Rogers 2008 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 35

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

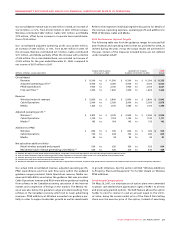

Wireless Network Revenue

The increase in network revenue in 2008 compared to 2007 was

driven predominantly by the continued growth of Wireless’ post-

paid subscriber base and the year-over-year growth of wireless

data. The 4% year-over-year increase in postpaid ARPU reflects the

impact of higher wireless data revenue, as well as increased usage

of various calling features. The voice component of postpaid ARPU

remained relatively flat during the year, reflecting the impact of

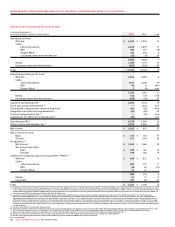

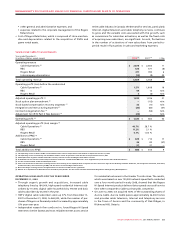

Summarized Wireless Subscriber Results

Years ended December 31,

(Subscriber statistics in thousands, except ARPU, churn and usage) 2008 2007 Chg

Postpaid

Gross additions (1) 1,341 1,352 (11)

Net additions 537 581 (44)

Adjustment to postpaid subscriber base (2) – (65) 65

Total postpaid retail subscribers 6,451 5,914 537

Average monthly revenue per user (“ARPU”) (3) $ 75.27 $ 72.21 $ 3.06

Average monthly usage (minutes) 589 573 16

Monthly churn 1.10% 1.15% (0.05%)

Prepaid

Gross additions 632 635 (3)

Net additions 67 70 (3)

Adjustment to prepaid subscriber base (2) – (26) 26

Total prepaid retail subscribers 1,491 1,424 67

ARPU (3) $ 16.65 $ 16.46 $ 0.19

Monthly churn 3.31% 3.42% (0.11%)

(1) During the third quarter of 2008, an adjustment associated with laptop wireless data card (“air card”) subscribers resulted in the addition of approximately 11,000 subscribers to Wireless’ postpaid

subscriber base. This adjustment is included in gross additions for the twelve months ended December 31, 2008. Beginning in the third quarter of 2008, air cards are included in the gross additions for

postpaid subscribers.

(2) During 2007, Wireless decommissioned its TDMA and analog networks and simultaneously revised certain aspects of its subscriber reporting for data-only subscribers. The deactivation of the remaining

TDMA subscribers and the change in subscriber reporting resulted in the removal of approximately 65,000 subscribers from Wireless’ postpaid subscriber base and the removal of approximately 26,000

subscribers from Wireless’ prepaid subscriber base. These adjustments are not included in the determination of postpaid or prepaid monthly churn.

(3) As defined. See the section entitled “Key Performance Indicators and Non-GAAP Measures”. As calculated in the “Supplementary Information: Non-GAAP Calculations” section.

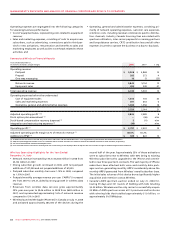

• WirelessannouncedthelaunchofitsFidoUNOandRogersHome

Calling Zone plans that allow customers to make unlimited calls

within their home using their wireless phone via a home WiFi

broadband connection. This converged service utilizes technol-

ogy known as Unlicenced Mobile Access (“UMA”) and provides

our customers the convenience of having one phone, one num-

ber, one address book and one voicemail which they can use

inside and outside of their home.

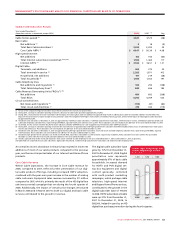

200820072006

6,4515,9145,398

1,4911,4241,380

Postpaid Prepaid

WIRELESS POSTPAID AND

PREPAID SUBSCRIBERS

(In thousands)

• AvailabilityoftheRogersPortableInternetservicewasexpanded

to now include more than 150 urban and rural communities across

Canada. With this most recent expansion, the Inukshuk joint ven-

ture’s network has become the second largest broadband fixed

wireless network in the world.

a softer economy on North American roaming, long-distance and

out-of-bucket voice usage combined with a general increase in the

level of competitive intensity.

Wireless’ success in the continued reduction of postpaid churn

reflects targeted customer retention activities and continued

enhancements in network coverage and quality.

