Rogers 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

to mitigate credit risk and has also established procedures to

suspend the availability of services when customers have fully

utilized approved credit limits or have violated established payment

terms. While the Company’s credit controls and processes have been

effective in mitigating credit risk, these controls cannot eliminate

credit risk and there can be no assurance that these controls will

continue to be effective or that the Company’s current credit loss

experience will continue.

There is no significant credit risk related to the Company’s

investments. Credit risk is managed through conducting financial

and other assessments of these investments on an ongoing basis.

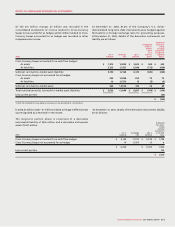

Credit risk of Cross-Currency Swaps arises from the possibility

that the counterparties to the agreements may default on their

respective obligations under the agreements in instances where

these agreements have positive fair value for the Company. The

Company assesses the creditworthiness of the counterparties

in order to minimize the risk of counterparty default under the

agreements. All of the portfolio is held by financial institutions

with a Standard & Poor’s rating (or the equivalent) ranging from A+

to AA-. The Company does not require collateral or other security

to support the credit risk associated with Cross-Currency Swaps

due to the Company’s assessment of the creditworthiness of the

counterparties. The obligations under U.S. $5,550 million aggregate

notional amount of the Cross-Currency Swaps are unsecured and

generally rank equally with the Company’s senior indebtedness.

The credit risk of the counterparties is taken into consideration in

determining fair value for accounting purposes (note 15(d)).

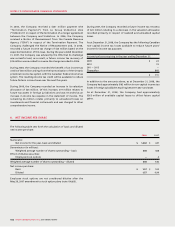

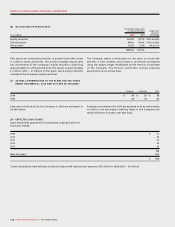

(C) LIQUIDITY RISK:

Liquidity risk is the risk that the Company will not be able to meet

its financial obligations as they fall due. The Company manages

liquidity risk through the management of its capital structure and

financial leverage, as outlined in note 21 to the consolidated financial

statements. It also manages liquidity risk by continuously monitoring

actual and projected cash flows to ensure that it will have sufficient

liquidity to meet its liabilities when due, under both normal and

stressed conditions, without incurring unacceptable losses or

risking damage to the Company’s reputation. At December 31, 2008,

the undrawn portion of the Company’s bank credit facility was

approximately $1.8 billion. Utilizations include advances borrowed

under the bank credit facility and issuances of letters of credit.

15. FINANCIAL RISK MANAGEMENT AND FINANCIAL INSTRUMENTS

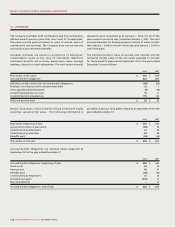

(A) OVERVIEW:

The Company is exposed to credit risk, liquidity risk and market risk.

The Company’s primary risk management objective is to protect

its income and cash flows and, ultimately, shareholder value.

Risk management strategies, as discussed below, are designed

and implemented to ensure the Company’s risks and the related

exposures are consistent with its business objectives and risk

tolerance.

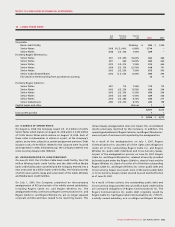

(B) CREDIT RISK:

Credit risk represents the financial loss that the Company would

experience if a counterparty to a financial instrument, in which the

Company has an amount owing from the counterparty, failed to

meet its obligations in accordance with the terms and conditions of

its contracts with the Company.

The Company’s credit risk is primarily attributable to its accounts

receivable. The amounts disclosed in the consolidated balance

sheets are net of allowances for doubtful accounts, estimated by

the Company’s management based on prior experience and their

assessment of the current economic environment. The Company

establishes an allowance for doubtful accounts that represents its

estimate of incurred losses in respect of accounts receivable. The

main components of this allowance are a specific loss component

that relates to individually significant exposures and an overall loss

component established based on historical trends. At December

31, 2008, the Company had accounts receivable of $1,403 million

(2007 – $1,245 million), net of an allowance for doubtful accounts

of $163 million (2007 – $151 million), which adequately reflects the

Company’s credit risk. At December 31, 2008, $614 million (2007 –

$598 million) of accounts receivable is considered past due, which is

defined as amounts outstanding beyond normal credit terms and

conditions for the respective customers. The Company believes that

its allowance for doubtful accounts is sufficient to reflect the related

credit risk.

The Company believes that the concentration of credit risk of

accounts receivable is limited due to its broad customer base,

dispersed across varying industries and geographic locations

throughout Canada.

The Company has established various internal controls, such as

credit checks, deposits on account and billing in advance, designed