Rogers 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

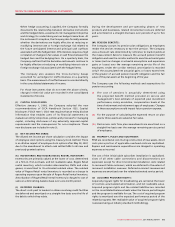

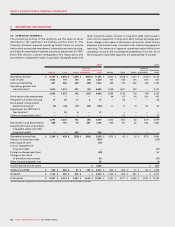

(A) OPERATING SEGMENTS:

The accounting policies of the segments are the same as those

described in the significant accounting policies (note 2). The

Company discloses segment operating results based on income

before stock option plan amendment, integration and restructuring,

stock-based compensation expense (recovery), adjustment for CRTC

Part II fees decision, contract renegotiation fee, depreciation and

amortization, impairment losses on goodwill, intangible assets and

other long-term assets, interest on long-term debt, debt issuance

costs, loss on repayment of long-term debt, foreign exchange gain

(loss), change in fair value of derivative instruments, other income

(expense) and income taxes, consistent with internal management

reporting. This measure of segment operating results differs from

operating income in the consolidated statements of income. All of

the Company’s reportable segments are substantially in Canada.

3. SEGMENTED INFORMATION

2008 2007

Corporate Corporate

items and Consolidated items and Consolidated

Wireless Cable Media eliminations totals Wireless Cable Media eliminations totals

Operating revenue $ 6,335 $ 3,809 $ 1,496 $ (305) $ 11,335 $ 5,503 $ 3,558 $ 1,317 $ (255) $ 10,123

Cost of sales 1,005 197 178 (77) 1,303 703 186 173 (101) 961

Sales and marketing 691 466 269 (92) 1,334 653 519 226 (76) 1,322

Operating, general and

administrative* 1,833 1,913 907 (15) 4,638 1,558 1,837 742 – 4,137

2,806 1,233 142 (121) 4,060 2,589 1,016 176 (78) 3,703

Stock option plan amendment – – – – – 46 113 84 209 452

Integration and restructuring 14 20 11 6 51 – 38 – – 38

Stock-based compensation

expense (recovery)* (5) (32) (17) (46) (100) 11 11 10 30 62

Adjustment for CRTC Part II

fees decision* – 25 6 – 31 – – – – –

Contract renegotiation fee* – – – – – – 52 – – 52

2,797 1,220 142 (81) 4,078 2,532 802 82 (317) 3,099

Depreciation and amortization 588 791 76 305 1,760 560 737 52 254 1,603

Impairment losses on goodwill,

intangible assets and other

long-term assets – – 294 – 294 – – – – –

Operating income (loss) $ 2,209 $ 429 $ (228) $ (386) 2,024 $ 1,972 $ 65 $ 30 $ (571) 1,496

Interest on long-term debt (575) (579)

Debt issuance costs (16) –

Loss on repayment of

long-term debt – (47)

Foreign exchange gain (loss) (99) 54

Change in fair value

of derivative instruments 64 (34)

Other income (expense), net 28 (4)

Income before income taxes $ 1,426 $ 886

Additions to PP&E $ 929 $ 886 $ 81 $ 125 $ 2,021 $ 822 $ 814 $ 77 $ 83 $ 1,796

Goodwill $ 1,140 $ 982 $ 902 $ – $ 3,024 $ 1,140 $ 926 $ 961 $ – $ 3,027

Total assets $ 8,357 $ 5,153 $ 1,941 $ 1,642 $ 17,093 $ 6,747 $ 5,211 $ 2,042 $ 1,325 $ 15,325

*Included with operating, general and administrative operating expenses in consolidated statements of income.