Rogers 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 53

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

over-year. We are contributing to the plans on this basis. As further

discussed in the section of this MD&A entitled “Critical Accounting

Estimates”, changes in factors such as the discount rate, the rate of

compensation increase and the expected return on plan assets can

impact the accrued benefit obligation, pension expense and the

deficiency of plan assets over accrued obligations in the future.

INTEREST RATE AND FOREIGN EXCHANGE MANAGEMENT

Economic Hedge Analysis

For the purposes of our discussion on the hedged portion of long-

term debt, we have used non-GAAP measures in that we include all

Cross-Currency Swaps, whether or not they qualify as hedges for

accounting purposes, since all such Cross-Currency Swaps are used

for risk management purposes only and are designated as a hedge

of specific debt instruments for economic purposes. As a result, the

Canadian dollar equivalent of U.S. dollar-denominated long-term

debt reflects the contracted foreign exchange rate for all of our

Cross-Currency Swaps regardless of qualifications for accounting

purposes as a hedge.

As discussed above, effective August 6, 2008 RCI entered into an

aggregate US$1.75 billion notional principal amount of Cross-

Currency Swaps. An aggregate US$1.4 billion notional principal

amount of these Cross-Currency Swaps hedge the principal and inter-

est obligations for the 2018 Notes through to maturity in 2018 while

the remaining US$350 million aggregate notional principal amount

of Cross-Currency Swaps hedge the principal and interest on the

2038 Notes for ten years to August 2018. The Cross-Currency Swaps

hedging the 2018 Notes have been designated as hedges against the

designated U.S. dollar-denominated debt for accounting purposes,

while the Cross-Currency Swaps hedging the 2038 Notes have not

been designated as hedges for accounting purposes.

Also effective on August 6, 2008 and as discussed above, RCI re-cou-

poned three of our existing Cross-Currency Swaps by terminating the

original Cross-Currency Swaps aggregating US$575 million notional

principal amount and, simultaneously, entering into three new

Cross-Currency Swaps aggregating US$575 million notional prin-

cipal amount at then current market rates. In each case, only the

fixed foreign exchange rate and the Cdn$ fixed interest rate were

changed and all other terms for the new Cross-Currency Swaps are

identical to the respective terminated Cross-Currency Swaps they

are replacing. The termination of the three original Cross-Currency

Swaps resulted in us paying US$360 million (Cdn$375 million) for the

aggregate out-of-the-money fair value for the terminated Cross-

Currency Swaps on the date of termination, thereby reducing by an

equal amount, the fair value of the Cross-Currency Swaps liability

on that date. Each of the three new Cross-Currency Swaps has been

designated as a hedge against the designated U.S. dollar-denomi-

nated debt for accounting purposes.

On December 15, 2008, two of our Cross-Currency Swaps matured

on their scheduled maturity date and, as a result, we received

US$400 million and paid $475 million aggregate notional principal

amounts on the settlement at maturity. Also on December 15, 2008,

we settled a forward foreign exchange contract to sell an aggre-

gate US$400 million in exchange for $476 million. As a result of the

maturity of these Cross-Currency Swaps, our US$400 million 8.00%

Senior Subordinated Notes due 2012 are no longer hedged.

As a result of the activity described above, on December 31, 2008,

93% of our U.S. dollar-denominated debt was hedged on an eco-

nomic basis while 87% of our U.S. dollar-denominated debt was

hedged on an accounting basis. That is, as stated above, the US$350

million aggregate notional principal amount of Cross-Currency

Swaps hedging the 2038 Notes do not qualify as hedges for account-

ing purposes and our US$400 million 8.00% Senior Subordinated

Notes due 2012 are no longer hedged.

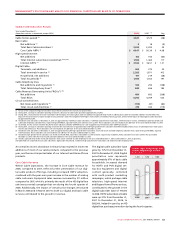

Consolidated Hedged Position

(In millions of dollars, except percentages) December 31, 2008 December 31, 2007

U.S. dollar-denominated long-term debt US $ 5,940 US $ 4,190

Hedged with cross-currency interest rate exchange agreements US $ 5,540 US $ 4,190

Hedged exchange rate 1.2043 1.3313

Percent hedged 93.3% (1) 100.0%

Amount of long-term debt (2) at fixed rates:

Total long-term debt Cdn $ 8,383 Cdn $ 7,454

Total long-term debt at fixed rates Cdn $ 7,798 Cdn $ 6,214

Percent of long-term debt fixed 93.0% 83.4%

Weighted average interest rate on long-term debt 7.29% 7.53%

(1) Pursuant to the requirements for hedge accounting under Canadian Institute of Chartered Accountants (“CICA”) Handbook Section 3865, Hedges, on December 31, 2008, RCI accounted for 93% of its Cross-

Currency Swaps as hedges against designated U.S. dollar-denominated debt. As a result, 87% of our U.S. dollar-denominated debt is hedged for accounting purposes versus 93% on an economic basis.

(2) Long-term debt includes the effect of the Cross-Currency Swaps.

FIXED VERSUS FLOATING DEBT COMPOSITION

(%)

Fixed 93%

Floating 7%