Net income (loss) for the year (29) (25)

The Company has contributed certain assets to joint ventures

involved in the provision of wireless broadband Internet service and

in certain mobile commerce initiatives (note 11(c)). As at December

31, 2008 and 2007 and for the years then ended, proportionately

consolidating these joint ventures resulted in the following increases

(decreases) in the accounts of the Company:

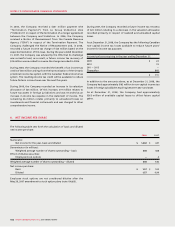

6. INTEGRATION AND RESTRUCTURING EXPENSES

During 2008, the Company incurred $38 million (2007 – nil) of

restructuring expenses related to severances resulting from the

targeted restructuring of its employee base across all segments to

improve its cost structure in light of the declining economic conditions.

Included in accounts payable and accrued liabilities is $35 million as at

December 31, 2008, which will be paid in 2009 and 2010.

During 2008, the Company incurred integration expenses of

$8 million (2007 - $14 million) related to acquisitions.

During 2008, the Company incurred $1 million (2007 - $24 million) of

restructuring expenses related to RBS, which is related to severances

resulting from staff reductions to reflect a reduction in customer

acquisition efforts related to enterprise and larger business

segments. Included in accounts payable and accrued liabilities as

at December 31, 2008, is $2 million (2007 - $12 million) related to the

severances, which will be paid in 2009.

During 2008, the Company incurred $4 million (2007 – nil) related

to the closure of 18 underperforming store locations, primarily

located in the province of Ontario.

In March 2007, the Company contributed its 2.3 GHz and 3.5 GHz

spectrum licences with a carrying value of $11 million to a 50%

owned joint venture for non-cash consideration of $58 million.

Accordingly, the carrying value of spectrum licences was reduced

by $5 million in 2007. A deferred gain of $24 million, being the

portion of the excess of fair value over carrying value related to

the other non-related venturer’s interest in the spectrum licences

contributed by the Company, was recorded on contribution of

these spectrum licences. This deferred gain is recorded in other

long-term liabilities and is being amortized to income over seven

years, of which $4 million was recognized in 2008 (2007 - $2 million).

In addition to a cash contribution of $8 million, the other venturer

also contributed its 2.3 GHz and 3.5 GHz spectrum licences valued

at $50 million to the joint venture. The Company recorded an

increase in spectrum licences and cash of $25 million and $4 million,

respectively, related to its proportionate share of the contribution

by the other venturer.