Rogers 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Recent Media Developments

Media announced that the CRTC had approved its application for

a 24-hour news television channel to serve the City of Toronto and

the Greater Toronto Area. The channel will reflect Citytv’s unique

brand of news delivery, will be complemented by content from

Rogers’ ethnically diverse OMNI stations and will also feature news

items contributed from other Rogers Media properties including

The Fan 590, 680News, Sportsnet, Publishing and the Blue Jays.

OMNI was honoured by the Canadian Association of Broadcasters

(“CAB”) with Gold Ribbon Awards in two categories, including

Diversity in News and Information Programming, and in Magazine

Programming. These awards reaffirm OMNI’s excellence in deliv-

ering independent and third language programming to Canada’s

multilingual and multicultural communities.

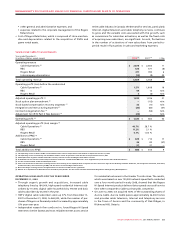

3. CONSOLIDATED LIQUIDITY AND FINANCING

LIQUIDITY AND CAPITAL RESOURCES

Operations

For 2008, cash generated from operations before changes in non-

cash operating items, which is calculated by removing the effect

of all non-cash items from net income, increased to $3,522 million

from $3,135 million in 2007. The $387 million increase is primarily the

result of a $357 million increase in adjusted operating profit.

Taking into account the changes in non-cash working capital items

for 2008, cash generated from operations was $3,307 million, com-

pared to $2,825 million in 2007. The cash generated from operations

of $3,307 million, together with the following items, resulted in

total net funds of approximately $5,105 million generated or raised

in 2008:

• receiptof$1,794millionaggregategrossproceedsfromtheissu-

ance of US$1.75 billion of public debt;

• receiptof$3millionfrom the issuanceofClassB Non-Voting

shares under the exercise of employee stock options;

• receipt of $1 million in net proceeds from the settlement at

maturity of certain Cross-Currency Swaps and related forward

contracts.

Net funds used during 2008 totalled approximately $5,063 million,

the details of which include the following:

• additionstoPP&Eof$1,981million,netof$40millionofrelated

changes in non-cash working capital;

• paymentofthespectrumauctionpurchasepriceandassociated

costs aggregating $1,008 million;

• net repayments under our bank credit facility aggregating

$655 million;

• thepaymentofquarterlydividendsaggregating$559millionon

our Class A Voting and Class B Non-Voting shares;

• the payment of $375 million on the termination and re-

couponing of three existing Cross-Currency Swaps aggregating

US$575 million notional principal amount;

• the purchasefor cancellation of4,077,400Class BNon-Voting

shares for an aggregate purchase price of $136.7 million;

• additionstoprogramrightsandCRTCcommitmentsaggregating

$150 million; and

• acquisitionsandothernetinvestmentsaggregating$198million,

including the acquisition of Aurora Cable, the two-thirds of OLN

not previously owned, channel m and CIKZ-FM Kitchener.

Taking into account the cash deficiency of $61 million at the begin-

ning of the year and the cash sources and uses described above, the

cash deficiency at December 31, 2008 was $19 million.

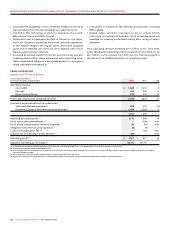

Financing

Our long-term debt instruments are described in Note 14 and Note

15 to the 2008 Audited Consolidated Financial Statements. During

2008, the following financing activities took place.

On August 6, 2008 RCI issued US$1.75 billion aggregate principal

amount of public debt securities, comprised of US$1.4 billion of

6.80% Senior Notes due 2018 (the “2018 Notes”) and US$350 mil-

lion of 7.50% Senior Notes due 2038 (the “2038 Notes”). The 2018

Notes were issued at a discount of 99.854% to yield 6.82% and the

2038 Notes were priced at a discount of 99.653% to yield 7.529%.

RCI received aggregate net proceeds of US$1,735 million (Cdn$1,778

million) from the issuance of the 2018 Notes and the 2038 Notes

after deducting the respective issue discounts and underwriting

commissions. The 2018 Notes and the 2038 Notes are unsecured and

are guaranteed on an unsecured basis by each of Rogers Wireless

Partnership and Rogers Cable Communications Inc. and rank pari

passu with all of RCI’s other senior unsecured and unsubordinated

notes and debentures and bank credit facility.

Effective August 6, 2008, RCI entered into an aggregate US$1.75

billion notional principal amount of Cross-Currency Swaps. An

aggregate US$1.4 billion notional principal amount of these Cross-

Currency Swaps hedge the principal and interest obligations for the

2018 Notes through to maturity in 2018 while the remaining US$350

million aggregate notional principal amount of Cross-Currency

Swaps hedge the principal and interest on the 2038 Notes for ten

years to August 2018. These Cross-Currency Swaps have the effect of:

(a) converting the US$1.4 billion aggregate principal amount of 2018

Notes from a fixed coupon rate of 6.80% into Cdn$1,435 million at

a weighted average fixed interest rate of 6.80%; and (b) converting

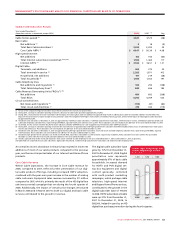

2008 USE OF CASH

(In millions of dollars)

2008

Acquisitions and other net investments: $198

Additions to program rights & CRTC commitments: $150

Repurchase of shares under NCIB: $137

Dividends: $559

Payments under bank credit facility: $655

Spectrum: $1,008$5,063

Additions to PP&E: $1,981

Re-couponing of cross-currency swaps: $375