Rogers 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

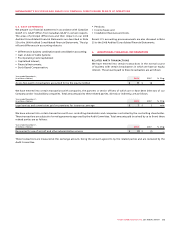

INTERNATIONAL FINANCIAL REPORTING STANDARDS (“IFRS”)

In 2006, the Canadian Accounting Standards Board (“AcSB”) pub-

lished a strategic plan that significantly affects financial reporting

requirements for Canadian public companies. The AcSB strategic

plan outlines the convergence of Canadian GAAP with IFRS over an

expected five-year transitional period.

In February 2008, the AcSB confirmed that IFRS will be mandatory

in Canada for profit-oriented publicly accountable entities for fiscal

periods beginning on or after January 1, 2011. Our first annual IFRS

financial statements will be for the year ending December 31, 2011

and will include the comparative period of 2010. Starting in the first

quarter of 2011, we will provide unaudited consolidated interim

financial information in accordance with IFRS including compara-

tive figures for 2010.

The table below illustrates key elements of our conversion plan,

our major milestones and current status. Our conversion plan is

organized in phases over time and by area. We have completed all

activities to date per our detailed project plan and expect to meet

all milestones through to completion of the conversion to IFRS.

We have allocated sufficient resources to our conversion project,

which include certain full-time employees in addition to contribu-

tions by other employees on a part-time or as needed basis. We

have completed the delivery of training to all employees with

responsibilities in the conversion process and our conversion plan

includes training for all other employees who will be impacted by

our conversion to IFRS.

Although we have completed preliminary assessments of account-

ing and reporting differences, impacts on systems and processes

and other areas of the business, we have not yet finalized these

assessments. As we finalize our determination of the significant

impacts on our financial reporting, including on our KPIs, systems

and processes, and other areas of our business, we intend to dis-

close such impacts in our future MD&As.

In the period leading up to the changeover, the AcSB will continue

to issue accounting standards that are converged with IFRS, thus

mitigating the impact of adopting IFRS at the changeover date.

The International Accounting Standards Board (“IASB”) will also

continue to issue new accounting standards during the conversion

period and, as a result, the final impact of IFRS on the Company’s

consolidated financial statements will only be measured once all

the IFRS applicable at the conversion date are known.

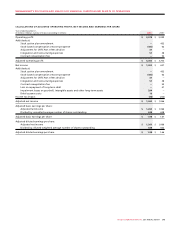

ACTIVITY MILESTONES STATUS

Financial reporting:

• Assessmentofaccountingandreport-

ing differences.

• SelectionofIFRSaccountingpolicies

and IFRS 1 elections.

• DevelopmentofIFRSnancialstate-

ment format, including disclosures.

• Quanticationofeffectsof

conversion.

Senior management and audit

committee approval for policy

recommendations and IFRS elections

during 2009.

Senior management and audit

committee approval on financial

statement format during 2010.

Final quantification of conversion

effects on 2010 comparative period

by Q1 2011.

Preliminary assessment of accounting

and reporting differences completed.

Selection of IFRS accounting policies

and IFRS 1 elections underway.

Systems and processes:

• Assessmentofimpactofchangeson

systems and processes.

• Implementationofanysystemandpro-

cess design changes including training

appropriate personnel.

• Documentationandtestingofinternal

controls over new systems and

processes.

Systems, process and internal control

changes implemented and training com-

plete in time for parallel run in 2010.

Testing of internal controls for 2010

comparatives completed by Q1 2011.

Preliminary assessment of required

changes completed.

Analysis of potential design solutions

underway.

Business:

• Assessmentofimpactsonallareasof

the business, including contractual

arrangements and implementation of

changes as necessary.

• Communicateconversionplanand

progress against it internally and

externally.

Contracts updated/renegotiated by end

of 2010.

Communication at all levels throughout

the conversion process.

Preliminary assessment of impacts on

other areas of the business completed.

Communication is ongoing.