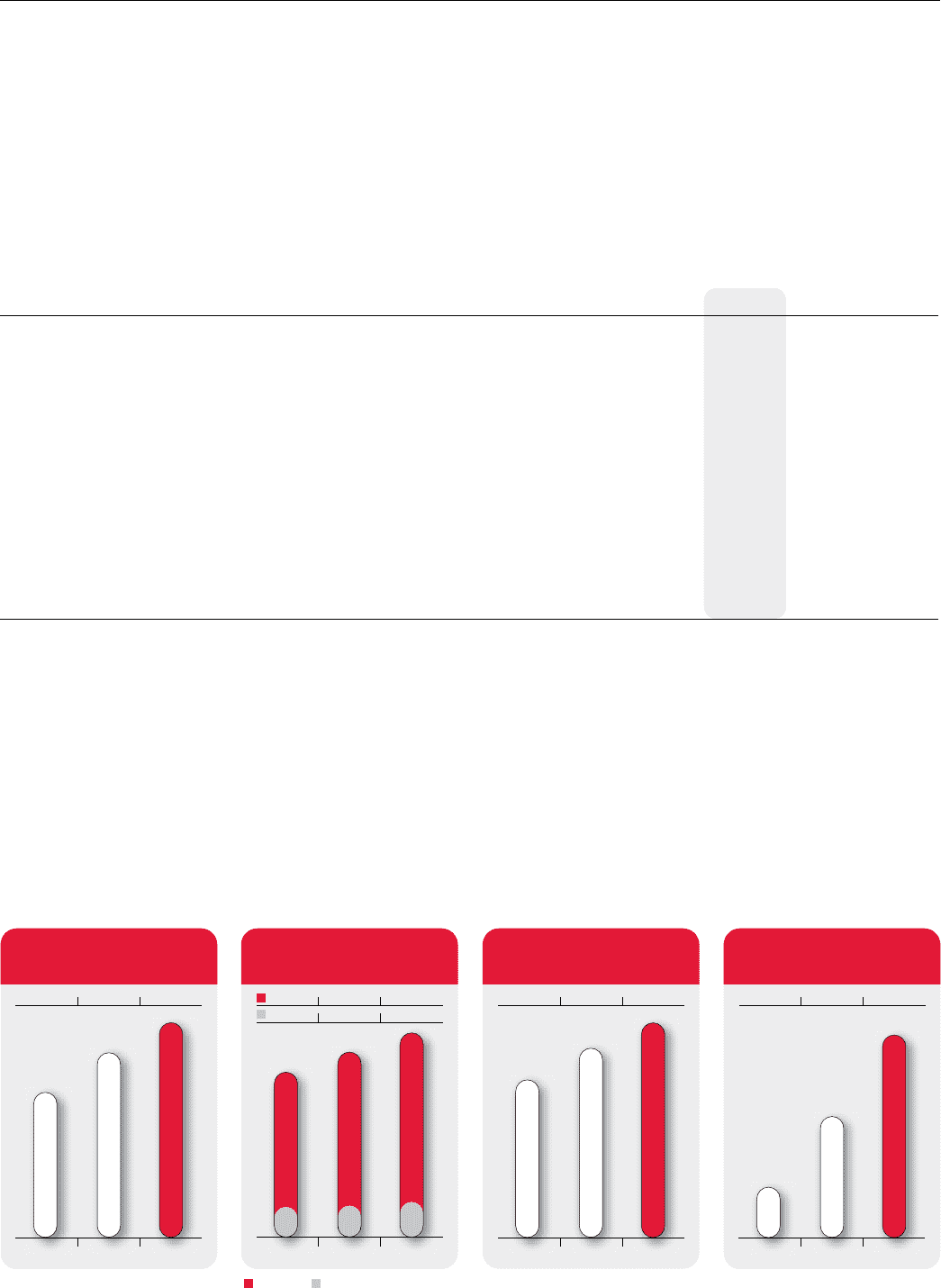

20082007

$5,843$5,154$4,313

WIRELESS NETWORK

REVENUE

(In millions of dollars)

2007

2008

2006

20082007

$4,333$4,018$3,586

LIFE-TIME REVENUE PER

SUBSCRIBER (at end of year)

2006

20082007

$946$683$459

WIRELESS DATA

REVENUE

(In millions of dollars)

2007

2008

2006