Rogers 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 75

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

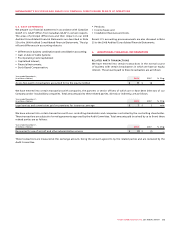

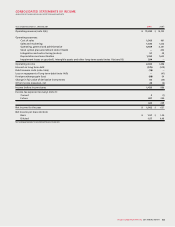

SUMMARY OF SEASONALITY AND QUARTERLY RESULTS

Quarterly results and statistics for the previous eight quarters are

outlined following this section.

Our operating results are subject to seasonal fluctuations that mate-

rially impact quarter-to-quarter operating results. As a result, one

quarter’s operating results are not necessarily indicative of what

a subsequent quarter’s operating results will be. Each of Wireless,

Cable and Media has unique seasonal aspects to its business.

Wireless’ operating results are subject to seasonal fluctuations

that materially impact quarter-to-quarter operating results. In

particular, operating results may be influenced by the timing of

our marketing and promotional expenditures and higher levels of

subscriber additions and subsidies, resulting in higher subscriber

acquisition and activation-related expenses in certain periods.

The operating results of Cable Operations services are subject to

modest seasonal fluctuations in subscriber additions and discon-

nections, which are largely attributable to movements of university

and college students and individuals temporarily suspending ser-

vice due to extended vacations, or seasonal relocations, as well as

our concentrated marketing efforts generally conducted during

the fourth quarter. Rogers Retail operations may also experience

modest fluctuations from quarter-to-quarter due to the availability

and timing of release of popular titles throughout the year. RBS

does not have any unique seasonal aspects to its business.

The seasonality at Media is a result of fluctuations in advertising

and related retail cycles, since they relate to periods of increased

consumer activity as well as fluctuations associated with the Major

League Baseball season, where revenues are generally concen-

trated in the spring, summer and fall months.

In addition to the seasonal trends, revenue and operating profit

can fluctuate from general economic conditions. The Canadian

economy, and Ontario in particular, experienced an economic slow-

down in the latter half of 2008.

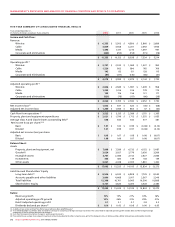

Wireless revenue and operating profit growth reflects the increas-

ing number of wireless voice and data subscribers, increase in

blended postpaid and prepaid ARPU, and increased handset subsi-

dies as a result of a consumer shift towards smartphones. Wireless

has continued its strategy of targeting higher value postpaid sub-

scribers and selling prepaid handsets at higher price points, which

has also contributed over time to the significantly heavier mix of

postpaid versus prepaid subscribers. Meanwhile, the successful

growth in customer base and increased market penetration have

been met by increasing customer service and retention expenses

and increasing credit and collection costs. However, these costs

have been offset by operating efficiencies and increasing GSM net-

work roaming revenues from our subscribers travelling outside of

Canada, as well as strong growth in roaming revenues from visitors

to Canada utilizing our GSM network.

Cable Operations services revenue and operating profit increased

primarily due to price increases, increased penetration of its digital

products and incremental programming packages, and the scal-

ing and rapid growth of our cable telephony service. Similarly, the

steady growth of Internet revenues has been the result of a greater

penetration of Internet subscribers as a percentage of homes

passed. RBS’ operating profit margin reflects the pricing pressures

on long-distance and higher carrier costs as it focuses on managing

the profitability of its existing customer base and evaluates prof-

itable opportunities within the medium and large enterprise and

carrier segments. Rogers Retail revenue has increased as a result of

increasing Wireless products and services.

Media’s results are primarily attributable to a general down-

turn in demand for local advertising due to the softness in the

Ontario economy.

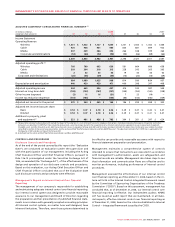

Other fluctuations in net income from quarter-to-quarter can also

be attributed to losses on repayment of debt, foreign exchange

gains or losses, changes in the fair value of derivative instruments,

other income and expenses, writedowns of goodwill, intan-

gible assets and other long-term assets and changes in income

tax expense.

SUMMARY OF FOURTH QUARTER 2008 RESULTS

During the three months ended December 31, 2008, consolidated

operating revenue increased 9% to $2,941 million in 2008 compared

to $2,687 million in the corresponding period in 2007, with all of

our operating segments contributing to the year-over-year growth,

including 13% growth at Wireless, 7% growth at Cable, and 8%

growth at Media. Consolidated fourth quarter adjusted operating

profit grew 1% year-over-year to $968 million, with 18% growth at

Cable, offset by 3% decline at Wireless, and 27% decline at Media.

The decline at Wireless was related to higher acquisition and reten-

tion costs related to a successful smartphone campaign, while

Media experienced declines in advertising revenues resulting from

the economic slowdown in Canada.

Consolidated operating income for the three months ended

December 31, 2008, totalled $137 million, compared to $476 million

in the corresponding period of 2007. Decline in operating income is

a result of the impairment loss recognized in the conventional tele-

vision business of the Media operating segment during the fourth

quarter of 2008 as discussed below.

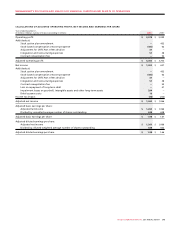

We recorded net loss of $138 million for the three months ended

December 31, 2008, or basic and diluted loss per share of $0.22,

compared to a net income of $254 million or basic and diluted earn-

ings per share of $0.40 in the corresponding period of 2007. The net

loss was primarily attributable to the writedown of certain Media

assets. In the fourth quarter of 2008, we determined that the fair

value of the conventional television business of Media was lower

than its carrying value. This primarily resulted from weakening of

industry expectations and declines in advertising revenues amidst

the slowing economy. As a result, we recorded an aggregate

non-cash impairment charge of $294 million with the following

components: $154 million related to goodwill, $75 million related to

broadcast licences and $65 million related to intangible assets and

other long-term assets.