Rogers 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 113

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

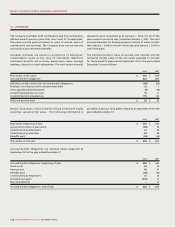

(d) Indemnifications:

The Company indemnifies its directors, officers and

employees against claims reasonably incurred and resulting

from the performance of their services to the Company, and

maintains liability insurance for its directors and officers as

well as those of its subsidiaries.

The Company is unable to make a reasonable estimate of

the maximum potential amount it would be required to pay

counterparties. The amount also depends on the outcome of future

events and conditions, which cannot be predicted. No amount has

been accrued in the consolidated balance sheets relating to these

types of indemnifications or guarantees at December 31, 2008

or 2007. Historically, the Company has not made any significant

payments under these indemnifications or guarantees.

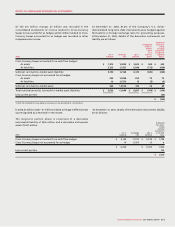

(iii) Fair values:

The Company has determined the fair values of its financial

instruments as follows:

(a) The carrying amounts in the consolidated balance sheets

of accounts receivable, bank advances arising from

outstanding cheques and accounts payable and accrued

liabilities approximate fair values because of the short-

term nature of these financial instruments.

(b) The fair values of investments that are publicly traded are

determined by the quoted market values for each of the

investments.

(c) The fair values of each of the Company’s public debt

instruments are based on the year-end trading values.

The fair value of the bank credit facility approximates

its carrying amount since the interest rates approximate

current market rates.

(d) The fair values of the Company’s Cross-Currency Swaps and

other derivative instruments are based on estimated credit-

adjusted mark-to-market valuation models (note 2(h)(iii)).

(e) The fair values of the Company’s other long-term financial

assets and financial liabilities are not significantly different

from their carrying amounts.

Fair value estimates are made at a specific point in time, based on

relevant market information and information about the financial

instruments. These estimates are subjective in nature and involve

uncertainties and matters of significant judgment and, therefore,

cannot be determined with precision. Changes in assumptions

could significantly affect the estimates.

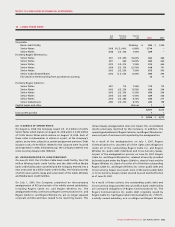

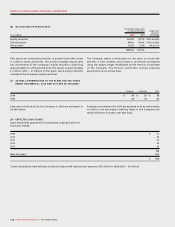

16. OTHER LONG-TERM LIABILITIES

2008 2007

CRTC commitments (note 13) $ 63 $ 66

Deferred compensation 33 36

Program rights liability 29 26

Supplemental executive retirement plan (note 17) 26 15

Deferred gain on contribution of spectrum licences, net of accumulated

amortization of $6 million (2007 - $2 million) (note 5) 18 22

Restricted share units 9 16

Liabilities related to stock options 2 22

Other 4 11

$ 184 $ 214