Rogers 2008 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 105

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

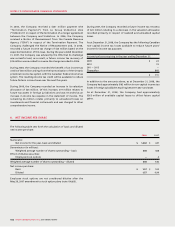

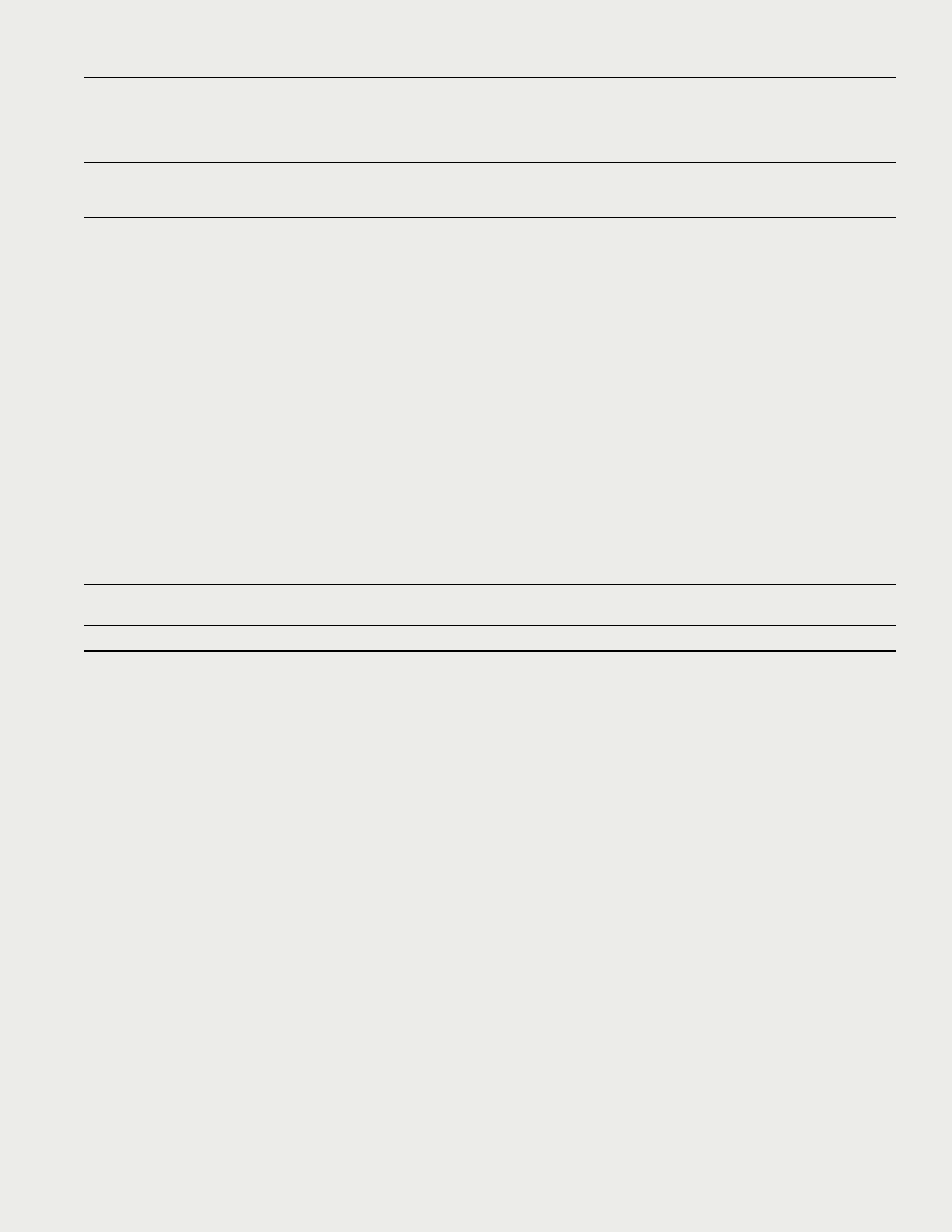

14. LONG-TERM DEBT

Due Principal Interest

date amount rate 2008 2007

Corporate:

