Rogers 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

25. CANADIAN AND UNITED STATES ACCOUNTING POLICY DIFFERENCES

(E) In April 2004, a proceeding was brought against Fido and other

Canadian wireless carriers claiming damages totalling $160 million,

breach of contract, breach of confidence, breach of fiduciary duty

and, as an alternative to the damages claims, an order for specific

performance of a conditional agreement relating to the use of 38

MHz of MCS Spectrum. The Plaintiff has also brought a proceeding

against Inukshuk Wireless Partnership (“Inukshuk”), the Company’s

50% owned joint venture asserting a claim against the MCS

Spectrum licences that were transferred from Fido to Inukshuk.

Inukshuk brought a motion to have the separate action against

it dismissed. In May 2008, the Court dismissed the separate action

brought against Inukshuk. The appeal of this decision was heard in

January 2009. The Company is awaiting a decision from the Court.

The Company believes it has good defences to the claim and no

amounts have been provided in the accounts.

(F) The Company believes that it has adequately provided for

income taxes based on all of the information that is currently

available. The calculation of income taxes in many cases, however,

requires significant judgment in interpreting tax rules and

regulations. The Company’s tax filings are subject to audits, which

could materially change the amount of current and future income

tax assets and liabilities, and could, in certain circumstances, result

in the assessment of interest and penalties.

(G) There exist certain other claims and potential claims against

the Company, none of which is expected to have a material adverse

effect on the consolidated financial position of the Company.

The consolidated financial statements of the Company have been

prepared in accordance with GAAP as applied in Canada. In the

following respects, GAAP, as applied in the United States, differs

from that applied in Canada.

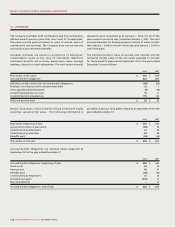

If United States GAAP were employed, net income for the years

ended December 31, 2008 and 2007 would be adjusted as follows:

2008 2007

Net income for the year based on Canadian GAAP $ 1,002 $ 637

Gain on sale of cable systems (B) (4) (4)

Pre-operating costs capitalized (C) 1 4

Capitalized interest, net of related depreciation (D) 11 10

Financial instruments (E) (76) 210

Stock-based compensation (F) (32) 3

Income taxes (H) 90 125

Installation revenues and costs, net (I) 10 (4)

Other (2) 3

Net income for the year based on United States GAAP $ 1,000 $ 984

Net income per share based on United States GAAP:

Basic $ 1.57 $ 1.54

Diluted 1.57 1.53

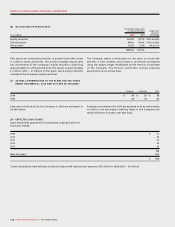

If United States GAAP were employed, comprehensive income for

the years ended December 31, 2008 and December 31, 2007 would

be adjusted as follows:

2008 2007

Comprehensive income for the year based on Canadian GAAP $ 857 $ 901

Impact of United States GAAP differences on net income (2) 347

Change in fair value of derivative instruments, net of income taxes of $88 (2007 – $100) (E) 5 (126)

Change in funded status of pension plans for unrecognized amounts, net of income taxes of $6 (2007 – $6) (G) 16 (15)

Comprehensive income for the year based on United States GAAP $ 876 $ 1,107