Rogers 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

116 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Employee contributions for 2009 are assumed to be at levels similar

to 2008 on the assumption staffing levels in the Company will

remain the same on a year-over-year basis.

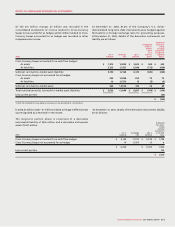

(B) ALLOCATION OF PLAN ASSETS:

Percentage of plan assets

Target asset

at measurement date

allocation

Asset category 2008 2007 percentage

Equity securities 52.2% 59.7% 50% to 65%

Debt securities 47.6% 40.0% 35% to 50%

Other (cash) 0.2% 0.3% 0% to 1%

100.0% 100.0%

Plan assets are comprised primarily of pooled funds that invest

in common stocks and bonds. The pooled Canadian equity fund

has investments in the Company’s equity securities comprising

approximately 1% of the pooled fund. This results in approximately

$1 million (2007 – $1 million) of the plans’ assets being indirectly

invested in the Company’s equity securities.

The Company makes contributions to the plans to secure the

benefits of plan members and invests in permitted investments

using the target ranges established by the Pension Committee

of the Company. The Pension Committee reviews actuarial

assumptions on an annual basis.

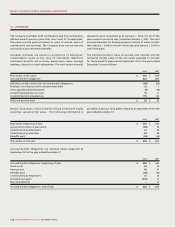

Employer Employee Total

2008 $ 38 $ 21 $ 59

2007 28 18 46

Expected contributions by the Company in 2009 are estimated to

be $64 million.

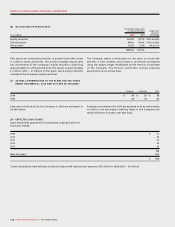

2009 $ 31

2010 32

2011 34

2012 35

2013 36

168

Next five years 200

$ 368

Certain subsidiaries have defined contribution plans with total pension expense of $2 million in 2008 (2007 – $2 million).

(C) ACTUAL CONTRIBUTIONS TO THE PL ANS FOR THE YEARS

ENDED DECEMBER 31, 2008 AND 2007 ARE AS FOLLOWS:

(D) EXPECTED CASH FLOWS:

Expected benefit payments for funded and unfunded plans for

fiscal year ending: