Rogers 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 45

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Cable Operations’ base of cir-

cuit-switched local telephony

customers as discussed above,

which was acquired in July 2005

through the acquisition of Call-

Net, is generally less capital

intensive than its on-net cable

telephony business but also

generates lower margins. As a

result, the inclusion of the cir-

cuit-switched local telephony

business, which includes approx-

imately 215,000 customers which

have not been migrated to our

cable network telephony plat-

form with Cable Operations’

telephony business, has a dilu-

tive impact on operating profit

margins.

Cable Operations Operating Expenses

The increase in Cable’s operating expenses for 2008 compared

to 2007 was primarily driven by the increases in the digital cable,

Internet and Rogers Home Phone subscriber bases, resulting in

higher costs associated with programming content, customer care,

network operations, information technology and credit and collec-

tions. Additionally, equipment costs increased over 2007, which is

primarily the result of an HD digital box sale (versus rental) cam-

paign. Partially offsetting these increases was a reduction in certain

costs associated with Cable’s Internet product resulting from a

renegotiated agreement with Yahoo! which became effective

January 1, 2008, a year-over-year reduction in selling expenditures

resulting from lower volumes of RGU net additions than in the cor-

responding periods of the prior year and scale efficiencies across

various functions.

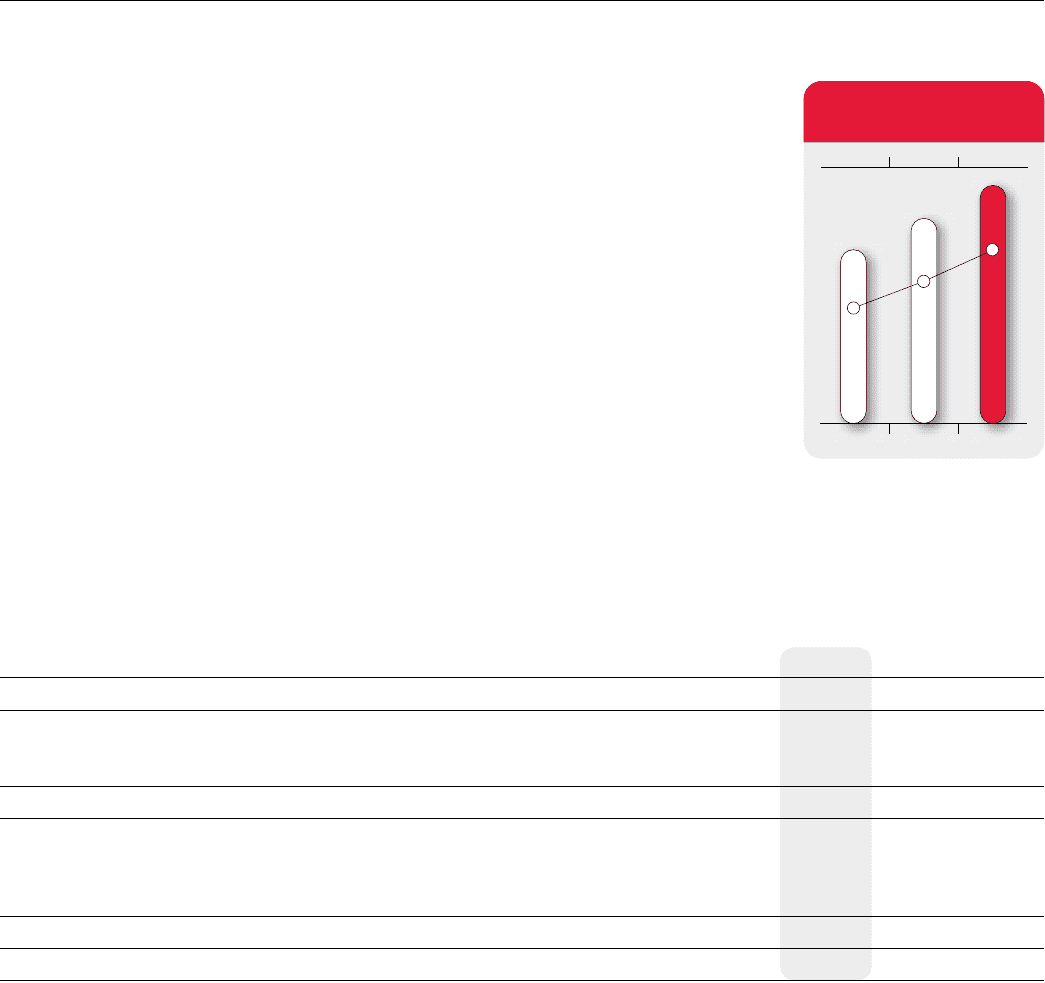

Cable Operations Adjusted Operating Profit

The year-over-year growth in adjusted operating profit was pri-

marily the result of the revenue growth described above, partially

offset by the changes in Cable’s operating expenses. As a result,

Cable Operations adjusted operating profit margins increased to

40.7% for 2008, compared to 38.7% in 2007.

ROGERS BUSINESS SOLUTIONS

Summarized Financial Results

Years ended December 31,

(In millions of dollars, except margin) 2008 2007 % Chg

RBS operating revenue $ 526 $ 571 (8)

Operating expenses before the undernoted

Sales and marketing expenses 26 75 (65)

Operating, general and administrative expenses 441 484 (9)

467 559 (16)

Adjusted operating profit (1) 59 12 n/m

Stock option plan amendment (2) – (2) n/m

Stock-based compensation recovery (2) 1 – n/m

Integration and restructuring expenses (3) (6) (29) (79)

Operating profit (loss) (1) $ 54 $ (19) n/m

Adjusted operating profit margin (1) 11.2% 2.1%

(1) As defined. See the sections entitled “Key Performance Indicators and Non-GAAP Measures” and “Supplementary Information: Non-GAAP Calculations”.

(2) See the section entitled “Stock-based Compensation”.

(3) Costs incurred relate to severances resulting from the restructuring of our employee base to improve our cost structure in light of the declining economic conditions, the integration of Call-Net and the

restructuring of RBS.

20082007

$1,171$1,008$854

CABLE OPERATIONS ADJUSTED

OPERATING PROFIT AND

MARGIN (In millions of dollars)

2007

2008

2006

37.1%

38.7%

40.7%