Rogers 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 51

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

the US$350 million aggregate principal amount of 2038 Notes from a

fixed coupon rate of 7.50% into Cdn$359 million at a weighted aver-

age fixed interest rate of 7.53%. The Cross-Currency Swaps hedging

the 2018 Notes have been designated as hedges against the desig-

nated U.S. dollar-denominated debt for accounting purposes, while

the Cross-Currency Swaps hedging the 2038 Notes have not been

designated as hedges for accounting purposes.

Also effective on August 6, 2008, RCI re-couponed three of the exist-

ing Cross-Currency Swaps by terminating the original Cross-Currency

Swaps aggregating US$575 million notional principal amount and,

simultaneously, entering into three new Cross-Currency Swaps

aggregating US$575 million notional principal amount at then cur-

rent market rates. In each case, only the fixed foreign exchange rate

and the Canadian dollar fixed interest rate were changed and all

other terms for the new Cross-Currency Swaps are identical to the

respective terminated Cross-Currency Swaps they are replacing. The

termination of the three original Cross-Currency Swaps resulted in

RCI paying US$360 million (Cdn$375 million) for the aggregate out-

of-the-money fair value for the terminated Cross-Currency Swaps

on the date of termination, thereby reducing by an equal amount,

the fair value of the derivative instruments liability on that date.

The three new Cross-Currency Swaps have the effect of converting

US$575 million aggregate notional principal amount of U.S. dol-

lar-denominated debt from a weighted average U.S. dollar fixed

interest rate of 7.20% into Cdn$589 million ($1.025 exchange rate)

at a weighted average Canadian dollar fixed interest rate of 6.88%.

In comparison, the original Cross-Currency Swaps had the effect of

converting US$575 million aggregate notional principal amount of

U.S. dollar-denominated debt from a weighted average U.S. dollar

fixed interest rate of 7.20% into Cdn$815 million ($1.4177 exchange

rate) at a weighted average Canadian dollar fixed interest rate of

7.89%. Each of the three new Cross-Currency Swaps has been desig-

nated as a hedge against the designated U.S. dollar-denominated

debt for accounting purposes.

On December 15, 2008, two of our Cross-Currency Swaps matured

on their scheduled maturity date and, as a result, we received

US$400 million and paid $475 million aggregate notional principal

amounts on the settlement at maturity. Also on December 15, 2008,

we settled a forward foreign exchange contract to sell an aggre-

gate US$400 million in exchange for $476 million. As a result of the

maturity of these Cross-Currency

Swaps, our US$400 million 8.00%

Senior Subordinated Notes due

2012 are no longer hedged.

In addition, during 2008, an

aggregate $655 million net

repayment was made under

our bank credit facility. As of

December 31, 2008, we had an

aggregate $585 million of bank

debt drawn under our $2.4 bil-

lion bank credit facility that

matures in July 2013, leaving

approximately $1.8 billion avail-

able to be drawn. This liquidity

position is also enhanced by the

fact that our earliest scheduled

debt maturity is in May 2011.

Shelf Prospectuses

In order to maintain financial

flexibility, in November 2007

RCI filed shelf prospec tuses

with securities regulators to

qualify debt securities of RCI

for sale in Canada and/or in the

United States. In August 2008,

US$1.75 billion aggregate prin-

cipal amount of debt securities

was issued in the United States

pursuant to the U.S. dollar shelf

prospectus. In October 2008, an

amendment was filed to permit

additional securities to be issued

in the United States pursuant to

the U.S. dollar shelf prospectus

so that the limit available for

securities to be issued in Canada

and the United States pursuant to the shelf prospectuses was essen-

tially restored to the range of the original shelf prospectus filings.

The notice set forth in this paragraph does not constitute an offer

of any securities for sale.

Normal Course Issuer Bid

In January 2008, RCI filed a normal course issuer bid (“NCIB”) which

authorizes us to repurchase up to the lesser of 15,000,000 of our

Class B Non-Voting shares and that number of Class B Non-Voting

shares that can be purchased under the NCIB for an aggregate pur-

chase price of $300 million for a period of one year. On May 21, 2008,

RCI repurchased for cancellation 1,000,000 of its outstanding Class

B Non-Voting shares pursuant to a private agreement between RCI

and an arm’s length third party seller for an aggregate purchase

price of $39.9 million and, on August 1, 2008, RCI repurchased for

cancellation 3,000,000 of its outstanding Class B Non-Voting shares

pursuant to a private agreement between RCI and an arm’s-length

third party seller for an aggregate purchase price of $93.9 million.

Each of these purchases was made under an issuer bid exemption

order issued by the Ontario Securities Commission and will be

included in calculating the number of Class B Non-Voting shares

that RCI may purchase pursuant to the NCIB. In addition, in August

and September 2008, RCI purchased an aggregate 77,400 of its

outstanding Class B Non-Voting shares directly under the NCIB for

an aggregate purchase price of $2.9 million. The NCIB expired on

January 13, 2009. On February 18, 2009, RCI announced that it had

filed a notice of intention to renew its prior NCIB for a further one-

year period commencing February 20, 2009 and ending February

19, 2010. The number of Class B Non-Voting shares to be purchased

under the renewed NCIB, if any, and the timing of such purchases

will be determined by RCI considering market conditions, stock

prices, its cash position, and other factors.

Wireless Spectrum Auction Letters of Credit and Payment for

Auctioned Spectrum

In order to participate in the auction of wireless spectrum licences

which commenced May 27, 2008, we arranged for the issuance of

standby letters of credit aggregating $534 million pursuant to the terms

and conditions of the auction. These letters of credit were cancelled on

September 3, 2008 upon payment in full for the spectrum licences in the

recent auction. See the section entitled “Spectrum Auction Conclusion”

in the Wireless segment review for further discussion.

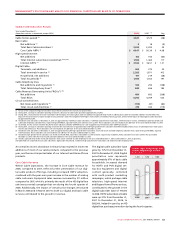

20082007

2.1x2.1x2.7x

RATIO OF DEBT TO

ADJUSTED OPERATING PROFIT*

200

7

2008

2006

* Includes debt and estimated risk-free fair value of

Cross-Currency Swaps.

20082007

$3,307$2,825$2,449

CONSOLIDATED CASH FLOW

FROM OPERATIONS

(In millions of dollars)

2007

2008

2006