Rogers 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 25

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

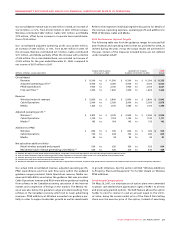

An overall economic slowdown in Canada, and particularly in

Ontario, has negatively impacted the results of our Wireless, Cable

and Media lines of business during 2008. The challenging economic

conditions have resulted in lower subscriber additions, predomi-

nantly in our Cable business, as well as declines of advertising,

roaming and other revenues. In response to these economic condi-

tions, we have taken action to restructure our employee base to

improve our cost structure going forward. The decline in advertising

revenue has lead to an impairment charge of $294 million related to

our conventional television business, which is fully described in the

section entitled ”Impairment Losses on Goodwill, Intangible Assets

and Other Long-Term Assets”. Despite the economic slowdown, we

are well positioned from a liquidity perspective with $1.8 billion in

available credit under our $2.4 billion committed bank credit facility

that does not mature until July 2013, and have no debt maturities

until May 2011.

Operating Highlights and Significant Developments in 2008

• Generated growth in annual revenue of 12%, while adjusted

operating profit grew 10% to $4,060 million

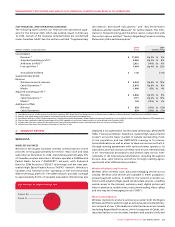

• WeclosedUS$1.75billionaggregateprincipalamountofinvest-

ment grade debt offerings on August 6, 2008, consisting of

US$1.4 billion of 6.8% Senior Notes due 2018, and US$350 million

7.5% Senior Notes due 2038. Proceeds of the offerings were used

in part to fund the $1.0 billion purchase of 20 MHz of Advanced

Wireless Services (“AWS”) spectrum in the spectrum auction.

• We purchased for cancellation 4,077,400 outstanding Class B

Non-Voting shares during the year for $136.7 million under Board

approval to repurchase up to $300 million of outstanding shares.

• In January 2008, we announced an increase in the annual

dividend from $0.50 to $1.00 per Class A Voting and Class B Non-

Voting share.

• InFebruary2009,weannouncedanincreaseintheannualdividend

from $1.00 to $1.16 per Class A Voting and Class B Non-Voting share.

This reflects our Board of Directors’ continued confidence in the

strategies that we have employed to position ourselves as a grow-

ing communications company, while concurrently recognizing the

importance of returning meaningful portions of the growing cash

flows being generated by the business to shareholders.

• AtDecember31,2008wehadapproximately$1.8billioninavail-

able credit under our $2.4 billion committed bank credit facility

that matures July 2013. This liquidity position is also enhanced

by the fact that our earliest scheduled debt maturity is in May

2011. This financial position provides us with substantial liquidity

and flexibility, particularly given the current global credit market

challenges.

• InFebruary2009,ourBoardofDirectorsapprovedtherenewal

of a normal course issuer bid (“NCIB”) to repurchase up to

$300 million of our shares on the open market during the follow-

ing twelve months.

• TheCompany’sfounder,PresidentandChiefExecutiveOfcer

Edward S. “Ted” Rogers, passed away on December 2, 2008. Alan

Horn, Chairman of the Board of Rogers Communications Inc.,

was appointed by the Board to serve as acting Chief Executive

Officer as the Board performs a search, considering internal and

external candidates, for a permanent CEO.

• PriortohisdeathinDecember2008,EdwardS.“Ted”Rogerscon-

trolled RCI through his ownership of voting shares of a private

holding company. RCI has been informed that under Mr. Rogers’

estate arrangements, those voting shares, and consequently

voting control of RCI and its subsidiaries, passed to the Rogers Control

Trust, a trust of which the trust company subsidiary of a Canadian

chartered bank is Trustee and members of the family of the late

Mr. Rogers are beneficiaries. Private Rogers family holding com-

panies controlled by the Rogers Control Trust together own

approximately 90.9% of the Class A Voting shares of RCI and 7.5%

of the Class B Non-Voting shares. The governance structure of the

Rogers Control Trust comprises the Control Trust Chair (who acts

in effect as the chief executive of the Control Trust), the Control

Trust Vice-Chair, the corporate trustee, and a committee of advisors

(the Advisory Committee). The Advisory Committee members are

appointed in accordance with the estate arrangements and include

members of the Rogers family, trustees of a Rogers family trust and

other individuals, including certain directors of RCI.

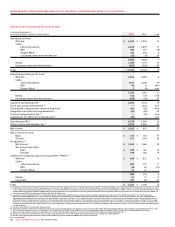

Year Ended December 31, 2008 Compared to Year Ended

December 31, 2007

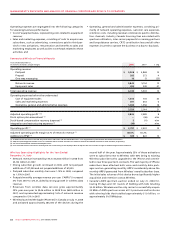

For the year ended December 31, 2008, Wireless, Cable and Media

represented 56%, 34% and 13% of our consolidated revenue,

respectively, offset by corporate items and eliminations of 3%.

Wireless, Cable and Media also represented 69%, 30% and 4% of

our consolidated adjusted operating profit, respectively, offset by

corporate items and eliminations of 3%.

For the year ended December 31, 2007, Wireless, Cable and Media

represented 54%, 35% and 13% of our consolidated revenue,

respectively, offset by corporate items and eliminations of 2%.

Wireless, Cable and Media also represented 70%, 27% and 5% of

our consolidated adjusted operating profit, respectively, offset by

corporate items and eliminations of 2%.

For more detailed discussions of Wireless, Cable and Media, refer

to the respective segment discussions below.