Rogers 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

A Loss in Media’s Leadership Position in Radio, Television or

Magazine Readership Could Adversely Impact Media’s Sales

Volumes and Advertising Rates.

It is well established that advertising dollars migrate to media prop-

erties that are leaders in their respective markets and categories

when advertising budgets are tightened. Although most of Media’s

radio, television and magazine properties are currently leaders

in their respective markets, such leadership may not continue in

the future. Advertisers base a substantial part of their purchasing

decisions on statistics such as ratings and readership generated by

industry associations and agencies. If Media’s radio and television

ratings or magazine readership levels were to decrease substan-

tially, Media’s advertising sales volumes and the rates which it

charges advertisers could be adversely affected.

Changes in Technology Could Increase Competition.

The deployment of PVRs could influence Media’s capability to gener-

ate television advertising revenues as viewers are provided with the

opportunity to ignore advertising aired on the television networks.

The emergence of subscriber-based satellite and digital radio prod-

ucts could change radio audience listening habits and negatively

impact the results of Media’s radio stations. Certain audiences are

also migrating to the Internet as more video becomes available. In

addition, as mandated by the CRTC, Canadian television signals are

migrating to a strictly digital platform by August 31, 2011, which

could impact Media’s ability to reach certain audiences.

An Increase in Paper Prices, Printing Costs or Postage Could

Adversely Affect Media’s Results of Operations.

A significant portion of Publishing’s operating expenses consists of

paper, printing and postage expenses. Paper is Publishing’s single

largest raw material expense, representing approximately 7% of

Publishing’s operating expenses in 2008. Publishing depends upon

outside suppliers for all of its paper supplies, holds relatively small

quantities of paper in stock itself, and is unable to control paper

prices, which can fluctuate considerably. Moreover, Publishing

is generally unable to pass paper cost increases on to customers.

Printing costs represented approximately 13% of Publishing’s oper-

ating expenses in 2008. Publishing relies on third parties for all of

its printing services. In addition, Publishing relies on the Canadian

Postal Service to distribute a large percentage of its publications.

Any disruption in printing or postage services could have a material

impact on Media’s results of operations or financial condition. A

material increase in paper prices, printing costs or postage expenses

to Publishing could have a material adverse effect on Media’s busi-

ness, results of operations or financial condition.

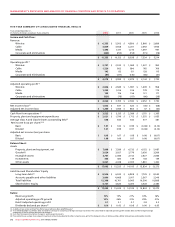

5. ACCOUNTING POLICIES AND NON-GAAP MEASURES

KEY PERFORMANCE INDICATORS AND NON-GAAP MEASURES

We measure the success of our strategies using a number of key

performance indicators, which are outlined below. The following

key performance indicators are not measurements in accordance

with Canadian or U.S. GAAP and should not be considered as an

alternative to net income or any other measure of performance

under Canadian or U.S. GAAP.

Subscriber Counts

We determine the number of subscribers to our services based on

active subscribers. A wireless subscriber is represented by each

identifiable telephone number. A cable subscriber is represented

by a dwelling unit. In the case of multiple units in one dwelling,

such as an apartment building, each tenant with cable service,

whether invoiced individually or having services included in his or

her rent, is counted as one subscriber. Commercial or institutional

units, such as hospitals or hotels, are each considered to be one

subscriber. When subscribers are deactivated, either voluntarily or

involuntarily for non-payment, they are considered to be deactiva-

tions in the period the services are discontinued. Wireless prepaid

subscribers are considered active for a period of 180 days from the

date of their last revenue-generating usage.

We report wireless subscribers in two categories: postpaid and

prepaid. Postpaid includes voice-only and data-only subscribers,

as well as subscribers with service plans integrating both voice and

data, while prepaid includes voice-only subscribers.

Internet, Rogers Home Phone and RBS subscribers include only

those subscribers with service installed, operating and on billing

and excludes those subscribers who have subscribed to the service

but for whom installation of the service was still pending.

Subscriber Churn

Subscriber churn is calculated on a monthly basis. For any partic-

ular month, subscriber churn for Wireless represents the number

of subscribers deactivating in the month divided by the aggregate

number of subscribers at the beginning of the month. When used

or reported for a period greater than one month, subscriber churn

represents the monthly average of the subscriber churn for the

period.

Average Revenue Per User

ARPU is calculated on a monthly basis. For any particular month,

ARPU represents monthly revenue divided by the average number

of subscribers during the month. In the case of Wireless, ARPU rep-

resents monthly network revenue divided by the average number

of subscribers during the month. ARPU, when used in connection

with a particular type of subscriber, represents monthly revenue

generated from those subscribers divided by the average number

of those subscribers during the month. When used or reported for

a period greater than one month, ARPU represents the monthly

average of the ARPU calculations for the period. We believe ARPU

helps indicate whether we have been successful in attracting and

retaining higher value subscribers. Refer to the section entitled

“Supplementary Information: Non-GAAP Calculations” for further

details on this Wireless and Cable calculation.

Operating Expenses

Operating expenses are segregated into three categories for assess-

ing business performance:

• Costofsales,whichiscomprisedofwirelessequipmentcosts,

Rogers Retail merchandise and depreciation of Rogers Retail

rental assets, as well as cost of goods sold by The Shopping

Channel;