Rogers 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

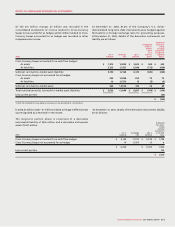

The current portion above represents net payments expected to be

made within one year on Cross-Currency Swaps, including upon

settlement for those Cross-Currency Swaps maturing within one year.

At December 31, 2008, all of the Company’s long-term debt was at

fixed interest rates, with the exception of advances under the bank

credit facility. Net income would have changed by $6 million in the

year ended December 31, 2008, net of income taxes of $2 million,

if there was a 1% change in the interest rates charged on advances

under the bank credit facility.

U.S. $750 million of the Company’s U.S. dollar-denominated long-

term debt instruments are not hedged for accounting purposes

and, therefore, a one cent change in the Canadian dollar relative

to the U.S. dollar would have resulted in a $8 million change in the

carrying value of long-term debt at December 31, 2008. In addition,

this would have resulted in a $6 million change in net income, net

of income taxes of $2 million.

A portion of the Company’s accounts receivable and accounts

payable and accrued liabilities is denominated in U.S. dollars;

however, due to their short-term nature, there is no significant

market risk arising from fluctuations in foreign exchange rates.

All of the Company’s Cross-Currency Swaps are unsecured

obligations of RCI. In addition, RCCI and RWP have provided

unsecured guarantees for all of the Company’s Cross-Currency

Swaps (note 15(b)).

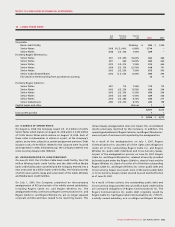

(E) FINANCIAL INSTRUMENTS:

(i) Classification and fair values of financial instruments:

The Company has classified its financial instruments as follows:

2008 2007

Carrying Fair Carrying Fair

amount value amount value

Financial assets, available for sale, measured at fair value:

Investments $ 319 $ 319 $ 465 $ 465

Loans and receivables, measured at amortized cost:

Accounts receivable 1,403 1,403 1,245 1,245

$ 1,722 $ 1,722 $ 1,710 $ 1,710

2008 2007

Carrying Fair Carrying Fair

amount value amount value

Financial liabilities, measured at amortized cost:

Bank advances, arising from outstanding cheques $ 19 $ 19 $ 61 $ 61

Accounts payable and accrued liabilities 2,412 2,412 2,260 2,260

Long-term debt 8,507 8,700 6,033 6,357

Other long-term liabilities 184 184 214 214

Financial liabilities (assets), held-for-trading:

Cross-Currency Swaps not accounted for as hedges (69) (69) 6 6

Cross-Currency Swaps accounted for as cash flow hedges 223 223 1,798 1,798

$ 11,276 $ 11,469 $ 10,372 $ 10,696

The Company did not have any non-derivative held-for-trading

or held-to-maturity financial assets during the years ended

December 31, 2008 and 2007.

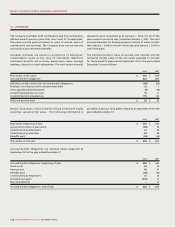

(ii) Guarantees:

In the normal course of business, the Company has entered

into agreements that contain features that meet the definition

of a guarantee under GAAP. A description of the major types

of such agreements is provided below:

(a) Business sale and business combination agreements:

As part of transactions involving business dispositions, sales

of assets or other business combinations, the Company

may be required to pay counterparties for costs and losses

incurred as a result of breaches of representations and

warranties, intellectual property right infringement, loss

or damages to property, environmental liabilities, changes

in laws and regulations (including tax legislation), litigation

against the counterparties, contingent liabilities of a

disposed business or reassessments of previous tax filings

of the corporation that carries on the business.

(b) Sales of services:

As part of transactions involving sales of services, the

Company may be required to pay counterparties for costs

and losses incurred as a result of breaches of representations

and warranties, changes in laws and regulations (including

tax legislation) or litigation against the counterparties.

(c) Purchases and development of assets:

As par t of transac tions involving purchases and

development of assets, the Company may be required

to pay counterparties for costs and losses incurred as a

result of breaches of representations and warranties, loss

or damages to property, changes in laws and regulations

(including tax legislation) or litigation against the

counterparties.