Rogers 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 71

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

CICA 3862 requires entities to provide disclosures in their finan-

cial statements that enable users to evaluate the significance of

financial instruments on the entity’s financial position and its per-

formance and the nature and extent of risks arising from financial

instruments to which the entity is exposed during the period and at

the balance sheet date, and how the entity manages those risks.

CICA 3863 establishes standards for presentation of financial

instruments and non-financial derivatives. It deals with the clas-

sification of financial instruments, from the perspective of the

issuer, between liabilities and equities, the classification of related

interest, dividends, gains and losses, and circumstances in which

financial assets and financial liabilities are offset.

The adoption of these standards did not have any impact on the

classification and measurement of our financial instruments. The

new disclosures pursuant to these new Handbook Sections are

included in Note 15 of the 2008 Audited Consolidated Financial

Statements.

RECENT C ANADIAN ACCOUNTING PRONOUNCEMENTS

Goodwill and Intangible Assets

In 2008, the CICA issued Handbook Section 3064, Goodwill and

Intangible Assets (“CICA 3064”). CICA 3064, which replaces Section

3062, Goodwill and Intangible Assets, and Section 3450, Research

and Development Costs, establishes standards for the recognition,

measurement and disclosure of goodwill and intangible assets.

The provisions relating to the definition and initial recognition of

intangible assets, including internally generated intangible assets,

are equivalent to the corresponding provisions of IFRS IAS 38,

Intangible Assets. This new standard is effective for our Interim and

Annual Consolidated Financial Statements commencing January 1,

2009. We are assessing the impact of the new standard.

the pension plan of the Company as there is no assurance that the

plan will be able to earn the assumed rate of return. As well, mar-

ket driven changes may result in changes in the discount rates and

other variables which would result in the Company being required

to make contributions in the future that differ significantly from

the current contributions and assumptions incorporated into the

actuarial valuation process.

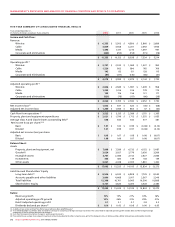

The following table illustrates the increase (decrease) in the accrued

benefit obligation and pension expense for changes in these pri-

mary assumptions and estimates:

Pension Plans

When accounting for defined benefit pension plans, assumptions

are made in determining the valuation of benefit obligations and

the future performance of plan assets. Delayed recognition of dif-

ferences between actual results and expected or estimated results

is a guiding principle of pension accounting. This principle results

in recognition of changes in benefit obligations and plan perfor-

mance over the working lives of the employees receiving benefits

under the plan. The primary assumptions and estimates include the

discount rate, the expected return on plan assets and the rate of

compensation increase. Changes to these primary assumptions and

estimates would impact pension expense and the deferred pension

asset. The current economic conditions may also have an impact on

Impact of Changes in Pension-Related Assumptions

Accrued Benefit Obligation at Pension Expense

(In millions of dollars) End of Fiscal 2008 Fiscal 2008

Discount rate 6.75% 5.65%

Impact of: 1% increase $ (80) $ (9)

1% decrease 104 11

Rate of compensation increase 3.00% 3.25%

Impact of: 0.25% increase $ 4 $ 1

0.25% decrease (3) (1)

Expected rate of return on assets N/A 7.00%

Impact of: 1% increase N/A 6

1% decrease N/A (6)

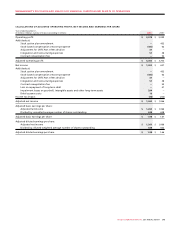

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such

as our historical collection and write-off experience, the number

of days the customer is past due and the status of the customer’s

account with respect to whether or not the customer is continuing

to receive service. As a result, fluctuations in the aging of subscriber

accounts will directly impact the reported amount of bad debt

expense. For example, events or circumstances that result in a dete-

rioration in the aging of subscriber accounts will in turn increase

the reported amount of bad debt expense. Conversely, as circum-

stances improve and customer accounts are adjusted and brought

current, the reported bad debt expense will decline.

NEW ACCOUNTING STANDARDS

Capital disclosures

Effective January 1, 2008, we adopted the new recommendations

of The Canadian Institute of Chartered Accountants’ (“CICA”)

Handbook Section 1535, Capital Disclosures (“CICA 1535”). CICA

1535 requires that an entity disclose information that enables users

of its financial statements to evaluate an entity’s objectives, poli-

cies and processes for managing capital, including disclosures of

any externally imposed capital requirements and the consequences

for non-compliance. These new disclosures are included in Note 21

of the 2008 Audited Consolidated Financial Statements.

Financial instruments

Effective January 1, 2008, we adopted the new recommendations

of CICA Handbook Section 3862, Financial Instruments - Disclosures

(“CICA 3862”), and Handbook Section 3863, Financial Instruments -

Presentation (“CICA 3863”).