Rogers 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OUR STRATEGY

Our business objective is to maximize subscribers, revenue, operat-

ing profit and return on invested capital by enhancing our position

as one of Canada’s leading diversified communications and media

companies. Our strategy is to be the preferred provider of commu-

nications, entertainment and information services to Canadians. We

seek to leverage our networks, infrastructure, sales channels, brand

and marketing resources across the Rogers group of companies by

implementing cross-selling and joint sales distribution initiatives as

well as cost-reduction initiatives through infrastructure sharing, to

create value for our customers and shareholders.

We help to identify and facilitate opportunities for Wireless, Cable

and Media to create bundled product and service offerings at

attractive prices, in addition to implementing cross-marketing and

cross-promotion of products and services to increase sales and

enhance subscriber loyalty. We also work to identify and implement

areas of opportunity for our businesses that will enhance operating

efficiencies by sharing infrastructure, corporate services and sales

distribution channels. We continue to develop brand awareness

and promote the “Rogers” brand as a symbol of quality, innovation

and value of a diversified Canadian media and communications

company.

ACQUISITIONS

Acquisition of channel m

On April 30, 2008, we acquired the assets of Vancouver multicultural

television station channel m, from Multivan Broadcast Corporation,

for cash consideration of $61 million. The acquisition was accounted

for using the purchase method with the results of operations con-

solidated with ours effective April 30, 2008.

Acquisition of Aurora Cable TV Limited

On June 12, 2008, we acquired 100% of the outstanding shares of

Aurora Cable TV Limited (“Aurora Cable”) for cash consideration of

$80 million, including a $16 million deposit paid during the first quar-

ter of 2008. In addition, we contributed $10 million to simultaneously

pay down certain credit facilities of Aurora Cable. Aurora Cable pro-

vides cable television, Internet and telephony services in the Town of

Aurora and the community of Oak Ridges, in Richmond Hill, Ontario.

The acquisition was accounted for using the purchase method with the

results of operations consolidated with ours effective June 12, 2008.

Acquisition of Outdoor Life Network

On July 31, 2008, we acquired the remaining two-thirds of the shares

of Outdoor Life Network (“OLN”) that we did not already own, for

cash consideration of $39 million. The acquisition was accounted

for using the purchase method with the results of operations con-

solidated with ours effective July 31, 2008.

Refer to “Critical Accounting Estimates – Purchase Price Allocations”

and Note 4 to the 2008 Audited Consolidated Financial Statements

for more details regarding these transactions.

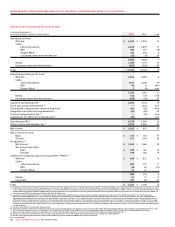

CONSOLIDATED FINANCIAL AND OPERATING RESULTS

See the sections in this MD&A entitled “Critical Accounting Policies”,

“Critical Accounting Estimates” and “New Accounting Standards”

and also the Notes to the 2008 Audited Consolidated Financial

Statements for a discussion of critical and new accounting policies

and estimates as they relate to the discussion of our operating and

financial results below.

We measure the success of our strategies using a number of key

performance indicators as outlined in the section entitled “Key

Performance Indicators and Non-GAAP Measures”. These key per-

formance indicators are not measurements in accordance with

Canadian or U.S. GAAP and should not be considered as alterna-

tives to net income or any other measure of performance under

Canadian or U.S. GAAP. The non-GAAP measures presented in this

MD&A include, among other measures, operating profit, adjusted

operating profit, adjusted operating profit margin, adjusted net

income, and adjusted basic and diluted net income per share. We

believe that the non-GAAP financial measures provided, which

exclude: (i) the impact of the one-time non-cash charge result-

ing from the introduction of a cash settlement feature related to

employee stock options; (ii) stock-based compensation expense; (iii)

integration and restructuring expenses; (iv) the impact of a one-

time charge resulting from the renegotiation of an Internet-related

services agreement; (v) an adjustment for Canadian Radio-television

and Telecommunications Commission (“CRTC”) Part II fees related

to prior periods; and (vi) in respect of net income and net income

per share, debt issuance costs, loss on repayment of long-term

debt, impairment losses on goodwill, intangible assets and other

long-term assets and the related income tax impacts of the above

items, provide for a more effective analysis of our operating per-

formance. See the sections entitled “Key Performance Indicators

and Non-GAAP Measures” and “Supplementary Information: Non-

GAAP Calculations” for further details.

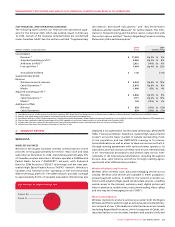

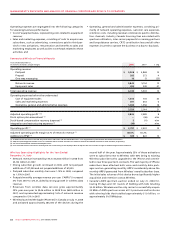

20082007

$2,021$1,796$1,712

ADDITIONS TO

CONSOLIDATED PP&E

(In millions of dollars)

2006

20082007

$17,093$15,325$14,105

CONSOLIDATED

TOTAL ASSETS

(In millions of dollars)

200

7

2008

2006