Rogers 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

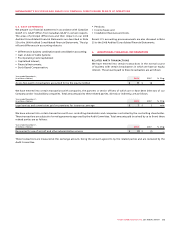

We believe that these non-GAAP financial measures provide for a

more effective analysis of our operating performance. In addition,

the items mentioned above could potentially distort the analysis

of trends due to the fact that they are either volatile or unusual or

non-recurring, can vary widely from company-to-company and can

impair comparability. The exclusion of these items does not mean

that they are unusual, infrequent or non-recurring.

We use these non-GAAP measures internally to make strategic deci-

sions, forecast future results and evaluate our performance from

period-to-period and compared to forecasts on a consistent basis.

We believe that these measures present trends that are useful to

investors and analysts in enabling them to assess the underlying

changes in our business over time.

Adjusted operating profit and adjusted operating profit margins,

which are reviewed regularly by management and our Board of

Directors, are also useful in assessing our performance and in mak-

ing decisions regarding the ongoing operations of the business and

the ability to generate cash flows.

These non-GAAP measures should be viewed as a supplement to,

and not a substitute for, our results of operations reported under

Canadian and U.S. GAAP. A reconciliation of these non-GAAP

financial measures to operating profit, net income and net income

per share is included in the section entitled “Supplementary

Information: Non-GAAP Calculations”.

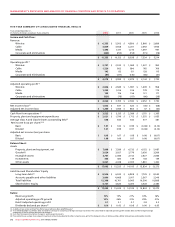

Additions to PP&E

Additions to PP&E include those costs associated with acquiring and

placing our PP&E into service. Because the communications busi-

ness requires extensive and continual investment in equipment,

including investment in new technologies and expansion of geo-

graphical reach and capacity, additions to PP&E are significant and

management focuses continually on the planning, funding and

management of these expenditures. We focus more on managing

additions to PP&E than we do on managing depreciation and amor-

tization expense because additions to PP&E have a direct impact on

our cash flow, whereas depreciation and amortization are non-cash

accounting measures required under Canadian and U.S. GAAP.

The additions to PP&E before related changes to non-cash working

capital represent PP&E that we actually took title to in the period.

Accordingly, for purposes of comparing our PP&E outlays, we believe

that additions to PP&E before related changes to non-cash working

capital best reflect our cost of PP&E in a period, and provide a more

accurate determination for period-to-period comparisons.

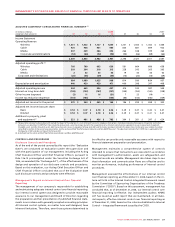

CRITICAL ACCOUNTING POLICIES

This MD&A has been prepared with reference to our 2008 Audited

Consolidated Financial Statements and Notes thereto, which have

been prepared in accordance with Canadian GAAP. The Audit

Committee of our Board reviews our accounting policies, reviews

all quarterly and annual filings, and recommends approval of our

annual financial statements to our Board. For a detailed discus-

sion of our accounting policies, see Note 2 to the 2008 Audited

Consolidated Financial Statements. In addition, a discussion of new

accounting standards adopted by us and critical accounting esti-

mates are discussed in the sections “New Accounting Standards”

and “Critical Accounting Estimates”, respectively.

Revenue Recognition

Revenue is categorized into the following types, the majority of

which are recurring in nature on a monthly basis from ongoing

relationships, contractual or otherwise, with our subscribers:

• Monthlysubscriberfeesinconnectionwithwirelessandwireline

services, cable, telephony, Internet services, rental of equip-

ment, network services and media subscriptions are recorded as

revenue on a pro rata basis as the service is provided;

• Revenuefromairtime,roaming,long-distanceandoptional

services, pay-per-use services, video rentals and other sales of

products are recorded as revenue as the services or products

are delivered;

• Revenue fromthesaleofwireless and cableequipmentis

recorded when the equipment is delivered and accepted by

the independent dealer or subscriber in the case of direct

sales. Equipment subsidies related to new and existing sub-

scribers are recorded as a reduction of equipment revenues;

• Installationfeesandactivationfeeschargedtosubscribers

do not meet the criteria as a separate unit of accounting.

As a result, in Wireless, these fees are recorded as part of

equipment revenue and, in the case of Cable, are deferred

and amortized over the related service period. The related

service period for Cable ranges from 26 to 48 months, based

on subscriber disconnects, transfers of service and moves.

Incremental direct installation costs related to re-connects

are deferred to the extent of deferred installation fees and

amortized over the same period as these related installation

fees. New connect installation costs are capitalized to PP&E

and amortized over the useful life of the related assets;

• Advertisingrevenueisrecordedintheperiodtheadvertis-

ing airs on our radio or television stations and the period in

which advertising is featured in our publications;

• Monthly subscription revenues received by television sta-

tions for subscriptions from cable and satellite providers are

recorded in the month in which they are earned;

• BlueJays’revenuefromhomegameadmissionandconces-

sions is recognized as the related games are played during

the baseball regular season. Revenue from radio and televi-

sion agreements is recorded at the time the related games

are aired. The Blue Jays also receive revenue from the Major

League Baseball Revenue Sharing Agreement, which distrib-

utes funds to and from member clubs, based on each club’s

revenues. This revenue is recognized in the season in which it

is earned, when the amount is estimable and collectibility is

reasonably assured; and

• Discountsprovidedto customersrelatedtocombinedpur-

chases of Wireless, Cable, and Media products and services

are charged directly to the revenue for the products and ser-

vices to which they relate.

We offer certain products and services as part of multiple deliver-

able arrangements. We divide multiple deliverable arrangements

into separate units of accounting. Components of multiple deliv-

erable arrangements are separately accounted for provided the

delivered elements have stand-alone value to the customers and

the fair value of any undelivered elements can be objectively

and reliably determined. Consideration for these units is mea-

sured and allocated amongst the accounting units based upon

their fair values and our relevant revenue recognition policies are