Rogers 2008 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

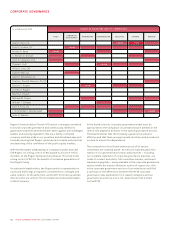

2008 FINANCIAL AND OPERATING HIGHLIGHTS

The following represents a sampling of Rogers Communications Inc.’s performance highlights for 2008.

For a detailed discussion of our financial and operating metrics and results, please see the accompanying MD&A later in this report.

20 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

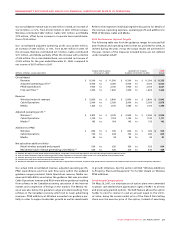

FREE CASH

FLOW GROWTH

Consolidated free cash

flow increased by 10% to

$1.5 billion

DIVIDEND

GROW TH

Annual dividend per share

increased from $0.50 to $1.00

annually

SHARE

BUYBACKS

Instituted first-ever share

buyback program, repurchas-

ing 4.1 million shares for

$137 million

DEBT

FINANCING

Issued US$1.75 billion of long-

term notes with investment

grade terms and pricing

BALANCE SHEET

STRENGTH

$1.8 billion liquidity with no

debt maturities until 2011,

and a ratio of 2.1 times debt

plus net derivative liabilities

to adjusted operating profit

WIRELESS

GROW TH

Grew wireless revenue by

15%, wireless data revenue

by 39% and subscribers by

604,000

CANADA’S FASTEST

WIRELESS NET WORK

Expanded next generation

HSPA wireless network to

76% of country while

increasing speed to 7.2 Mbps

WIRELESS SPECTRUM

ACQUISITION

Acquired 20 MHz of

Advanced Wireless Services

(AWS) spectrum across

Canada by auction for

$1 billion

APPLE

iPHONE

Launched the Apple iPhone

3G in Canada selling 385,000

high ARPU units in less than

six months

INTERNET AND DIGITAL

SERVICES PENETRATION

Grew high-speed Internet

and digital cable penetra-

tion levels to 68% and 67% of

basic subscribers, respectively

CABLE TELEPHONY

PENETRATION

Increased penetration of

cable telephony service to

24% of homes passed in our

cable territory, topping more

than 840,000 subscribers

CABLE MARGIN

EXPANSION

Expanded Cable Operations

adjusted operating profit

margins by nearly 200 basis

points year-over-year to 41%

AURORA C ABLE

ACQUISITION

Expanded and tightened

Ontario cable TV cluster

with acquisition of

Aurora Cable TV

NEW BROADCASTING

PROPERTIES

Added three new OMNI

television stations and a

new FM radio station in

Western Canada

TORONTO

NFL SERIES

Announced a five-year,

eight-game series of

Buffalo Bills NFL games at

Rogers Centre in Toronto

DOUBLE-DIGIT

REVENUE GROW TH

Consolidated revenue

growth of 12%, the sixth

consecutive year of double-

digit top-line growth