Bank credit facility Floating $ 585 $ 1,240

Senior Notes 2018 $U.S.1,400 6.80% 1,714 –

Senior Notes 2038 U.S. 350 7.50% 429 –

Formerly Rogers Wireless Inc.:

Senior Notes 2011 U.S. 490 9.625% 600 484

Senior Notes 2011 460 7.625% 460 460

Senior Notes 2012 U.S. 470 7.25% 575 464

Senior Notes 2014 U.S. 750 6.375% 918 741

Senior Notes 2015 U.S. 550 7.50% 673 543

Senior Subordinated Notes 2012 U.S. 400 8.00% 490 395

Fair value increment arising from purchase accounting 12 17

Formerly Rogers Cable Inc.:

Senior Notes 2011 175 7.25% 175 175

Senior Notes 2012 U.S. 350 7.875% 429 346

Senior Notes 2013 U.S. 350 6.25% 429 346

Senior Notes 2014 U.S. 350 5.50% 429 346

Senior Notes 2015 U.S. 280 6.75% 343 277

Senior Debentures 2032 U.S. 200 8.75% 245 198

Capital leases and other Various 1 1

8,507 6,033

Less current portion 1 1

$ 8,506 $ 6,032

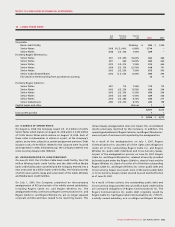

(A) ISSUANCE OF SENIOR NOTES:

On August 6, 2008, the Company issued U.S. $1.4 billion of 6.80%

Senior Notes which mature on August 15, 2018 and U.S. $350 million

of 7.50% Senior Notes which mature on August 15, 2038. Each of

these notes is redeemable, in whole or in part, at the Company’s

option, at any time, subject to a certain prepayment premium. Debt

issuance costs of $16 million related to this issuance were incurred

and expensed in 2008. Simultaneously, the Company entered into

Cross-Currency Swaps (note 15(d)(iii)).

(B) REORGANIZATION OF LONG-TERM DEBT:

On June 29, 2007, the $1 billion Cable bank credit facility, the $700

million Wireless bank credit facility and the $600 million Media

bank credit facility were cancelled and the Company entered into a

new unsecured $2.4 billion bank credit facility, the initial proceeds

of which were used to repay and cancel each of the Cable, Wireless

and Media bank credit facilities.

On July 1, 2007, the Company completed an intracompany

amalgamation of RCI and certain of its wholly owned subsidiaries,

including Rogers Cable Inc. and Rogers Wireless Inc. The

amalgamated entity continues as Rogers Communications Inc. and

Rogers Cable Inc. and Rogers Wireless Inc. are no longer separate

corporate entities and have ceased to be reporting issuers. This

intracompany amalgamation does not impact the consolidated

results previously reported by the Company. In addition, the

operating subsidiaries of Rogers Cable Inc. and Rogers Wireless Inc.

were not part of and were not impacted by the amalgamation.

As a result of the amalgamation, on July 1, 2007, Rogers

Communications Inc. assumed all of the rights and obligations

under all of the outstanding Rogers Cable Inc. and Rogers

Wireless Inc. public debt indentures and Cross-Currency Swaps.

As part of the amalgamation process, on June 29, 2007, Rogers

Cable Inc. and Rogers Wireless Inc. released all security provided

by bonds issued under the Rogers Cable Inc. deed of trust and the

Rogers Wireless Inc. deed of trust for all of the then-outstanding

Rogers Cable Inc. and Rogers Wireless Inc. senior public debt and

Cross-Currency Swaps. As a result, none of the senior public debt

or Cross-Currency Swaps remain secured by such bonds effective

as of June 29, 2007.

As a result of these actions, the outstanding public debt and

Cross-Currency Swaps and the new $2.4 billion bank credit facility

are unsecured obligations of Rogers Communications Inc. The

Rogers Communications Inc. public debt originally issued by

Rogers Cable Inc. has Rogers Cable Communications Inc. (“RCCI”),

a wholly owned subsidiary, as a co-obligor and Rogers Wireless