Rogers 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 97

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

purchase method, with $13 million allocated to net tangible

assets acquired, $29 million allocated to broadcast licences

acquired and $1 million allocated to goodwill, which is tax

deductible, within the Media reporting segment.

During 2007, the Company made various other acquisitions for

cash consideration of approximately $3 million.

The goodwill has been allocated to the Media reporting segment

and is not tax deductible.

(iii) Other:

On January 1, 2007, the Company acquired five Alberta radio

stations for cash consideration of $43 million, including

acquisition costs. The acquisition was accounted for using the

During 2008, the Company announced that it had reached

an agreement to increase its ownership of K-Rock 1057 Inc.

to 100%. This transaction is subject to CRTC approval and is

expected to close in 2009.

During 2008, the Company received CRTC approval of an

agreement with Newfoundland Capital Corporation (“NCC”)

to exchange its CIGM AM radio licence in Sudbury, Ontario for

NCC’s CFDS AM licence in Halifax, Nova Scotia and to convert

both of the AM licences to FM. In addition to the radio station

exchange, the Company will pay cash consideration of $5 million.

The transaction is expected to close in 2009.

(B) 2007 ACQUISITIONS:

(i) Futureway Communications Inc.:

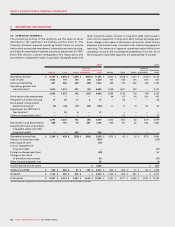

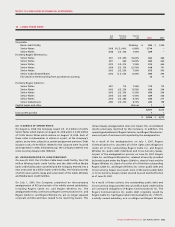

On June 22, 2007, the Company acquired the remaining 80%

of the common shares that it did not already own and the

outstanding stock options of Futureway Communications

Inc. (“Futureway”) for cash consideration of $38 million. In

addition, the Company contributed $48 million to Futureway to

simultaneously repay obligations under capital leases, advances

from affiliated companies and to terminate a services agreement.

The total cash outlay for the acquisition was $86 million. At the

same time, Cable entered into a marketing agreement with the

former controlling shareholder of Futureway that entitles the

Company to preferred marketing arrangements in certain new

residential housing developments in the Greater Toronto Area.

The acquisition was accounted for using the purchase method

with the results of operations consolidated with those of the

Company effective June 22, 2007. The fair values of the assets

Current assets $ 4

PP&E 4

Marketing agreement 52

Other intangible assets 7

Future income tax assets 22

Current liabilities (3)

Other liabilities (48)

Fair value of net assets acquired $ 38

(ii) Citytv:

On October 31, 2007, the Company acquired certain real

properties and 100% of the shares of the legal entities holding

the operations of the Citytv network of five television stations

in Canada, from CTVglobemedia Inc. for cash consideration of

$405 million, including acquisition costs. The acquisition was

accounted for using the purchase method, with the results of

operations consolidated with those of the Company effective

October 31, 2007.

During 2008, the Company finalized the purchase price

allocation of the Citytv acquisition and the Company paid

an additional $3 million as settlement for a working capital

adjustment which increased the purchase price paid to $408

million. In addition to the working capital adjustment,

valuations of certain tangible and intangible assets acquired

were completed. The adjustments had the following effects on

the purchase price allocation from that recorded and disclosed

in the 2007 consolidated financial statements:

Final

As at purchase

December 31, price

2007 Adjustments allocation

Purchase price $ 405 $ 3 $ 408

Current assets $ 33 $ (2) $ 31

Program inventory 25 (16) 9

PP&E 32 18 50

Brand name 26 – 26

Broadcast licence 86 – 86

Advertising bookings – 6 6

Future income tax liabilities (15) – (15)

Current liabilities (32) (16) (48)

Other liabilities (14) 6 (8)

Fair value of net assets acquired $ 141 $ (4) $ 137

Goodwill $ 264 $ 7 $ 271

acquired and liabilities assumed in the Futureway acquisition

are as follows: