Rogers 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ROGERS COMMUNICATIONS INC. 2008 ANNUAL REPORT 101

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

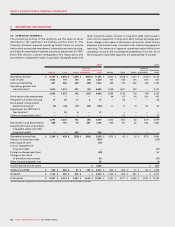

Amortization expense for Rogers Retail rental inventory is

charged to cost of sales and amounted to $43 million in 2008

(2007 – $46 million). The costs of acquired program rights are

amortized to operating, general and administrative expenses over

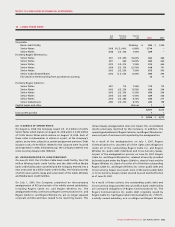

9. OTHER CURRENT ASSETS

2008 2007

Inventories $ 256 $ 110

Prepaid expenses 99 86

Acquired program rights 43 45

Rogers Retail rental inventory 29 32

Deferred compensation 12 10

Other 3 21

$ 442 $ 304

the expected performances of the related programs and amounted to

$103 million in 2008 (2007 – $46 million). Cost of sales includes

$1,260 million (2007 – $915 million) of inventory costs.

Depreciation expense for 2008 amounted to $1,456 million (2007 –

$1,303 million).

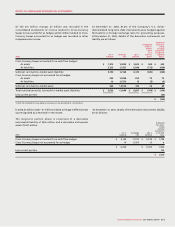

10. PROPERTY, PLANT AND EQUIPMENT

2008 2007

Accumulated Net book Accumulated Net book

Cost depreciation value Cost depreciation value

Land and buildings $ 762 $ 156 $ 606 $ 662 $ 133 $ 529

Towers, head-ends and transmitters 1,179 705 474 998 566 432

Distribution cable and subscriber drops 4,874 2,802 2,072 4,562 2,542 2,020

Network equipment 5,320 2,805 2,515 4,749 2,393 2,356

Wireless network radio base station equipment 1,459 876 583 1,250 770 480

Computer equipment and software 2,424 1,730 694 2,068 1,518 550

Customer equipment 1,260 787 473 1,068 614 454

Leasehold improvements 349 193 156 316 175 141

Equipment and vehicles 825 500 325 754 427 327

$ 18,452 $ 10,554 $ 7,898 $ 16,427 $ 9,138 $ 7,289

Details of PP&E are as follows:

PP&E not yet in service and, therefore, not depreciated at December 31,

2008 amounted to $853 million (2007 - $614 million).

.

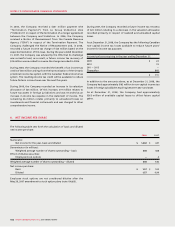

11. GOODWILL AND INTANGIBLE ASSETS

(A) IMPAIRMENT:

(i) Goodwill:

In the fourth quarter of 2008, the Company determined that

the fair value of its conventional television reporting unit

was lower than its carrying value. This primarily resulted

from weakening of industry expectations in the conventional

television business and declines in advertising revenues. As a

result, the Company recorded a goodwill impairment charge

of $154 million related to its conventional television reporting

unit, which is included in the Company’s Media operating

segment.

In assessing whether or not there is an impairment, the

Company uses a combination of approaches to determine the

fair value of a reporting unit, including both the discounted

cash flows and market approaches. If there is an indication of

impairment, the Company uses a discounted cash flow model

in estimating the amount of impairment. Under the discounted

cash flows approach, the Company estimates the discounted

future cash flows for three to seven years, depending on the

reporting unit, and a terminal value. The future cash flows are

based on the Company’s estimates and include consideration

for expected future operating results, economic conditions and