Rogers 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 27

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

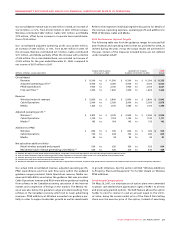

Our consolidated revenue was $11,335 million in 2008, an increase of

$1,212 million, or 12%, from $10,123 million in 2007. Of the increase,

Wireless contributed $832 million, Cable $251 million, and Media

$179 million, offset by an increase in corporate items and elimina-

tions of $50 million.

Our consolidated adjusted operating profit was $4,060 million,

an increase of $357 million, or 10%, from $3,703 million in 2007. Of

this increase, Wireless contributed $217 million, Cable contributed

$217 million, and Media partially offset the increase with a decline

of $34 million. On a consolidated basis, we recorded net income of

$1,002 million for the year ended December 31, 2008, compared to

net income of $637 million in 2007.

Refer to the respective individual segment discussions for details of

the revenue, operating expenses, operating profit and additions to

PP&E of Wireless, Cable and Media.

2008 Performance Against Targets

The following table sets forth the guidance ranges for selected full

year financial and operating metrics that we provided for 2008, as

revised during the year, versus the actual results we achieved for

the year. Certain of the measures included below are not defined

under Canadian GAAP.

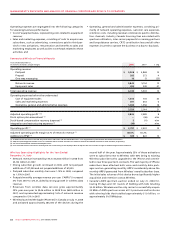

Our actual 2008 consolidated revenue, adjusted operating profit,

PP&E expenditures and free cash flow were within the updated

guidance ranges provided. Cable Operations revenue, Media rev-

enue and Cable RGUs were below the guidance that was provided.

Cable Operations revenue and RGUs were below guidance resulting

from softness in the Canadian economy, saturation of the Internet

market and competitive offerings in the market. The Media rev-

enue was also below the guidance range provided resulting from

softness in the Canadian economy which led to lower advertising

revenues. PP&E additions at Wireless exceeded our guidance par-

tially in order to support subscriber growth as well as investments

in growth initiatives. See the section entitled “Wireless Additions

to Property, Plant and Equipment” for further details on Wireless

PP&E additions.

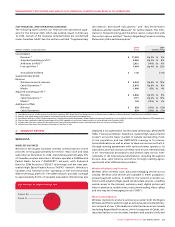

Stock-based Compensation

On May 28, 2007, our employee stock option plans were amended

to attach cash settled share appreciation rights (“SARs”) to all new

and previously granted options. The SAR feature allows the option

holder to elect to receive in cash an amount equal to the intrin-

sic value, being the excess market price of the Class B Non-Voting

share over the exercise price of the option, instead of exercising

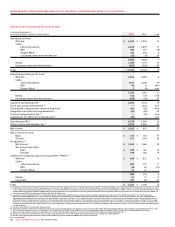

Original 2008 Guidance Updated from Original 2008

(Millions of dollars, except subscribers) (At January 7, 2008) Guidance (At October 28, 2008) Actual

Consolidated

Revenue $ 11,200 to $ 11,500 $ 11,200 to $ 11,500 $ 11,335

Adjusted operating profit (1) 4,000 to 4,200 4,000 to 4,100 4,060

PP&E expenditures 1,900 to 2,100 1,900 to 2,100 2,021

Free cash flow (2) 1,400 to 1,600 1,400 to 1,600 1,464

Revenue

Wireless (network revenue) $ 5,800 to $ 5,900 $ 5,800 to $ 5,900 $ 5,843

Cable Operations 2,900 to 2,950 2,900 to 2,950 2,878

Media 1,525 to 1,575 1,480 to 1,510 1,496

Adjusted operating profit (1)

Wireless (3) $ 2,875 to $ 2,975 $ 2,800 to $ 2,850 $ 2,820

Cable Operations 1,130 to 1,190 1,130 to 1,190 1,171

Media (4) 165 to 180 145 to 155 142

Additions to PP&E

Wireless $ 850 to $ 925 $ 850 to $ 925 $ 929

Cable Operations 750 to 830 750 to 830 829

Media 80 to 95 80 to 95 81

Net subscriber additions (000s)

Retail wireless postpaid and prepaid 550 to 625 550 to 625 604

Residential cable revenue generating units (RGUs) (5) 550 to 625 410 to 440 365

(1) Excludes the impact of stock-based compensation expense, integration and restructuring expenses and a one-time charge related to CRTC Part II fees.

(2) Free cash flow is defined as adjusted operating profit less PP&E expenditures and interest expense and is not a term defined under Canadian GAAP.

(3) Excludes operating losses related to the Inukshuk fixed wireless initiative of $14 million in 2008.

(4) Includes losses from Sports Entertainment of $33 million in 2008.

(5) Residential cable RGUs are comprised of basic cable subscribers, digital cable households, residential high-speed Internet subscribers and residential cable and circuit-switched telephony subscribers.