Rogers 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 119

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

At December 31, 2008, the range of exercise prices, the weighted

average exercise price and the weighted average remaining

contractual life are as follows:

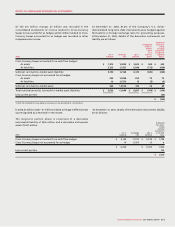

At December 31, 2008, a summary of the stock option plans is as follows:

2008 2007

Weighted Weighted

average average

Number of exercise Number of exercise

options price options price

Outstanding, beginning of year 15,586,066 $ 15.96 19,694,860 $ 11.17

Granted 2,148,110 38.83 1,886,088 39.19

Exercised (3,804,520) 10.55 (5,847,046) 7.17

Forfeited (88,036) 34.69 (147,836) 20.16

Outstanding, end of year 13,841,620 $ 20.80 15,586,066 $ 15.96

Exercisable, end of year 9,228,740 $ 13.82 11,409,666 $ 11.41

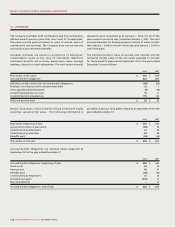

Options outstanding Options exercisable

Weighted

average Weighted Weighted

remaining average average

Range of Number contractual exercise Number exercise

exercise prices outstanding life (years) price exercisable price

$ 1.38 – $ 6.99 774,518 3.4 $ 5.50 774,518 $ 5.50

$ 7.00 – $ 9.99 1,380,632 4.4 8.41 1,380,632 8.41

$10.00 – $10.99 2,358,650 4.7 10.43 2,358,650 10.43

$11.00 – $11.99 702,096 2.1 11.82 702,096 11.82

$12.00 – $16.99 1,819,679 4.1 13.88 1,661,154 13.59

$17.00 – $18.99 943,859 1.5 17.87 938,614 17.87

$19.00 – $37.99 2,003,144 7.2 23.13 975,501 22.82

$38.00 – $47.99 3,859,042 8.7 39.04 437,575 39.21

13,841,620 5.7 20.80 9,228,740 13.82

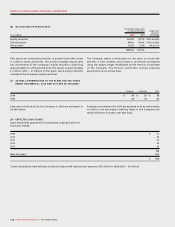

The weighted average estimated fair value at the date of grant

for options granted from January 1, 2007 to May 28, 2007 was

$13.62 per share.

For in-the-money stock options measured at the Company’s

December 31 share price, unrecognized stock-based compensation

expense related to stock-option plans was $3 million (2007 –

$20 million), and will be recorded in the consolidated statements of

income over the next four years.

(iii) Performance options:

During the year ended December 31, 2008, the Company

granted 1,142,300 (2007 – 1,036,200) performance-based

options to certain key executives. These options are governed

by the terms of the 2000 Plan. These options vest on a straight-

line basis over four years provided that certain targeted stock

prices are met on or after the anniversary date.

As a result of the May 28, 2007, SAR amendment, all

outstanding options, including the performance options, are

classified as liabilities and are carried at their intrinsic value as

adjusted for vesting.