Rogers 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

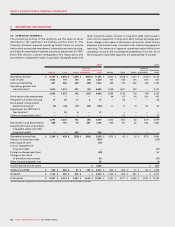

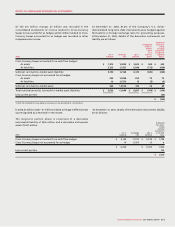

2008 2007

Cost prior to Impairment

impairment Accumulated losses Net book Accumulated Net book

losses amortization (note 11(a)(ii)) value Cost amortization value

Indefinite life:

Spectrum licences $ 1,929 $ – $ – $ 1,929 $ 921 $ – $ 921

Broadcast licences 164 – 75 89 147 – 147

Definite life:

Brand names 437 158 14 265 437 116 321

Subscriber bases 999 900 – 99 1,046 790 256

Roaming agreements 523 181 – 342 523 138 385

Dealer networks 41 41 – – 41 32 9

Wholesale agreement 13 13 – – 13 13 –

Marketing agreement 52 15 – 37 52 5 47

Advertising bookings 6 6 – – – – –

Baseball player contracts – – – – 120 120 –

$ 4,164 $ 1,314 $ 89 $ 2,761 $ 3,300 $ 1,214 $ 2,086

(C) INTANGIBLE ASSETS:

Details of intangible assets are as follows:

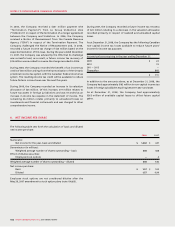

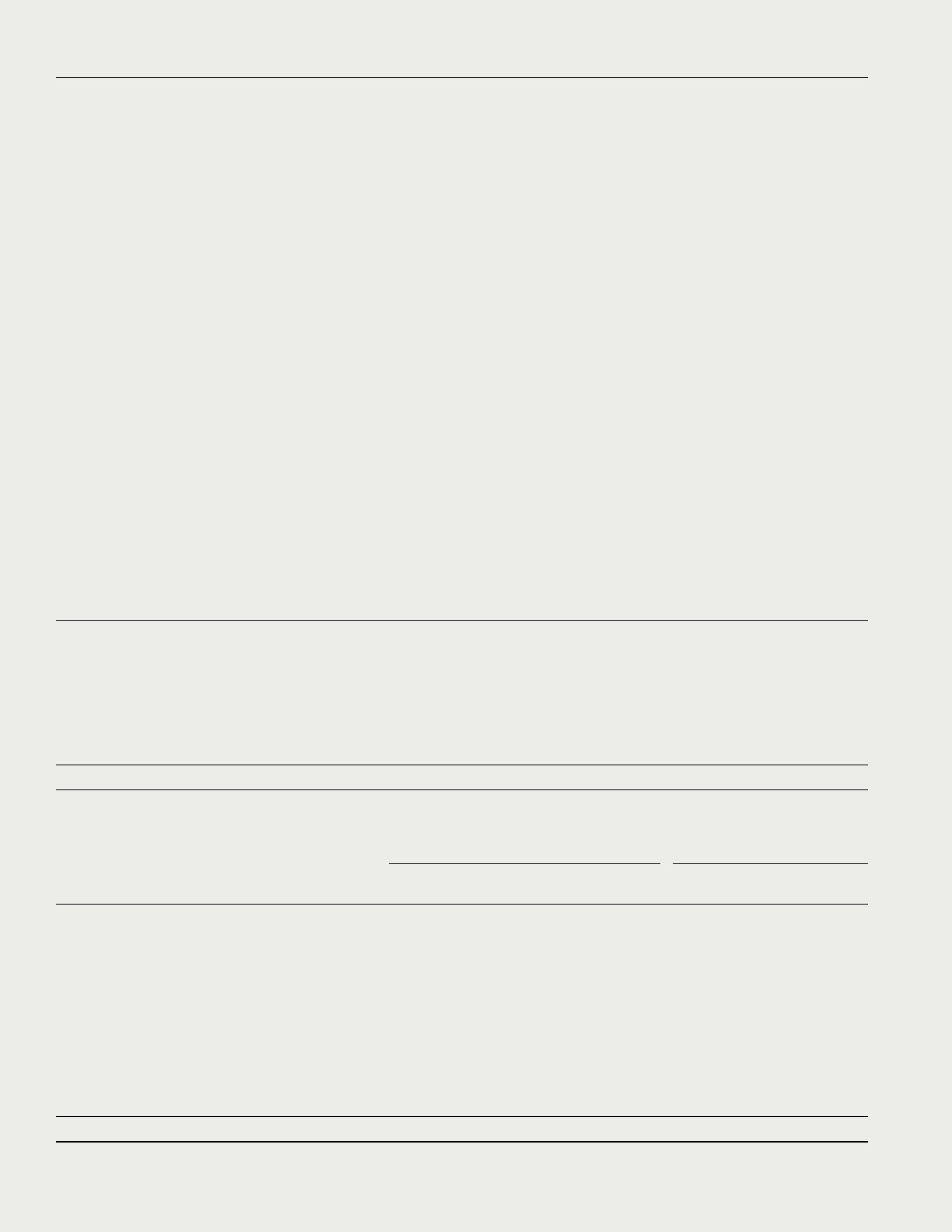

(B) GOODWILL:

A summary of the changes to goodwill is as follows:

2008 2007

Opening balance $ 3,027 $ 2,779

Acquisition of Outdoor Life Network (note 4(a)(i)) 31 –

Acquisition of Aurora Cable (note 4(a)(ii)) 56 –

Acquisition of channel m (note 4(a)(iii)) 48 –

Other acquisitions and adjustments 9 (6)

Adjustments to Citytv purchase price allocation (note 4(b)(ii)) 7 264

Reduction in valuation allowance for acquired future income tax assets – (10)

Impairment charge on conventional television reporting unit (note 11(a)(i)) (154) –

$ 3,024 $ 3,027

a general outlook for the industry in which the reporting unit

operates. The discount rates used by the Company consider

debt to equity ratios and certain risk premiums. The terminal

value is the value attributed to the reporting unit’s operations

beyond the projected time period of 2011 or 2015 using a

perpetuity rate based on expected economic conditions and a

general outlook for the industry. Under the market approach,

the Company estimates the fair value of the reporting unit by

multiplying normalized earnings before interest, income taxes

and depreciation and amortization by multiples based on

market inputs.

The Company has made certain assumptions for the discount and

terminal growth rates to reflect variations in expected future

cash flows. These assumptions may differ or change quickly

depending on economic conditions or other events. Therefore,

it is possible that future changes in assumptions may negatively

impact future valuations of reporting units and goodwill which

would result in further goodwill impairment losses.

(ii) Intangible assets:

In the fourth quarter of 2008, the Company recorded an

impairment charge of $75 million relating to the Citytv

broadcast licences. Using the Greenfield income approach

(in which the value is determined based on the present value

of required resources and eventual returns of the broadcast

licences), and replacement cost, the Company determined the

fair value of the Citytv broadcast licences to be lower than

their carrying value.

In addition, the Company recorded an impairment charge of

$14 million related to the Citytv brand name as the Citytv asset

group was determined to be impaired and its carrying value

exceeded its fair value. The Company determined the fair value

of the Citytv brand name using the Capitalized Royalty Method.

The fair values of the broadcast licences and brand name

declined primarily as a result of the weakening of industry

expectations in the conventional television business and

declines in advertising revenues.

The Company has made certain assumptions within the

Greenfield income approach and Capitalized Royalty Method

which may differ or change quickly depending on economic

conditions or other events. Therefore, it is possible that

future changes in assumptions may negatively impact future

valuations of intangible assets which would result in further

impairment losses.