Rogers 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

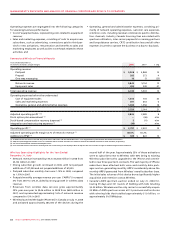

Rogers Home Phone Revenue

The revenue growth of Rogers Home Phone for 2008 reflects the

year-over-year growth in the cable telephony customer base, offset

by the ongoing decline of the circuit-switched and long-distance

only customer bases. The lower net additions of cable telephony

lines versus the previous year reflects the impact of a slowing

Ontario economy combined with increased win-back activities by

incumbent telecom providers as Rogers’ market share increases.

The base of cable telephony lines grew 28% from December 31, 2007

to December 31, 2008. At December 31, 2008, cable telephony lines

represented 36% of basic cable subscribers and 24% of the homes

passed by our cable networks.

Cable continues to focus principally on growing its on-net cable

telephony line base, and as part of this on-net focus, began to

significantly de-emphasize circuit-switched sales earlier in 2008

and intensified its efforts to convert circuit-switched lines that are

within the cable territory onto its cable telephony platform. Of

the 182,000 net line additions to cable telephony during the year,

approximately 60,000 were migrations of lines from our circuit-

switched to our cable telephony platform.

The greater number of circuit-switched net line losses during

2008 compared to 2007 reflect Cable’s migrations of lines within

the cable areas from the circuit-switched platform onto the cable

telephony platform, combined with a significant de-emphasis

since early 2008 on the sales and marketing of the lower margin

circuit-switched telephony product in markets outside of the cable

footprint. Because of the strategic decision to de-emphasize sales

of the circuit-switched telephony product outside of the cable

footprint, Cable expects that circuit-switched net line losses will

continue as that base of subscribers shrinks over time.

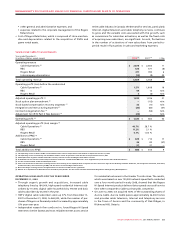

Internet (Residential) Revenue

The year-over-year increases in Internet revenues for 2008 primarily

reflect the 8% increase in the Internet subscriber base combined

with certain Internet services price increases made during the previ-

ous twelve months and incremental revenue from additional usage

charges. The average monthly revenue per Internet subscriber has

increased in 2008 compared to 2007 due to various pricing adjust-

ments over the prior year.

With the high-speed Internet base now at approximately 1.6 million,

Internet penetration is approximately 45% of the homes passed by

our cable networks.

In addition to the economic impacts on sales as discussed above,

the lower high-speed Internet net additions also reflect the grow-

ing penetration of broadband in Canada.

20082007

568361223

HIGH DEFINITION

HOUSEHOLDS

(In thousands)

2006

20082007

1,5821,4651,297

CABLE INTERNET SUBSCRIBERS

AND INTERNET PENETRATION

OF HOMES PASSED (In thousands)

2007

2008

2006

45%

41%

37%

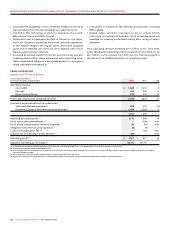

200820072006

2,3202,2952,277

Basic cable InternetDigital households

Residential cable telephony

1,5821,4651,297

1,5501,3531,134

840656366

CABLE RGUs

(In thousands)

200820072006

840656366

HOME PHONE CABLE TELEPHONY

SUBSCRIBERS AND PENETRATION

OF HOMES PASSED (In thousands)

24%

18%

11%

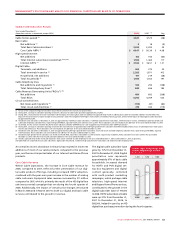

CABLE RGU BREAKDOWN

(%)

Telephony 13%

Digital 25%

High-speed Internet 25%

Basic 37%